Germany is a major player in the global e-commerce industry, as 50% of international shoppers have placed orders from foreign websites. Aided by its vast consumer base and tech-savvy population, Germany's online market shows vigorous growth, with experts projecting that it will become Europe's largest sector before 2027, generating an estimated revenue of $211 billion over this period.

To embrace the above opportunity, merchants must integrate payment gateways that support local German and global payment gateways. After all, if customers get enough payment options to choose from, they will come back to your website to buy.

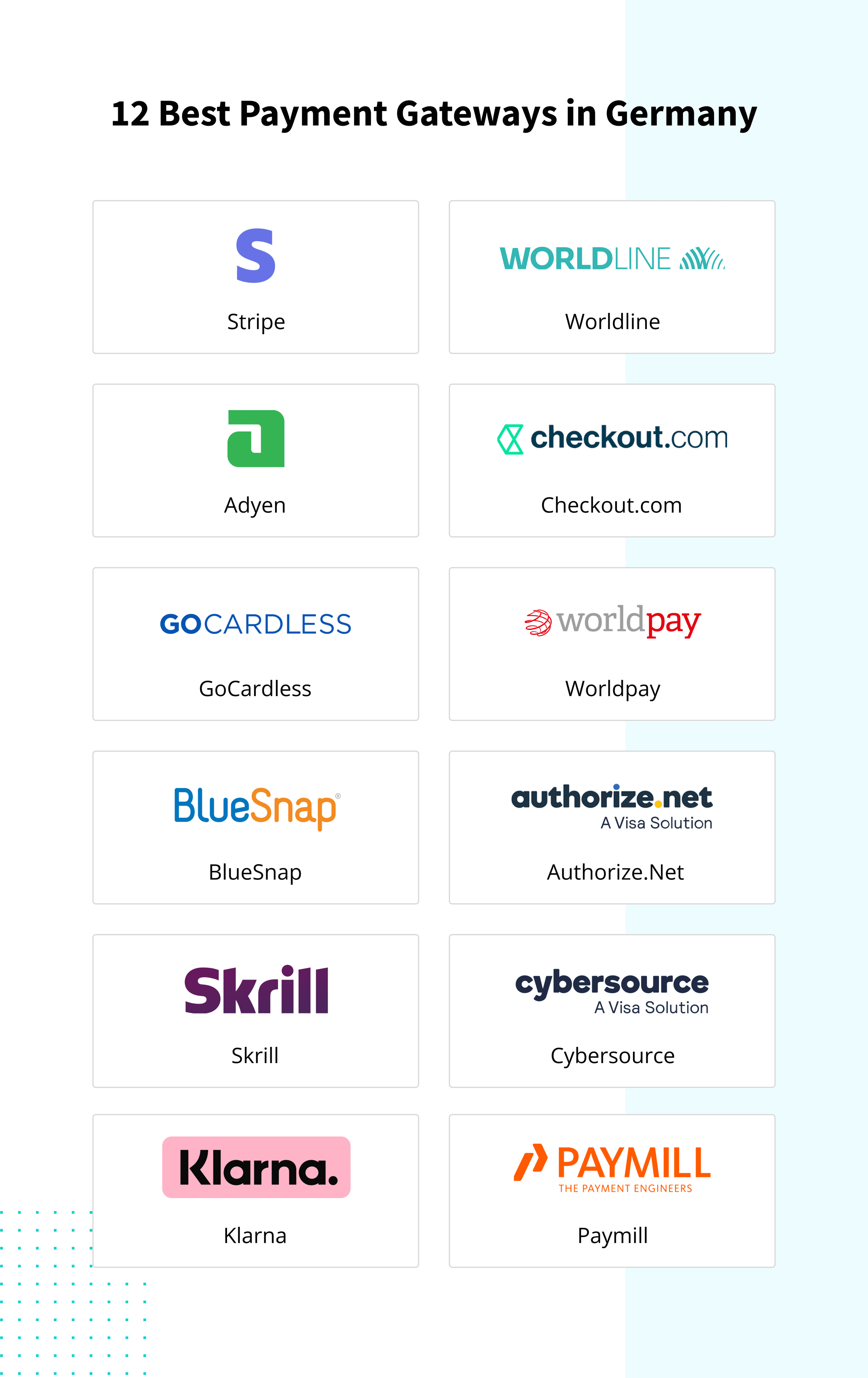

This blog lists the 12 most reliable payment gateways in Germany you need to know about. In addition, you'll find a short guide to help you choose the best payment gateway. Make sure you read it in full for all of your merchant needs.

