E-commerce is booming in Thailand. According to a study by Google and Temasek, the Thai E-commerce market has been growing at a compound annual growth rate of 7.7 percent since 2017 and has reached $27 billion.

This growth can be attributed to the country's young population and increasing affinity for shopping online. In addition, social media and mobile commerce have helped propel Thailand ahead of more developed eCommerce nations like Japan and South Korea. The Thai government's introduction of several tax regulations favoring eCommerce has also been a critical driver of growth.

While many payment gateways are available in Thailand, not all are suitable for every business. Researching and finding a payment gateway that meets your specific needs is essential.

Current Payment Solution Landscape in Thailand

The citizens of Thailand prefer mobile commerce over desktop commerce. This is because mobile devices are more accessible and convenient to use. The country's mobile commerce accounts for about 57 percent, ahead of Global leaders like China and the US.

There is no one-size-fits-all solution when it comes to payments in Thailand. Businesses need to offer a mix of payment methods to cater to the needs of their customers such as:

- Bank transfers

- Credit/debit card payments

- Cash on delivery (COD)

- Digital wallets

Card (26%) and bank transfers (28%) are the most popular payment methods, accounting for about 50 percent of all eCommerce transactions in Thailand.

Cash on delivery (COD) or cash on pick up is a popular payment method, used by about 21 percent of eCommerce businesses.

Digital wallets account for about 19% of all eCommerce transactions. Thailand's most popular digital wallets are TrueMoney, Rabbit Line Pay, and PromptPay.

This is the least popular payment method, used infrequently. However, this is changing as more people become aware of the benefits of digital wallets. "The Thai eCommerce market is more intriguing because a third of eCommerce occurs across borders. This means 49% of consumers have already shopped from overseas."

With a population of 69 million and a growing middle class, the potential for eCommerce in Thailand is undeniable. "Thailand's eCommerce market was valued at the US $12.32 billion in 2015 and is expected to reach the US $32.54 billion by 2025, growing at a CAGR of 14.24 percent during the forecast period." The country has a high Internet and smartphone penetration, driving the growth of eCommerce in Thailand. A key challenge for businesses operating in the Thai eCommerce market is the lack of standardized payment methods.

Criteria to Look Out For Payment Gateways in Thailand

Local payment gateways have been instrumental in driving the growth of eCommerce in Thailand. With most US providers shunning the Asian market, local providers have stepped in to enable merchants to accept payments online. Thailand's payment gateway providers have continued to innovate to address the needs of merchants.

This has led to a thriving eCommerce ecosystem in the country. The number of local payment gateways is a testament to this fact. They have played a pivotal role in enabling merchants to grow their businesses online. Thanks to these gateways, Thai companies can compete on a global stage.

Here Are Some Things To Look For When Selecting a Payment Gateway in Thailand

1. Reliability:

The payment gateway you select must be dependable. It should handle a high volume of transactions without any issues.

2. Supported currencies:

As your business grows, you will need to expand into new markets. This means you will need a gateway that supports multiple currencies.

3. Payment options:

Your customers should have a variety of payment options to choose from. The gateway you select should support popular payment methods such as credit cards, debit cards, and bank transfers.

4. Market integrations:

The payment gateway you select should be able to integrate with your existing eCommerce platform. This will make it easier for you to accept payments on your website.

5. Security:

Security is of the utmost importance when it comes to online payments. The gateway you select should have robust security measures to protect your customers' data.

6. Customer support:

You should be able to get in touch with the payment gateway's customer support team if you have any questions or problems.

7. Pricing and other fees:

Be sure to compare the pricing of different payment gateways before deciding. Some providers charge high fees, while others have more reasonable pricing.

