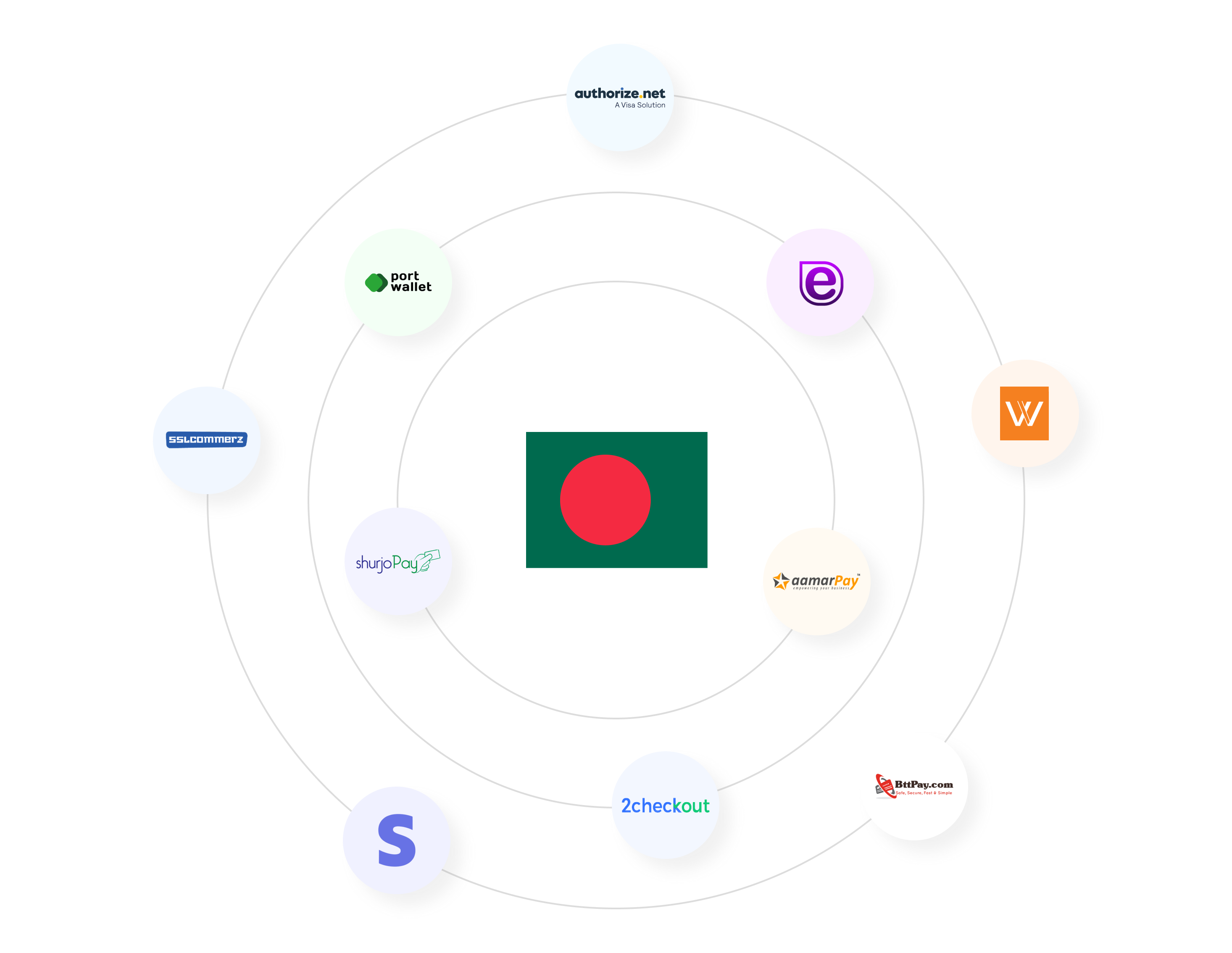

Payment gateways play a significant role in smoothly transacting money from the customer to the merchant's account and securing their clients against fraud. There are plenty of Fintech companies providing payment gateway services in Bangladesh. Businesses and users can compare these ` companies to find the best payment solution for themselves.

Current Payment Solution Landscape in Bangladesh

After the pandemic, Bangladesh observed a surge in internet usage and digital payments within and across the border. The demand for contactless payment in urban and rural areas of the country has contributed to the rise of the FinTech industry in Bangladesh.

The country's payment ecosystem is shifting from cash payments to cashless payments online and at the point of sale (POS). As per projections, the digital payment transactions landscape is USD 9.83 billion in 2022, while it will touch USD 21.4 billion by 2027. Businesses are integrating various payment methods like card payments, digital wallets, and online money transfers into their payment models to create a better user experience.