Current Payment Solution Landscape in Germany

Despite its heavy reliance on technological solutions, people in Germany used to prefer cash for all their transactions. However, much has changed over time, especially after the COVID-19 pandemic. Several payment methods, such as debit/credit cards, digital wallets, bank transfers, direct debit, and open invoices, have diminished the use of cash to purchase goods.

And as these payment methods continue to increase their market share, the payment solution landscape in Germany will also grow. So, online merchants should integrate the best payment gateways to adhere to the customers' changing needs and to get a competitive edge.

Let's now learn how you can choose the best payment gateway in Germany.

Criteria to Look Out for Payment Gateways in Germany

Here's what you need to consider while choosing payment gateways in Germany:

1. Reliability

Reliability is something you cannot compromise with. Only if your payment gateway is reliable you can ensure a good customer experience whenever they make payments. So, make sure the payment gateway is reliable.

Here's what you can do:

- Check customer reviews on Google and not on the gateway's website.

- Talk to previous customers, if you can.

- Transaction approval rate.

- Type of customer support they offer. Check how easy it is to contact customer support.

2. Supported Currencies

The more currencies your payment gateway supports, the better it is. Why, may you ask? Initially, you may have a small customer base from a specific region.

However, you may need to target more customers from different locations when your business grows. And then multiple currencies will come to your rescue. If you choose a payment gateway that supports limited currencies, you may have to opt for a different solution when you expand, which can be financially and logistically tough.

3. Payment Options/Methods

Your customers deserve the best. Offer them a selection of popular domestic and international payment methods to help streamline their checkout experience. Choosing an extensive gateway service for your business can make all the difference in retaining or losing valuable clients - choose wisely!

4. Market Integrations

When selecting a payment gateway, integration is key. Inadequate integrations can lead to tech stack changes or gaps in communication between processes - both of which can be costly and lead to uncomfortable issues for businesses.

Research popular integrations such as Storefront, WooCommerce, Shopify, BigCommerce, Salesforce, and Microsoft 365 before making your selection to ensure the best fit possible!

5. Security

Security is perhaps the most crucial factor to consider when looking for a payment gateway. A secure payment gateway that follows the latest security protocols is what you'd want. Only then you'll be able to ensure completely secure transactions for your customers.

6. Pricing and other Fees

Another essential factor to consider is the pricing and transaction or other types of fees. After all, the pricing or fees will decide whether you'll break even, lose, or make money. You can ask your payment gateway about the following expenses:

- Setup Fee

- Monthly Fee

- Annual Maintenance Charges

- Transaction fees for local and international cards and other payment methods they support.

- Chargeback fee and more.

12 Best Payment Gateways in Germany

1. Stripe

Stripe is one of the most reliable international payment gateways available in Germany. It supports dozens of popular local and global payment methods making accepting payments easier. Here are the primary features that Stripe offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 1.4% + €0.25 for European Economic Area cards and 2.9% + €0.25 for international cards.

Accepted Payment Methods:

- Credit/Debit Cards: Credit cards from JCB, Discover, American Express, Diners Club, Visa, PO, Skrill, MasterCard, and SEPA Debit cards are supported.

- Other methods: Other methods include Alipay and iDEAL

Supported Currencies: It supports +135 currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- NetSuite

- Shopify

- WooCommerce

2. Worldline

Worldline is a one-stop solution for all types of merchants for all types of payment needs. It also comes with fraud management tools to ensure completely secure transactions. Here are the primary features of Worldline:

Pricing and Other Fees:

- Setup Fee: Free

- Annual Fee: Free

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: Information Available on request

Accepted Payment Methods: Accepts 150+ local and global payment methods.

