Reduce Involuntary Churn with Smarter

Payment Retries

Failed payments are quietly eroding your bottom line.

With Revive, turn every missed transaction into a new opportunity for growth.

TRUSTED BY THE BEST BRANDS IN THE WORLD

The Impact of Payment Failures

Churn Crisis

Payment issues are responsible for 50% of all customer churn in subscription models.

ARR Drain

Up to 10% of Annual Recurring Revenue (ARR) can be lost to involuntary churn.

CLTV Downturn

70% of subscription businesses face failed payment challenges, affecting CLTV, brand perception, and revenue growth.

Stop losing revenue. Start recovering it with Revive.

Why Payment Failures Hurt More Than You Think

Traditional retry strategies are outdated, leaving revenue on the table. Relying on fixed retry days

without accounting for transaction-level complexities results in lost payments and frustrated customers.

Ineffective Retry Strategies

Most companies use basic retries, failing to address the nuanced reasons behind each failed transaction.

Operational Complexity

Managing retries across teams and payment partners requires coordination and specialized knowledge, often leading to inefficiencies.

Lack of Expertise

Without an intelligent, data-driven approach, companies risk missing out on significant revenue recovery opportunities.

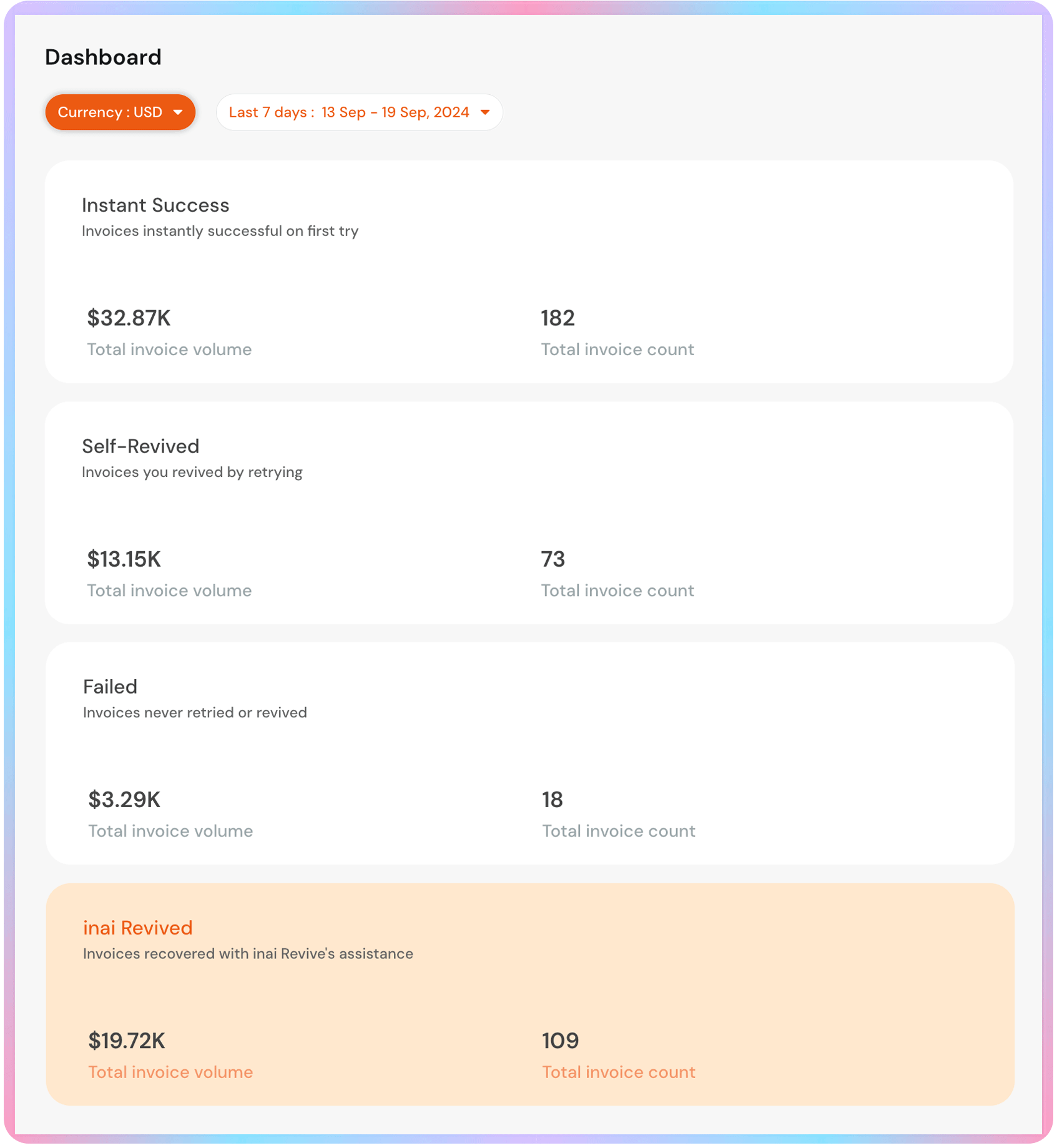

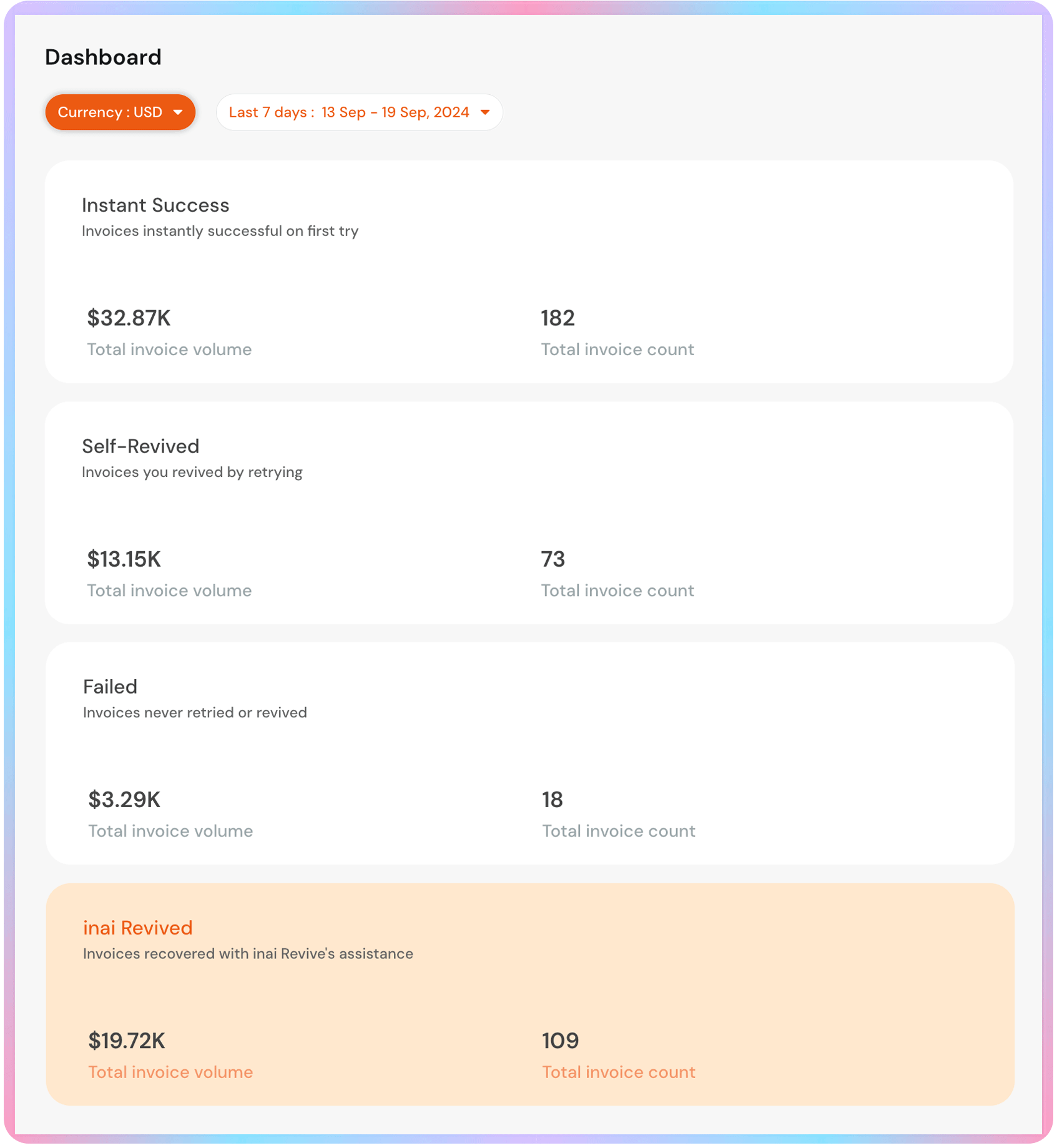

Revive: The Smart Way to Recover Failed Payments

At Revive, we take the complexity out of payment recovery. Using cutting-edge machine learning and a 300+ data dimension retry algorithm, we recover failed payments that others can’t.