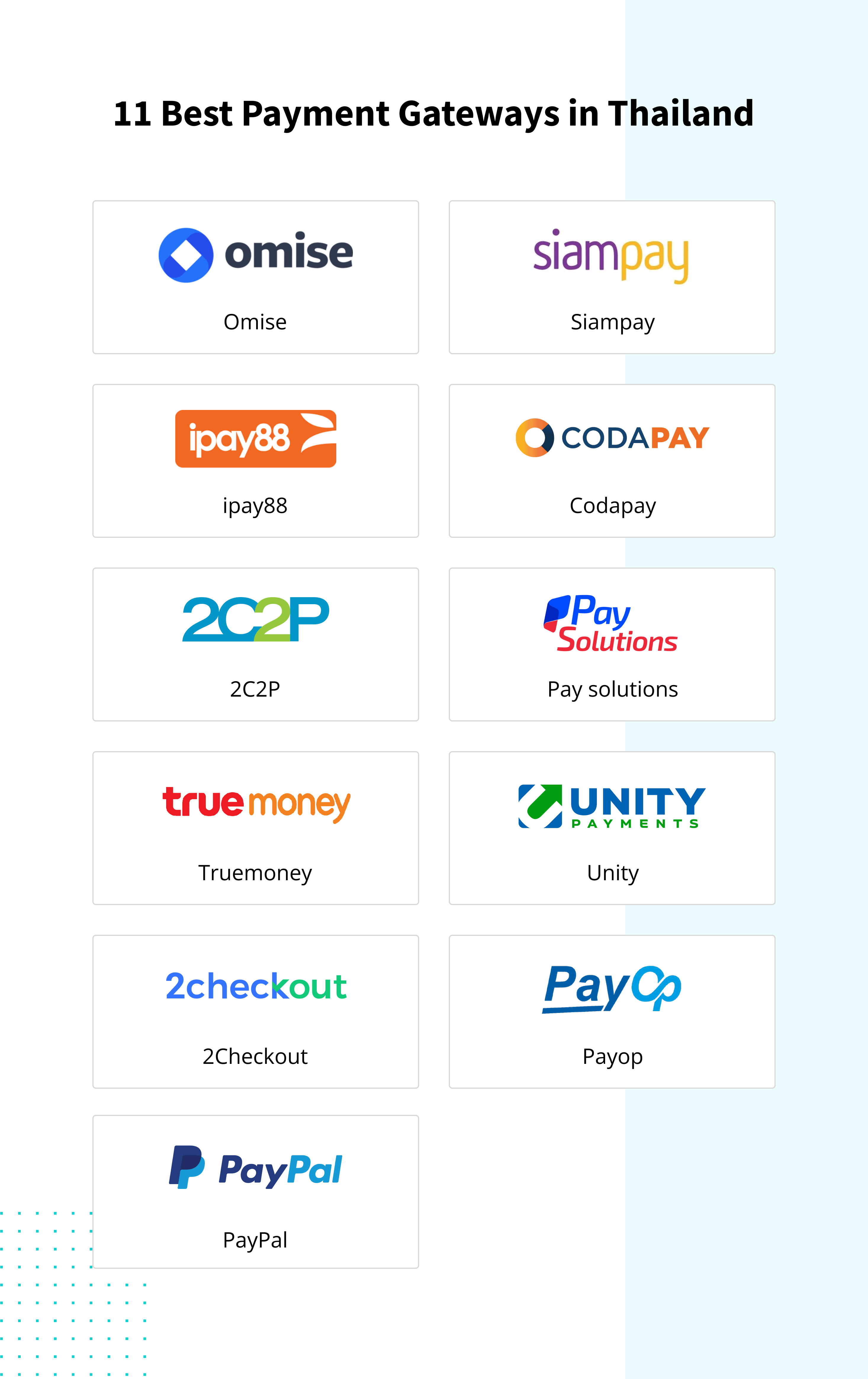

All About the 12 Best Payment Gateways in Thailand

1. Omise

Omise is a popular payment gateway in Thailand. It offers many features, including support for multiple currencies, credit card payments, and bank transfers. It also has a robust security system, which is vital for businesses operating in Thailand.

Pricing and other fees:

- No minimum commitment.

- No hidden fees.

- 2.5% cross-border fee

- There's no setup fee

- No annual fees is not charged

- The transaction fees for credit cards, e-wallets and internet banking is 3.65%, 1.6% and 3.65% respectively.

Accepted payment methods:

- Credit/Debit cards, installments

- Other payments include Promptpay, TrueMoney wallet, Rabbit Line Pay, Pay with points, Alipay, WeChat Pay, and Internet banking.

Supported Currencies:

- AUD, US, CHF, EUR, CNY, DKK, GBP, HKD, JPY, SGD, THB,

eCommerce Integration: Yes.

Onboarding time: 1-7 days

2. SiamPay

SiamPay is a Thailand-based payment gateway that allows businesses to accept payments via credit and debit cards and bank transfers. Its features include support for multiple currencies, recurring payments, and fraud prevention.

Pricing and other fees:

- There's NO setup fees

- No annual fees is NOT charged

- The transaction fees is 1.85%

- No minimum commitment.

- No hidden fees.

Accepted payment methods:

- Credit/Debit cards, installments, bank transfer

- Other payments include Promptpay, Rabbit Line Pay, Shopeepay, PayPal, and Internet Banking.

Supported Currencies:

THB, USD.

eCommerce Integration: Yes.

Onboarding time: 1-2 days

3. iPay88

iPay88 is a Malaysian-based payment gateway that offers support for multiple currencies and credit card payments. It also has a robust security system, which is essential for businesses operating in Thailand.

Pricing and other fees:

- Setup fees: Free

- Annual charges: Free

- Transaction fees: Information Available on request

- No minimum commitment.

