Given its pivotal location, Saudi Arabia has garnered considerable attention. From being the hub for well-known ancient trade routes to becoming a digital beacon in the current age, there is a lot of emphasis on making the country digitally independent.

According to a recent study by Saudi Central Bank (SAMA), e-payments overtake cash payments in 2021. Since two-thirds of the current Saudi economy is under 35 years, there is a significant dependence on smartphones.

The payment landscape in Saudi Arabia 2022 is a year of change for the Middle Eastern country, as 91% of the local populace buy their products online, while 78% of consumers are rearing to increase their online shopping in 2023.

Saudi Arabia's region is one of the largest economies in the Middle East region. The country's retail sector is affluent, as the digitally savvy population adopts modern e-shopping. The increasing trust of the consumers in online channels is enhancing trust among the users, rapidly leading to an evergreen adoption of eCommerce and online payments.

Payment gateways are a significant player in the digital payment gamut. Add the new government regulations and well-established digital infrastructure to this list, and the environment is conducive enough to facilitate a stable digital layout.

Criteria to Look Out for Payment Gateways in Saudi Arabia

Payment gateways are an excellent way to connect consumers and merchants. Not only are they convenient ways of facilitating payments, but they also act as a bridge between the concerned parties by adding a secure layer to enable quick payments.

Having said that, how do you select a payment gateway for your business? Remember, you need a payment gateway that offers a series of options to you and your merchants. Here are a few things to consider while selecting a payment gateway in Saudi Arabia.

1. Reliability: Since a payment gateway is an intermediary between buyers and sellers, selecting a reliable option for your business is essential. This way, you can ensure your customer's financial information is secure, while your merchants can accept payments without incurring any fraudulent transactions.

To ensure you are selecting some of the best options for your business, you can check the payment gateway's online rating, which should act as a guide to help you make the right choice.

2. Support currencies: As an online business, your markets are never limited. The internet offers endless opportunities, and you should not compromise your payment methods. Since each country has its established market and local currency, you need to use a payment gateway that offers you conducive conversion rates while keeping the transaction fee at the lowest.

Additionally, when accepting payments in multiple currencies, you need to provide several options to your customers so they can pay as per their local currency. This way, your brand gains customer loyalty while establishing a good name for your brand in the market.

3. Payment options: A good, reliable payment gateway offers plenty of opportunities for users to make payments via different payment methods.

These might include payments via the following channels:

-

Credit cards

-

Debit cards

-

Net banking

-

Digital wallets

The list is not exhaustive; what’s important is that you need to have the facility for your customers to make payments without worrying about transaction safety.

4. Market integration: Market integrations relate to the various options available to you as an online business, especially concerning the market situations your business might need to work with.

Suppose you are partnering with a local payment gateway. In that case, they can guide you on government regulations and help you integrate your business platform with the local guidelines.

However, if you are going with a global brand, you might still get this advantage, along with a few other options, which will enhance your integrations and customer experience manifold.

5. Security: Security is crucial since you and your customers will be exposed to market variations.

Customers' financial information is stored on your website's server when they make an online transaction. In case of a data breach, this financial information can be hacked and misused by hackers to fulfill their unscrupulous methods.

Payment gateways provide an additional layer of security to their customers to ensure such data breaches have no impact on the stored financial information.

A renowned payment gateway knows how to protect its customer's data, so you should always go with an experienced brand rather than a new entrant.

6. Pricing and other options: Finally, you must consider the pricing and the other features you will get upon signing up with a brand. Pricing can cater to some of the extra charges these gateways charge to extend their services to your business and customers.

You can begin conversations around setting up and onboarding the payment gateway if you get a good set of services catering to your business needs.