Supported Currencies: It supports 140+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce platforms.

3. Adyen

Adyen is a comprehensive end-to-end payment solution that helps merchants accept payments from Germany and across the globe. Here are the primary features that Adyen offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Varies with the payment method used.

- Commission per transaction: €0.10 per transaction + payment method fee.

Accepted Payment Methods:

- Credit/Debit Cards: American Express, BACS Direct Debit, JCB, giro card, Diners Club, Discover, and several other credit/debit card\ brands are supported.

- Other methods: Other methods include Google Pay, GoPay, GrabPay, Affirm, Alipay, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms, including:

- Vue Storefront

- Big Commerce

- Microsoft 365

- WooCommerce

Good Read : What is the difference between 2D and 3D payment gateway?

4. Checkout

Checkout is yet another reliable payment gateway for merchants in Germany that supports a host of different payment methods. It is easy to use, intuitive, and feature loaded. Here are the primary features that Checkout offers:

Pricing and Other Fees:

- Setup Fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 2.9% + 20 cents for non-European and 0.95 % + 2 for European cards.

Accepted Payment Methods:

- Credit/Debit Cards: Cards from Discover, JCB, American Express, Visa, Diners Club, and MasterCard are supported.

- Other methods: SEPA, ideal, ACH Payments and digital wallets such as OPay, Google Pay, Apple Pay, AliPay, and are supported.

Supported Currencies: It supports over 150 currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- Salesforce Commerce Cloud

- SAP Commerce Cloud

- Shopify

5. GoCardless

GoCardless is a versatile payment gateway using which you can collect one-off, instant, and even recurring payments without incurring expensive transaction fees. Here are the primary features that GoCardless offers:

Pricing and Other Fees:

- Setup Fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 1% + £/€ 0.20 per transaction (£/€ 4 max) for UK and eurozone and 2% + £0.20 for international.

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards are supported.

- Other methods: Digital wallets such as Paypal, Visa Checkout, and MasterPass are supported.

Supported Currencies: It supports major currencies such as GBP, EUR, USD, SEK, DKK, AUD, NZD, and CAD.

Approvals and Onboarding Time: Information Available on requestA.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- Salesforce

- ChargeBee

6. Worldpay

Worldpay is a global payment solution that makes online payment processing easier and optimizes the checkout experience for customers. The platform supports major currencies and has an easy-to-use interface. Here are the primary features that Worldpay offers:

Pricing and Other Fees:

- Setup Fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: Information Available on request

Accepted Payment Methods: It supports over 300 payment methods.

- Credit/Debit Cards: All major debit and credit cards are supported.

- Other methods: Digital wallets, local card schemes, direct debits, bank transfers, Pre-Pay, Post Pay, and Invoices are supported.

Supported Currencies: It supports over 126 currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms.

7. BlueSnap

BlueSnap is a major online payments platform that enables merchants to accept credit and debit card payments along with several other payment methods. It comes with fraud detection and prevention, shipping cart integrations, PCI compliance, and more. Here are the primary features that BludeSnap offers:

Pricing and Other Fees:

- Setup Fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 1.4% + €0,25 per successful card transaction

Accepted Payment Methods: It supports over 300 payment methods.

- Credit/Debit Cards: All major debit and credit cards such as Visa, MasterCard, Discover, Diner’s Club, and JCB Discover are supported.

- Other methods: Payment methods such as PayPal, SEPA, Masterpass, Visa Checkout, Apple Pay, Google Pay, etc., are also supported.

Supported Currencies: It supports 100+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- BigCommerce

- Magento

8. Authorize.net

Authorize.net helps merchants accept traditional payment methods, such as credit/debit cards, and alternative payment methods, such as digital wallets, from customers. It’s safe, reliable, and easy to integrate. You can start accepting the same day you integrate Authorize.net. Here are the primary features that Authorize.net offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: $25

- Charges on Refunds: Information Available on request

- Commission per transaction: 2.9% + 30¢

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards such as Visa, MasterCard, Discover, American Express, and more are accepted.

