With steadily increasing internet penetration (95.2% at the start of 2022), the eCommerce industry in Oman is growing, leading to more online purchases. And to facilitate seamless payments and support the growing customer base, businesses need to opt for reliable payment gateways

With the continuously developing payment landscape, it can be difficult for businesses to determine which gateways are the most suitable and reliable in Oman. This blog is here to help!

Explore five of the top payment gateways available today and get all you need to make an informed decision – giving you confidence that your payments will run smoothly.

Payment Landscape in Oman

Oman has been steadily upgrading its payment systems over the last couple of years. For instance, the Central Bank of Oman launched MpClear in 2017 to facilitate mobile-based instant payments. It enables customers to transfer funds using mobile numbers, adding to their convenience.

Also, alternative payments are becoming popular in Oman, with companies launching their services. For instance, eFloos is a mobile payment solution that allows customers to make payments at merchant stores and to other eFloos users.

In a nutshell, the payment landscape in Oman looks good and is growing and optimizing. Therefore, businesses must opt for the most reliable payment systems (payment gateways) to get a competitive advantage and ensure a seamless customer experience.

Criteria to Look Out for Payment Gateways in Oman

Payment gateways are an excellent way to connect consumers and merchants. Not only are they convenient ways of facilitating payments, but they also act as a bridge between the concerned parties by adding a secure layer to enable quick payments.

Having said that, how do you select a payment gateway for your business? Remember, you need a payment gateway that offers a series of options to you and your merchants. Here are a few things to consider while selecting a payment gateway in Saudi Arabia.

1. Reliability:

Since a payment gateway is an intermediary between buyers and sellers, selecting a reliable option for your business is essential. This way, you can ensure your customer's financial information is secure, while your merchants can accept payments without incurring any fraudulent transactions.

To ensure you are selecting some of the best options for your business, you can check the payment gateway's online rating, which should act as a guide to help you make the right choice.

2. Support currencies:

As an online business, your markets are never limited. The internet offers endless opportunities, and you should not compromise your payment methods. Since each country has its established market and local currency, you need to use a payment gateway that offers you conducive conversion rates while keeping the transaction fee at the lowest.

Additionally, when accepting payments in multiple currencies, you need to provide several options to your customers so they can pay as per their local currency. This way, your brand gains customer loyalty while establishing a good name for your brand in the market.

3. Payment options:

A good, reliable payment gateway offers plenty of opportunities for users to make payments via different payment methods.

These might include payments via the following channels:

-

Credit cards

-

Debit cards

-

Net banking

-

Digital wallets

The list is not exhaustive; what’s important is that you need to have the facility for your customers to make payments without worrying about transaction safety.

4. Market integration:

Market integrations relate to the various options available to you as an online business, especially concerning the market situations your business might need to work with.

Suppose you are partnering with a local payment gateway. In that case, they can guide you on government regulations and help you integrate your business platform with the local guidelines.

However, if you are going with a global brand, you might still get this advantage, along with a few other options, which will enhance your integrations and customer experience manifold.

5. Security:

Security is crucial since you and your customers will be exposed to market variations.

Customers' financial information is stored on your website's server when they make an online transaction. In case of a data breach, this financial information can be hacked and misused by hackers to fulfill their unscrupulous methods.

Payment gateways provide an additional layer of security to their customers to ensure such data breaches have no impact on the stored financial information.

A renowned payment gateway knows how to protect its customer's data, so you should always go with an experienced brand rather than a new entrant.

6. Pricing and other options:

Finally, you must consider the pricing and the other features you will get upon signing up with a brand. Pricing can cater to some of the extra charges these gateways charge to extend their services to your business and customers.

You can begin conversations around setting up and onboarding the payment gateway if you get a good set of services catering to your business needs.