Accepted Payment Methods

Visa, MasterCard Credit/Debit Card

FPX, Malaysia Online Bank Transfer Alliance Online, CIMB Clicks, Am Online, installments Online, EON Online, RHB Online

Other Payment Methods: PayPal, Grabpay, TouchnGo pay, Boost Wallet, KipplePay, Vcash Wallet.

Supported Currencies

Only RM (other currencies, including USD, are supported in iPay88 multi-currency gateway)

Onboarding time: 7-14 days for internet bank transfer and 1-2 months for credit card gateway

4. CodaPay

Coda Payments ("Coda") is a significant provider of secure cross-border monetization solutions for digital products and services. Coda integrates with local payment methods in each market, allowing global companies to expand their reach into new geographies quickly. Coda is in Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Pricing and other fees:

- No setup cost.

- No monthly or annual fees.

- Supports subscription payments

- No transaction fees

Accepted payment methods:

Direct carrier billing (AIS, DTAC, CAT, TrueMove H), Bank/ATM transfer (all major banks), cash payments at convenience stores (Tesco Lotus, Family Mart, 7-Eleven), physical voucher redemptions (True Money Cash Card), e-wallets (Rabbit LINE Pay).

Supported Currencies:

Codapay processes transactions in the local currency of each country in which we operate (i.e., Rupiah in Indonesia, Kyat in Myanmar, Baht in Thailand, Peso in the Philippines, Ringgit in Malaysia, Singapore Dollar in Singapore, Dong in Vietnam), and we pay out in US Dollars.

eCommerce Integration:

Merchants integrate against Coda's API, and one developer can typically complete integration in a couple of days.

Onboarding time: 4-6 weeks

Good read: Top payment gateways in the USA

5. 2C2P

Founded in 2003, Bangkok-based Payment Gateway provider ฿500 million revenue company that provides end-to-end payment processing solutions for merchants, payment service providers, and financial institutions across Asia.

Pricing:

- No setup cost.

- No monthly or annual fees.

- Per-transaction fee of THB 0.45 + VAT for credit/debit card transactions, and THB 0.25 + VAT for internet banking transactions.

Accepted payment methods:

- Credit/Debit cards, Digital wallets, QR payments, BNPL

Supported Currencies: Multiple currencies

eCommerce Integration:

- API-based integration, Mobile SDK, Shopping Cart Plugin.

Onboarding time: 1-2 weeks

6. Pay Solutions (Formerly Thaiepay)

Pay Solutions is a Thailand-based eCommerce system provider that provides services including credit card online payment systems, internet shops, and shopping malls. Businesses can now accept Visa, MasterCard, and American Express payments on their websites, thanks to the firm's payment solutions.

Pricing:

- 0.80% interest on monthly payments.

- Merchant fee (MDR) is 3.60% per transaction.

- There's NO setup fees

- No annual fees is NOT charged

- The transaction fees ranges from 12-15 THB

Accepted payment methods:

- Credit/ Debit cards, Installments, Internet banking, bill payment point, Promptpay, TrueMoney Wallet, Alipay, WeChat Pay.

Supported Currencies:

eCommerce Integration:

- Easy to connect system, supports many CMS including Woocommerce, VirtueMart, Magento, and Opencart, convenient for both seller and developer.

Onboarding time: 1-2 weeks

7. TrueMoney

TrueMoney was founded in 2003 as part of True Corporation but is now reorganized under Ascend Group in 2014, a spin-off of True Corporation and a subsidiary of Charoen Pokphand Group. The company offers various financial services, including money transfers, bill payments, and top-ups, and is a popular eWallet provider.

Pricing:

- No monthly fees.

- The setup fees is $29.99

- There's no annual fees

- Transaction fees is 20 Baht

- Foreign exchange fees is 3.5% of the transferred amount

Accepted Payment Methods: PLN, BPJS, PDAM, Telkom Speedy, credit and debit cards

Supported Currencies: The primarily supported currencies are Dollar and Baht

eCommerce Integration: Convenient system for integration and supports various e-commerce platforms in southeast Asia, like Lazada

Onboarding time: 1-7 days

8. Unity

Unity is a payment provider that focuses on gaming payments. The firm owns two websites, www.gamemoney.in.th and www.gamertopup.com, which are currently available for trade via prepaid cards. The company also uses Unitry's e-wallet and software system to provide services such as online game top-ups, mobile phone credits, and other digital content.

Pricing:

- No Commitments

- There's no setup fees

- There aren't any annual charges but monthly, ranging from $99-$199

- The transaction fee ranges from $0.12 to $0.15 per transaction

- There's no exchange fees

Accepted payment methods: Unity Support Paypal and bank transfers.