Good read : Top Payment gateways in UAE

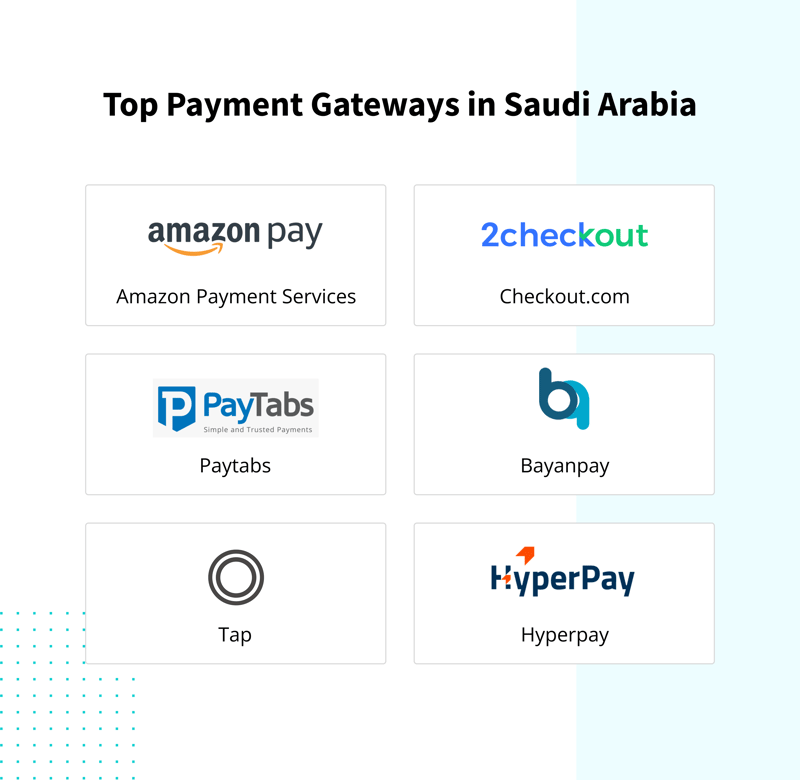

Top Payment Gateways in Saudi Arabia

1. Amazon Payment Services

Amazon Payment Services (APS) is a renowned world in the UAE market. It continues to garner a lot of attention with its services as an established payment gateway.

From accepting payments to growing your business and data insights, there is a little something for every type of business in the market.

Pricing and Other Fees:

· Setup fee: Free

· Annual Fee: N/A

· Monthly fee: N/A

· Charges on refunds: N/A

Commission per transaction: 2.8% plus extra charges

Accepted Payment Methods:

- Credit/Debit cards: All major credit cards are accepted.

- Other accepted payments: Digital wallets, Apple Pay, PayPal, Mada STC Pay, Visa Checkout, and Masterpass

Supported Currencies: All major currencies are supported by Amazon Payment Services.

Approvals and Onboarding Time: The integration process can take 3-5 business days

eCommerce Platform Integration: You can integrate Amazon Payment Services with the following:

· Woocommerce

· Shopify

· Prestashop

· OpenCart

· CS Cart

· Open Cart 2

2. 2checkout (Verifone)

Verifone is a multi-faceted monetization platform that allows you to expand your business internationally and locally within Saudi Arabia. With 400000+ customers globally, you get a suite of services with 2checkout, each aimed at a different business and customer segment.

Some standard services include the following:

Global Payments

Digital commerce

Subscription billing

Reporting and analytics

Risk management

Pricing and Other Fees:

Setup fee: Free

Annual Fee: N/A

Monthly fee: None

Charges on refunds: N/A

Commission per transaction:

There are three payment plans you can choose based on the following:

2Checkout 2 SELL: 3.5% + $0.35

2Checkout 2 SUBSCRIBE: 4.5% + $0.45

2Checkout 2 MONETIZE: 6.0% + $0.60

Accepted Payment Methods:

- Credit/Debit cards: Skrill, PO, Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

- Other accepted payments: Apple Pay, OPay, Google Pay, AliPay

Supported Currencies: 87 major currencies

Approvals and Onboarding Time: N/A

eCommerce Platform Integration: All major e-commerce platforms, such as:

- Astound Commerce

- WooCommerce

- 5874

- Shopify

- Cabiri

3. Paytabs

Paytabs, an omnichannel payment solutions company, is venturing into Saudi Arabia. It offers several payment plans to entrepreneurs, freelancers, businesses, artisans, micro-vendors, and consultants. You can raise invoices and share them with your customers via social media channels. You can share payment links and create repeat billing orders for your business.

Here are some notable features of Paytabs:

Pricing and Other Fees:

Setup fee: Free

Annual Fee: N/A

Monthly fee: N/A

Charges on refunds: N/A

Commission per transaction:

- $49.99/month (volumes below $2000)

- 2.85% + $0.27 (volumes over $2000)

Accepted Payment Methods

- Credit/Debit cards: Visa, MasterCard, American Express, STCPay, Knet, Oman Net, and Mada

- Other accepted payments: Information not available.