The government has introduced the Interoperable Digital Payment Platform (IDPP), Pro-Internet Banking policies, and micro merchant support to promote the growth of the digital payments sector in the country.

Criteria to Look Out For Payment Gateways in Bangladesh

As a business, you need to look for a few points before shortlisting payment gateways in Bangladesh.

1. Reliability

Every payment gateway must manage a three-step process to handle payment successfully. The three-step process includes authorization, settlement, and security. A good payment gateway must manage all these processes and ensure a quicker processing time.

2. Supported currencies

Today, many of Bangladesh's businesses are interacting with overseas clients that need a payment gateway to provide hassle-free currency exchange without incurring extra charges.

3. Payment options

Many payment methods are available for Bangladeshi consumers, including net banking, card payments, mobile/digital wallets, and QR payments. Businesses must provide various payment methods to enhance their consumer experiences.

4. Market integrations

A market integration with various procedures is necessary for a seamless client experience. Payment gateways must provide multiple integration systems for different devices and marketplaces.

5. Security

Cash transfers need to be highly secure, irrespective of the mode of transaction. A payment gateway must ensure that the client's funds are highly secure and are not vulnerable to any fraudulent activity. They must comply with PCI DSS security standards and should have additional internal safety measures to keep the client's data secure.

6. Pricing and other fees

Payment gateways should be able to handle multiple processes; ideally, each user incurs a miscellaneous cost as per the transaction type.

Some cost types include:

- Annual charges

- Security charges

- Setup fee

- Commission fee

- Refund charges

A business needs to understand the overall charge of a payment gateway and ensure there are no hidden costs.

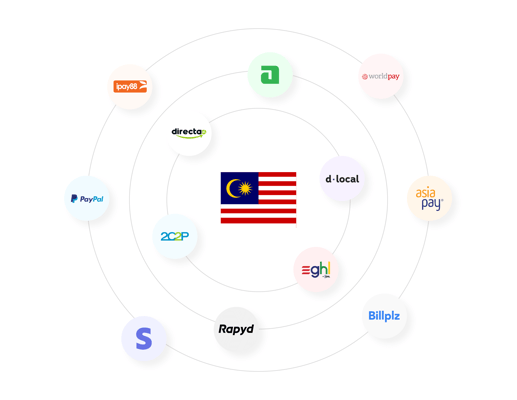

Good Read: Top 12 Payment gateways In Malaysia That You Need To Know About

12 Best Payment Gateways in Bangladesh

These are the top ten payment gateways in Bangladesh that you can associate with:

1. SSLCOMMERZ

SSLCOMMERZ is a leading payment gateway in Bangladesh. It's been operating since 2020 and boasts more than 3500 clients in providing digital payment solutions across web and mobile platforms.

SSLCOMMERZ offers an easy checkout option associated with more than 30+ payment options. The platform has additional features to make payment gateway integration easier and complexity-free for its clients.

Supported Currencies

BDT, EUR, GBP, AUD, USD, CAD

Payment Options

Visa, Mastercard, Mutual Trust Bank Net Banking, DBBL NEXUS Cards, Islamic Bank Net Banking, Bank Asia Net Banking, City Bank/ Amex, and many others

Market Integration

Plug-ins available for major platforms and languages

Security

PCI DSS Level 1, ISO 27001, DigiCert EV SSL

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

2. UniquePay BD

UniquePay BD, a payment automation software in Bangladesh, helps businesses manage their financial operations with features such as invoicing, payment processing, billing management, and API integration.

Supported Currencies

BDT, EUR, GBP, AUD, USD, CAD

Payment Options

VbKash, Rocket, Nagad, Upay, Cellfin, MasterCard, Binance, Coinbase, PayPal, and banks like Brack Bank, and Islamic Bank.

Setup Charges/Annual Fee/Commission Fee

3. Portwallet

Portwallet is a new payment gateway based out of Dhaka. The platform offers online payments to its customers and intends to expand its infrastructure to enable internet commerce.

Supported Currencies

Multi-currency support

Payment Options

Visa, MasterCard, bKash, Nexus

Market Integration

E-commerce

Security

PCI-DSS compliant

Setup Charges

Starter Package - BDT 5000

Business plan - BDT 0

Annual Fee

No charges

Commission Fee

Starter Package - BDT 2 per transaction

Business plan - BDT 1 per transaction

4. Fast Spring

Fast Spring is an ideal option for businesses to receive payments in a foreign country. The payment gateway works seamlessly without long-term contracts and a signup fee in place; they continue to offer one of the best payment services in Bangladesh.

Payment Options

Visa, MasterCard, American Express, Discover, JCB, and UnionPay.