Supported Currencies: BRL, CNY, JPY, KRW, EUR and USD

eCommerce Integration: NO

Onboarding time: 1-10 days

9. 2Checkout

Established in 2000, Ohio-based enables businesses in Thailand to sell products and services online securely. The company provides a payment solution that combines the latest technology with expert support to help companies succeed in today's global marketplace.

Pricing:

- It starts at 3.5% + $0.35 per successful sale.

- No monthly fees

- There's NO setup fees

- No annual fees is NOT charged

- The transaction fees is 3.9% + 0.45 USD along with 1.5% cross-border charges

Accepted payment methods:

- Internet banking, bank transfers, Prepaid vouchers, eWallets, etc.

Supported Currencies:

- Over 200 currencies accepted.

eCommerce Integration:

- More than 85 shopping carts are supported.

Onboarding time: 24-48 hours

10. PayOp

PayOp is an international payment service provider that offers a wide range of payment options to merchants in Thailand.

Pricing:

- Local markets: from 2.7% plus 0.3 USD fixed fee

- There's NO setup fees

- No annual fees is NOT charged

- The transaction fees is 2.4% + 0.2USD

Accepted payment methods:

- Over 300 payment methods are included. Multiple offline and online payments, Wire transfer, ACH, PayPal, Payoneer

Supported Currencies:

- Over 200 currencies accepted.

eCommerce Integration:

- Integration with major eCommerce platforms

Onboarding time: 1 day

11. Bangkok Bank

Bangkok Bank Payment Gateway, commonly known as BBL, is an online platform to make and receive payments in Bangkok. It integrates famously with various e-commerce platforms and accepts various payment options, including credit and debit cards and online banking.

Some added features include real-time transaction monitoring, settlement, and reporting. Their flexible payment options comply with the highest security standards, making them cost-effective, secure and a convenient solution for merchants and businesses accepting payments online.

Pricing: Information not available

Accepted payment methods:

- Visa, MasterCard, and Bangkok Bank credit cards, POS payments, recurring payments, phone and mail order payments.

Supported Currencies: Information not available

eCommerce Integration: Information not available

Onboarding time: Information not available

12. K-Payment

As a digital solution, K-Payment offers various features to make a merchant’s experience user-friendly, customizable, and robust. Its enhanced security features, customizable payment forms, and fraud standards maintain the highest levels of security for all merchant transactions.

As a business, you will find that the payment gateway is easy to use, and your account setup offers convenient setup.

Pricing:

Entrance fee: 20,000 baht

- Monthly fee: 5,000 baht

- Transaction fee:

- Within region: 20 baht per baht transaction

- Outside your region:

- 20 baht for transactions not more than 50,000 baht

- Greater than 50,000 baht: 10 baht for every 10,000 baht (not more than 1,000 baht)

Accepted payment methods:

- Visa, MasterCard, JCB, and UnionPay

Supported Currencies: 35 currencies

eCommerce Integration: Information not available

Onboarding time: merchant account approval takes approximately 2 weeks after receiving all required documents.

Local Payment Gateways and the Rising Complexities for Businesses

While Thailand's early adoption of mobile commerce paved the growth for phenomenal growth, the lack of infrastructural development has given way to a more complex eCommerce landscape. According to a study by Paysafe, Thailand is the world's most challenging country for online payments.

Also read: "Payment Methods in Asia: Navigate Local eCommerce Payments"

This is due to the high number of local payment methods - currently 27 and counting.

Thailand's geography, which includes islands and remote mountains, makes it difficult for courier carriers to reach potential customers. This, coupled with the lack of trust in online transactions in these regions, has resulted in a lower adoption rate of eCommerce compared to developed areas in the country. eCommerce fraud is also on the rise in Thailand. It is estimated that 40 percent of consumers don't shop online due to the fear of fraud.

How inai helps you address multiple payment gateway integrations in Thailand?

The inai platform is designed to integrate more than 300+ international payment methods, including those widely popular in Thailand. This makes it one of the most comprehensive and user-friendly platforms available on the market today. Our payment platform provides a single source of integration, allowing you to connect to multiple payment gateways and numerous local payment methods.

Inai's payment integration model is designed to be developer-friendly and supports flexible business models, including eCommerce and other digital marketplaces. Our platform helps business owners improve their conversion rates by offering a localized checkout experience in terms of payment methods, language, or currency. This makes it easier for customers to pay for products and services, and also helps to boost sales.

Our fully customizable front-end and best-in-class CXO dashboards ensure that your brand design is aligned with your refund management needs and failed transaction assessment goals. Inai platform securely captures payment method data while fully embedded on your site or in your app.

With customizable integration and Enterprise Grade security built-in, our technology makes PCI-DSS and GDPR compliance simple.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=4068&name=62cc39dfe9738c1a94b878f1_CTA%20(4).png)