Also read : Top Payment gateways in Saudi Arabia

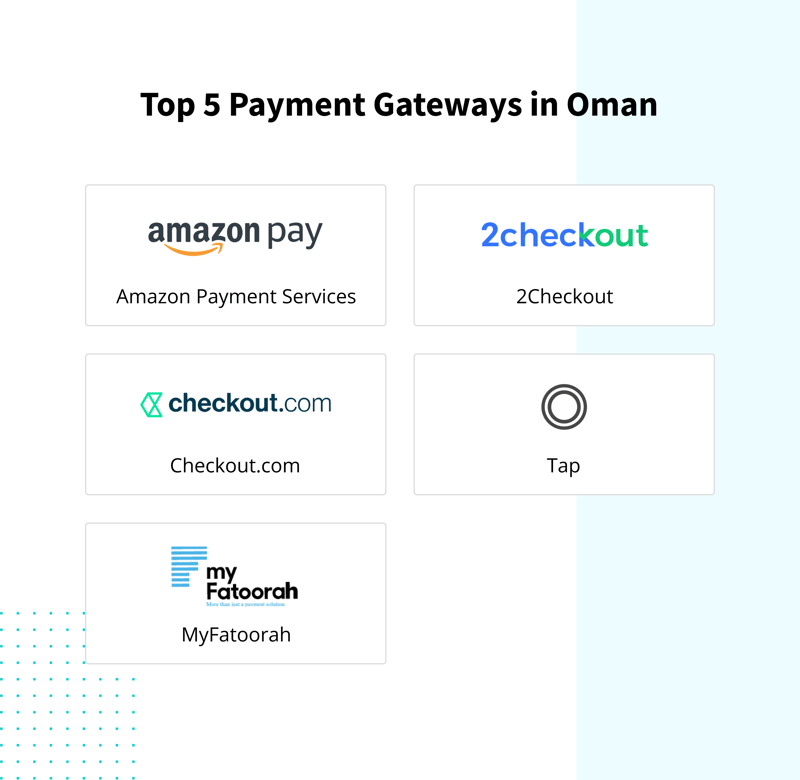

Top Payment Gateways in Oman

1. Amazon Payment Services

Amazon Payment Services (APS) is a renowned world in the UAE market. It continues to garner a lot of attention with its services as an established payment gateway.

From accepting payments to growing your business and data insights, there is a little something for every type of business in the market.

Pricing and Other Fees:

· Setup fee: Free

· Annual Fee: Free

· Monthly fee: None

· Charges on refunds: Information Available on request

Commission per transaction: 2.8% plus extra charges

Accepted Payment Methods:

- Credit/Debit cards: All major credit cards are accepted.

- Other accepted payments: Digital wallets, Apple Pay, PayPal, Mada STC Pay, Visa Checkout, and Masterpass

Supported Currencies: All major currencies are supported by Amazon Payment Services.

Approvals and Onboarding Time: The integration process can take 3-5 business days

eCommerce Platform Integration: You can integrate Amazon Payment Services with the following:

· Woocommerce

· Shopify

· Prestashop

· OpenCart

· CS Cart

· Open Cart 2

2. 2checkout (Verifone)

Created by Verifone, 2Checkout is a widely used payment gateway across Oman. It’s available in 190+ countries and supports 87+ currencies making it one of the best payment gateways on the list. Also, it’s fully PCI compliant and follows fraud detection and other security checks to prevent fraud.

Some standard services include the following:

Global Payments

Digital commerce

Subscription billing

Reporting and analytics

Risk management

Pricing and Other Fees:

Setup fee: Free

Annual Fee: Free

Monthly fee: None

Charges on refunds: Information Available on request

Commission per transaction:

There are three payment plans you can choose based on the following:

2Checkout 2 SELL: 3.5% + $0.35

2Checkout 2 SUBSCRIBE: 4.5% + $0.45

2Checkout 2 MONETIZE: 6.0% + $0.60

Accepted Payment Methods:

- Credit/Debit cards: Skrill, PO, Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

- Other accepted payments: Apple Pay, OPay, Google Pay, AliPay

Supported Currencies: 87 major currencies

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: All major e-commerce platforms, such as:

- Astound Commerce

- WooCommerce

- 5874

- Shopify

- Cabiri

3. Checkout

Checkout is yet another popular payment gateway in Oman that supports a range of merchants and over 150 currencies, along with several global and local payment methods. This way, businesses can expand their user base across the globe while facilitating seamless payments.

Checkout comes with an easy-to-integrate API, a compliant and secure interface, and a seamless customer experience.

Here are the primary features that Checkout offers:

Pricing and Other Fees:

Setup fee: Free

Annual Fee: Free

Monthly fee: None

Charges on refunds: Information Available on request

Commission per transaction:

- 0.95 % + 2 for European cards

- 2.9% + 20 cents for non-European cards.

Accepted Payment Methods

- Credit/Debit cards: JCB, Discover, American Express, Diners Club, Visa, and MasterCard are supported.

- Other accepted payments: Omannet and digital wallets such as OPay, Google Pay, Apple Pay, AliPay, and are supported.

Supported Currencies: It supports +150 currencies in +45 countries.

Approvals and Onboarding Time: The integration process can take anywhere between 24 to 48 hours.

eCommerce Platform Integration:

Offers integration with a range of eCommerce platforms such as:

WooCommerce

Shopify

SAP Commerce Cloud

Salesforce Commerce Cloud

and more

4. Tap

Ever since its inception in 2014, Tap is evolving and has become a widely accepted payment technology company in the MENA region. It services more than 50000 businesses, startups, and SMEs across various regions.