Market Integration

eCommerce

Security

EU-US Privacy Shield Framework.

Supported Currencies

23+ currencies supported

Setup Charges/Annual Fee/Commission Fee

5. AamarPay

Aamarpay is another leading FinTech company in Bangladesh. It offers budget-friendly payment gateway services for B2B and B2C businesses while providing clients with mobile integration and QR payment options.

Payment Options

bKash, Rocket, SureCash, Visa and MasterCard, qCashu, UnionPay, and Amex

Market Integration

API & plug-ins are available

Security

PCI DSS Level 1

Supported Currencies

BDT only

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

6. Paddle

Paddle has established itself as a renowned domestic and international payment gateway in Bangladesh. It’s features integrate well with SaaS, B2B, and B2C platforms, making them a significant player in the payment domain.

Supported Currencies

BDT

Payment Options

Visa, Mastercard, American Express, PayPal, Apple Pay, and other local payment options

Market Integration

SaaS, B2B, and B2C platforms

Security

PCI-DSS Level 1 certification and SSL encryption

Setup Charges/Annual Fee/Commission Fee

7. Stripe

Stripe is one of the largest payment gateways available to businesses worldwide. They offer easy-to-use APIs integration customized for meeting different business needs.

Supported Currencies

135+ currencies

Payment Options

Cards, bank debits, bank transfers, buy now, pay later, real-time payments, vouchers, and wallets.

Market Integration

E-commerce, Enterprise, Mobile Integration

Security

PCI DSS Level 1

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

8. ShurjoPay

Shurjopay has been providing payment solutions in Bangladesh since 2010. They are helping many prominent organizations in Dhaka by solving their payment problems.

They offer QR-based payment solutions and are known for providing a developer-friendly platform for businesses.

Supported Currencies

All currencies

Payment Options

All Debit/Credit cards

Security

PCI-DSS Level 1

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

9. BTTPay

BTTPay provides its services across Asia. It is a leading FinTech sector pioneer, combining payment gateway services from small start-ups to large enterprises.

Supported Currencies

Support for 100+ currencies

Payment Options

All major Debit and Credit Card

Market Integration

APIs, Mobile SDK, and Plug-in Integrations

Security

PCI-DSS Level 1

Pricing and other fees

Setup Charges/Annual Fee

No fees

Commission Fee

3.8% + $2.00

10. 2Checkout

2Checkout is a global payment gateway solution, providing services in more than 180 countries. It has been operating since 2006 and has worked with more than 20,000+ clients. 2Checkout provides modular and customized payment options depending on the businesses' needs and has infrastructure that makes it easier for companies to interact with international clients.

Supported Currencies

All major currencies

Payment Options

American Express, Visa, MasterCard, JCB, Neteller, PO, Skrill, Paypal, and bank transfer

Market Integration

Shopping cart integration, API & 3rd party integrations

Security

PCI-DSS Level 1

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

11. Easy Pay Way

Easy Pay Way is another Bangladeshi payment solution, providing an easy-to-integrate and highly secure payment solution.

Supported Currencies

BDT

Payment Options

Visa, Mastercard, and Nexus debit/credit cards

Market Integration

Ecommerce

Security

SSL Encryption

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

12. WalletMix

WalletMix is a B2B solution provider working with various corporations and banks.

Supported Currencies

Information Available on request

Payment Options

Visa, MasterCard, American Express, UnionPay, Trust Bank, and others

Market Integration

Shopping cart integration

Security

PCI-DSS, SSL, CCV, AVS

Pricing and other fees

Setup Charges/Annual Fee/Commission Fee

Local Payment Gateways and the Rising Complexities for Businesses

The growth in the FinTech market has provided numerous options for local business owners and large enterprises. Every business demands custom features depending on their standard requirements. Small and medium-sized businesses demand easy-to-integrate, codeless, complexity-free, and budget-friendly payment services.

Similarly, large enterprises need complete control over the payment solution and demand a customized and modular payment solution for their business. Additionally, there is an imminent need to support various international currencies at lower exchange rates. Businesses need an integrated solution to cater to their varying needs, all on a single platform.

How inai helps you address multiple payment gateway integrations in Bangladesh?

inai is an all-in-one payment integration solution, offering businesses more than 30+ payment methods. We have custom solutions for e-commerce, subscription services, content and marketing services, and marketplaces.

Inai offers a cost-friendly, easy-to-integrate, less technical, and complex solution to all your payment requirements. You can easily manage your funds through our easy-to-navigate dashboard. Our system is PCI compliant and keeps all the security measures in check. Our highly dedicated internal security team ensures all the security checks are in place and saves our clients from any chances of fraud.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)