Stay on top of any anomalies with

real-time payment alerts. It's a Data dog for payments.

Optimize your revenue and streamline payment processes with real-time monitoring and faster issue detection. Our platform allows you to set up customized alerts, ensuring your team stays informed through your preferred channels and takes proactive actions.

.png?length=100&name=cover_fill_Huel_Logo_large_5_7ed55590-35a9-4c2c-9aa2-02af266ae92b%20(1).png)

Start monitoring key payment

metrics in minutes

Authorization rate

The percentage of transactions that you submit and are accepted by the card networks.

Decline rate

Attempted credit card transactions that are declined compared to the total number of attempted transactions.

Withdrawal velocity

Velocity checks are a fraud prevention strategy designed to reduce the amount of fraud.

Transaction volume

The total monetary value of all transactions processed by a payment platform over a given period.

Chargebacks

A chargeback is a return of money to a payer of a transaction, especially a credit card transaction.

Average order value

An ecommerce metric that measures the average total of every order placed with a merchant over a defined period of time.

Plug payment leaks in real-time

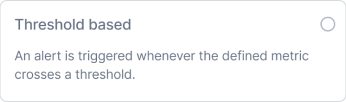

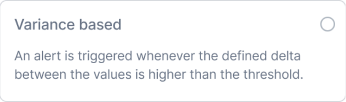

with three types of alerts

ThresholdGet notified when a metric crosses a set limit. Useful for continuous data streams or sporadic events with predefined values.

VarianceGet notified when a metric changes significantly over time-based on your chosen threshold. Useful for tracking changes that surpass a defined difference from a previous period.

RangeGet notified when a metric goes beyond a user-defined range. It is useful for spotting anomalies, like when a metric usually stays between 75-85% and any deviation triggers an alert.

Fix issues by getting notified on channels that matter to you

Select medium

Get alerts via Slack, email, or pagerduty based on your preference.

Select the team

Assign to team or individuals based on the severity

(1).png)

How it works

Step 1

Alerts can be supported on any parameter, or metadata passed to your payment processor

(e.g., BIN) or any derivation thereof (e.g., auth rate).

Step 2

Step 3

Security and Compliance You Can Trust

No PII needed

Only what's necessary for PSP compliance, ensuring top-tier privacy.

Enterprise-Grade Security

Stay protected with end-to-end encryption and globally recognized compliance standards.

SOC2 Type2

ISO 27001

PCI-DSS

.png)

GDPR

Ready to Recover Lost Revenue?

Don’t Let Failed Payments Cost You Any More Revenue. Get in touch with our team to start maximizing your revenue with Revive.

Find out how much extra revenue you could gain by recovering failed payments. Contact us for a free assessment and see the potential impact.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)