-

Recover 5-15% More ARR:

Our advanced retry algorithm consistently delivers a measurable uplift in annual recurring revenue for subscription businesses. -

One API, One Day Integration:

With a single API and webhook, Revive integrates with your payment processor/billing engine seamlessly. Know more →

-

No Upfront Costs:

We work on a fully variable fee model, meaning you only pay when we recover revenue for you. No recovery, no fees.

-

Low Risk:

Revive works alongside your current retry strategy, enhancing payment recovery without the need for any changes or disruptions.

Why your Business needs Revive?

Proven Track Record

Demonstrated success in recovering payments and boosting revenue across various industries

No Win, No Fee Model

Pay only when we successfully recover failed payments—no upfront costs or risks

Custom ML Strategies

Revive leverages advanced machine learning tailored specifically to your businesses unique needs and customer base, unlike generic solutions.

Security and Compliance You Can Trust

No PII needed

Only what's necessary for PSP compliance, ensuring top-tier privacy.

Enterprise-Grade Security

Stay protected with end-to-end encryption and globally recognized compliance standards.

SOC2 Type2

ISO 27001

PCI-DSS

.png)

GDPR

Ready to Recover Lost Revenue?

Don’t Let Failed Payments Cost You Any More Revenue. Get in touch with our team to start maximizing your revenue with Revive.

Find out how much extra revenue you could gain by recovering failed payments. Contact us for a free assessment and see the potential impact.

Frequently Asked Questions

Is my data safe with Revive? Do I need to share PII data?

No, you don’t need to share any PII data. We can use customer identifiers too. Please get in touch with the team for more details

Are there any upfront costs or monthly minimum fees?

How long does the integration take?

Will my existing retry strategies be affected?

Can Revive integrate with our current payment processors and billing systems?

Yes, we work seamlessly with Stripe, Adyen, Braintree, Shopify Payments, Cybersource, PayPal, and Worldpay (coming soon). If you use a different provider, contact us at sales@inai.io.

How effective are Revive’s ML-driven retry strategies compared to our current methods?

Revive’s ML strategies analyze over 300 parameters, offering a more customized and effective approach. We have typically been able to add 5-15% to the top line working alongside the merchant’s own retries.

Will additional retries harm customer experience or increase chargebacks?

No, the retries don’t require customer input, and we see minimal risk of chargebacks.

What advantages does Revive offer over our existing retry strategies?

Revive’s highly customized retries can add 5-15% to your topline ARR.

When can we expect to see ROI with Revive?

You can expect a return on investment within 2-3 months.

What kind of security measures does Revive use?

Revive is built with enterprise-grade security, including SOC-II Level II, PCI Level 1, ISO 27001, and GDPR compliance.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)