- Other methods: Echeck and Digital wallets such as PayPal and Apple Pay are accepted.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- BigCommerce

- Magento

9. Skrill

Skrill offers an instant, fast, and secure payment solution to merchants across the globe, including Germany. Using a single integration, businesses can accept payments and offer multiple payment methods to customers. Here are the primary features that Skrill offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 1.25 % for global cards.

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards such as Visa, MasterCard, Discover, American Express, and more are accepted.

- Other methods: Klarna, Giropay, Rapid Transfer, Trustly, and more.

Supported Currencies: It supports 40+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- BigCommerce

- Magento

- Wix

10. Cybersource

Using Cybersource, merchants can offer customers the payment methods they like and improve conversions. The platform is fast, secure, and has a simple user interface. Here are the primary features that Skrill offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: Information Available on request

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards such as Visa, MasterCard, Discover, American Express, and more are accepted.

- Other methods: Direct debits, BNPL, online bank transfers, and digital wallets such as Samsung Pay, Google Pay, and Apple Pay are supported.

Supported Currencies: It supports 50+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a

range of eCommerce platforms, including:

- SAP

- Salesforce Commerce Cloud

- Intershop

11. Klarna Payments

Klarna International is an easy-to-use payment solution both for merchants and shoppers. It allows customers to pay in easy installments, which is an interesting way to increase sales and convenience to customers. Here are the primary features that Skrill offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: Free

- Charges on Refunds: Information Available on request

- Commission per transaction: Information Available on request

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards are accepted.

- Other methods: Invoices, installments, bank payments, and more.

Supported Currencies: It supports several major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- Shopify

- Salesforce Commerce Cloud

- Magento

12. Paymill

Last on our list is Paymill, a payment gateway crafted in Munich, Germany. It allows merchants to accept credit card payments, among other payment methods. Paymill is built securely and helps merchants scale their business globally. Here are the primary features that Paymill offers:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: Information Available on request

Accepted Payment Methods:

- Credit/Debit Cards:

- All major debit and credit cards are

- accepted.

- Other methods: Digital wallets such as PayPal

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Information Available on request

Local Payment Gateways and The Rising Complexities for Businesses

You can find numerous local payment gateways in Germany that'll allow you to accept and manage your payments. But that will limit your business to Germany only. You may have to opt for other payment gateways to expand your business to other countries, which can be super expensive.

Moreover, relying on local payment methods can be dangerous as they might start charging you more than you agreed or face downtime. And this can lead to a poor customer experience. So, what can you do? Well, that's when inai comes in.

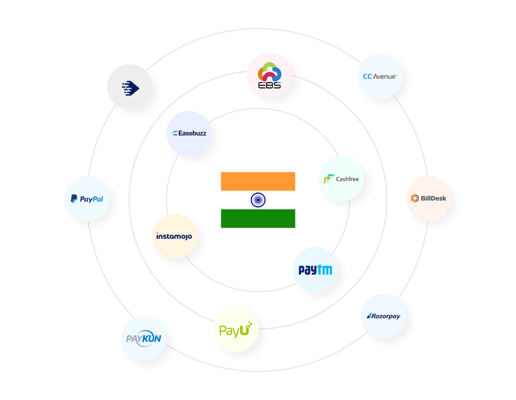

How Can inai Help You Integrate Multiple Payment Gateway Integrations in Germany?

inai is a global payment aggregation and integration platform using which you can offer 300+ payment methods via 30+ payment gateways across 190+ countries. This way, location is not a barrier for you. Whether you want to take your business to Tokyo, Oman, Kuwait, or any other country, you can do that with inai.

Moreover, you need not rely on a single payment gateway with inai. If one payment gateway is not processing payments, charging an excessive fee, or has a poor success rate, you can route your transactions through a reliable payment gateway and ensure 24/7 uptime.

Offer more payment methods in Germany by integrating with multiple payment gateways and improve your conversion and success rates.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?height=400&name=Header%20-%20Top%208%20Payment%20Gateways%20in%20the%20Czech%20Republic%20(1).png)