Pricing and Other Fees:

Setup fee: Free

Annual Fee: Free

Monthly fee: None

Charges on refunds: None

Commission per transaction: Information not available

Accepted Payment Methods:

- Credit/Debit cards: KNET, Benefit, Mada, Sadad, Visa, MasterCard, or American Express

- Other accepted payments: Information not available

Supported Currencies: Tap supports ten currencies, which are:

· UAE Dirham

· Bahraini Dinar

· Egyptian Pound

· Euro

· UK Pound Sterling

· Kuwaiti Dinar

· Omani Riyal

· Qatari Riyal

· Saudi Riyal

· US Dollar

Approvals and Onboarding Time: 24 hours

eCommerce Platform Integration: WordPress/ WooCommerce

· Shopify

· Magento (1&2)

· OpenCart

· PrestaShop

· Joomla

· ECWID

· Zid

· Zyda

· Salla

· Shopgo

· Alligator

· Magna

· Expand Cart

· Matajer

· Innoshop

· Plugn

· Matjrah

· Ordr DirectWordPress/ WooCommerce

5. MyFatoorah

MyFatoorah is an underrated payment gateway that enables online businesses to send and receive funds seamlessly. Using Fatoorah, businesses can analyze and monitor transaction and customer data via a single dashboard, saving them time and improving accuracy. What’s more, this payment gateway is PCI compliant and has decent customer support.

Pricing and Other Fees:

Setup fee: Free

Annual Fee: Free

Monthly fee: None

Charges on refunds: Information Available on request

Commission per transaction: 2% for Knet payments and 3.5% credit cards

Accepted Payment Methods:

- Credit/Debit cards: MyFatoorah supports American Express, Visa, MasterCard, and even Mada cards,

- Other accepted payments: BENEFIT, MADA, NAPS QATAR, Apple Pay, and more.

Supported Currencies: MyFatoorah supports over 10 most commonly used currencies.

Approvals and Onboarding Time: Information not available

eCommerce Platform Integration:

MyFatoorah offers integrations with:

MySQL

Shopify

WooCommerce

Magento

Local Payment Gateways and the Rising Complexities for the Businesses

Accepting online payments does not have to be complicated; various payment gateways are available. However, finding one that offers the perfect combination of affordability and customer support while supporting a wide range of currencies can take time and effort. And if you rely on a single payment gateway, you might get caught off guard in case:

The payment gateway fails or is going through maintenance.

Customers need help maneuvering through the payment options.

The payment gateway doesn't offer the desired payment methods.

If any of the above happens, it'll lead to poor customer experience, further impacting your business's bottom line. So, what should you do? Read along to find out.

How Can inai Help You Integrate Multiple Payment Gateway Integrations in Saudi Arabia?

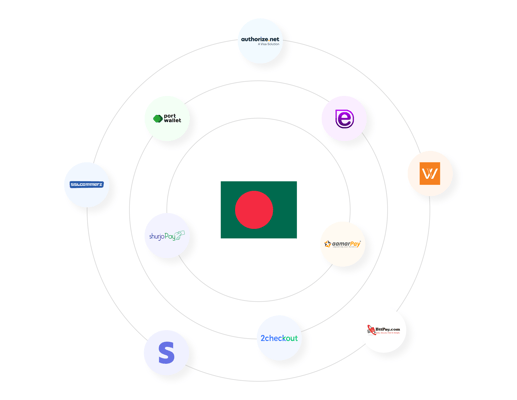

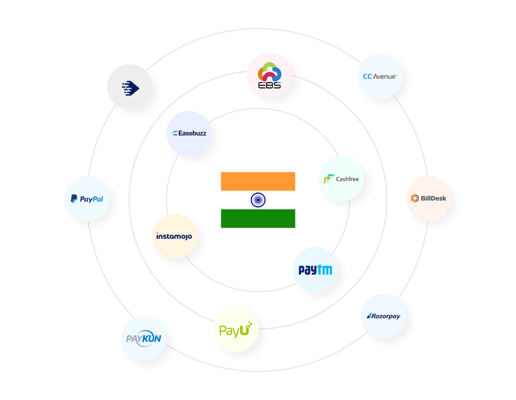

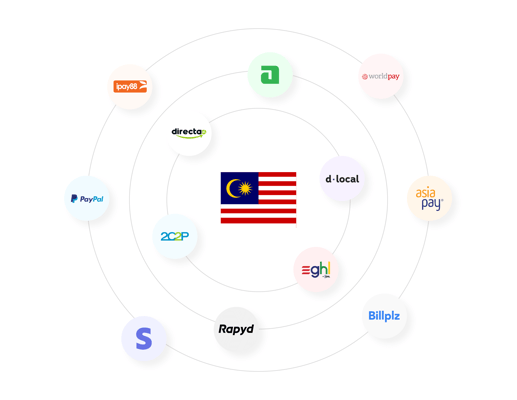

inai is a global payment aggregator that can help you integrate or bring together 30+ payment gateways that support 300+ payment methods across 190+ countries. This way, you can expand your business in almost any country worldwide while offering customers a seamless payment experience.

Also, suppose a payment gateway fails or cannot support your business's needs in any way. In that case, you can easily switch the payment gateway to a favorable one and ensure seamless operations. Now, how can you beat that?

If you're excited to learn more about inai and how we can support your payment needs in Oman, book a demo now!

.png?width=4068&height=1080&name=CTA%20(2).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)