Supported Currencies: SAR, USD, AED, GBP, EUR, OMR, KWD, EGP, JOD, and IQD

Approvals and Onboarding Time: The integration process can take anywhere between 24 to 48 hours.

eCommerce Platform Integration: You can integrate Paytabs with the following:

· Magento

· CS-Cart

· Woocommerce

· Shopify

· Prestashop

· OpenCart

· Expand Cart

4. Bayanpay

BayanPay, as a payment gateway aggregator, enables payment gateway solutions for several business-to-business customers (B2B), business-to-consumer customers (B2C), and business-to-government (B2G) customers.

Pricing and Other Fees:

Setup fee: N/A

Annual Fee: N/A

Monthly fee: N/A

Charges on refunds: N/A

Commission per transaction: Information not available

Accepted Payment Methods:

- Credit/Debit cards: Information not available

- Other accepted payments: Information not available

Supported Currencies: Saudi Riyal only

Approvals and Onboarding Time: Information not available

eCommerce Platform Integration: All major e-commerce platforms, such as:

Astound Commerce

WooCommerce

5874

Shopify

Cabiri

5. Tap

Ever since its inception in 2014, Tap is evolving and has become a widely accepted payment technology company in the MENA region. It services more than 50000 businesses, startups, and SMEs across various regions.

Pricing and Other Fees:

Setup fee: N/A

Annual Fee: N/A

Monthly fee: N/A

Charges on refunds: N/A

Commission per transaction: Information not available

Accepted Payment Methods:

- Credit/Debit cards: KNET, Benefit, Mada, Sadad, Visa, MasterCard, or American Express

- Other accepted payments: Information not available

Supported Currencies: Tap supports ten currencies, which are:

· UAE Dirham

· Bahraini Dinar

· Egyptian Pound

· Euro

· UK Pound Sterling

· Kuwaiti Dinar

· Omani Riyal

· Qatari Riyal

· Saudi Riyal

· US Dollar

Approvals and Onboarding Time: 24 hours

eCommerce Platform Integration: WordPress/ WooCommerce

· Shopify

· Magento (1&2)

· OpenCart

· PrestaShop

· Joomla

· ECWID

· Zid

· Zyda

· Salla

· Shopgo

· Alligator

· Magna

· Expand Cart

· Matajer

· Innoshop

· Plugn

· Matjrah

· Ordr DirectWordPress/ WooCommerce

6. Hyperpay

Hyperpay is a native payment gateway, which allows businesses to accept and make payments online. It offers various services, including recurring billing, reporting, and payments to multiple merchants and customers.

Pricing and Other Fees:

Setup fee: N/A

Annual Fee: N/A

Monthly fee: N/A

Charges on refunds: N/A

Commission per transaction: Information not available

Accepted Payment Methods:

- Credit/Debit cards: Visa, MasterCard, PayPal, OneCard, CashU, PaySafeCard, AMEX, and SADAD

- Other accepted payments: Information not available

Supported Currencies: Saudi Arabia

Approvals and Onboarding Time: Information not available

eCommerce Platform Integration:

All major e-commerce platforms, such as:

Astound Commerce

WooCommerce

5874

Shopify

Cabiri

Local Payment Gateways and the Rising Complexities for the Businesses

The pandemic in Saudi Arabia changed the entire way people transact online and offline. The economy reacted by reducing cash transactions to curb the spread of the virus.

Startups are blossoming across the country, driving a seismic shift in digital payment solutions and enabling customers to purchase products and services online. However, this transformation has its challenges; from regulatory obstacles to product testing difficulty or lack of appropriate personnel - all need surmounting for effective development within this sector.

Given the massive changes, there is a long way for the economy to establish trust in the customers' minds so that they can purchase products online.

How Can inai Help You Integrate Multiple Payment Gateway Integrations in Saudi Arabia?

At inai, we are committed to powering the growth of small and medium-sized businesses. Our comprehensive suite empowers you with an all-in-one solution for managing multiple payment gateways while providing accurate reporting in one comprehensive platform. Leverage our advanced analytics capabilities to unlock never before seen insights into your digital transactions.

Some other services include the following:

1. You can manage multiple subscriptions from one platform

2. Onboard your payments solution in a flash with inai's no-code integration!

3. Integrate your online store and accept more than 300+ payment methods

4. Route payments to different merchants to improve customer conversion, retention, and payments.

Our team of experts is well-renowned in the payment aggregation realm and provides a variety of services to help our customers stay ahead in their market. Our cutting-edge solutions empower them to grow, innovate, and excel.

.png?width=4068&height=1080&name=CTA%20(2).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)