If you're looking to expand your business in the USA (United states of America) or any other developed country, you must select a secure payment gateway for customers. Highly evolved consumer demographics now require multiple methods and an effortless checkout experience when purchasing from your store - something only available through reliable payment solutions! Keep reading to discover which type of gateway will best fit all needs leading to maximum customer satisfaction and growth potential for your company.

In this blog, we've listed the top 10 payment gateways in the USA that you can choose from. To simplify the decision-making process, we've included some factors to consider when looking for payment gateways. So, let's dive right in.

Current Payment Landscape in the USA

With over 70% of Americans shopping online, the USA's eCommerce market is the 2nd largest in terms of revenue only after China. In 2022, there were 268 million digital shoppers in the USA, and this is expected to reach 285 million by 2025. This shows how prevalent online shopping is in the USA.

The best part, Americans are using and popularizing alternative or online payment methods, such as BNPL, digital wallets, credit/debit cards, etc., for online shopping, because of the seamless user experience these methods/apps offer.

Therefore, merchants looking forward to expanding their customer base in the USA must support all online payment methods. And that's only possible if you choose the right payment gateway. Let's learn how!

Factors to Consider When Looking for Payment Gateways in the USA

1. Security

You can never compromise security when looking for a payment gateway. If a payment gateway is not secure enough, it will risk your and your customer's data and finances, which is unsuitable for your business' reputation.

So, look for a PCI-certified payment gateway that follows the latest security protocols. Also, an ideal payment gateway must come equipped with fraud prevention tools to identify and block fraudulent transactions.

2. Payment Methods Supported

If customers see their favorite payment methods when shopping from you, your chances of making a sale increase significantly. Also, this may motivate them to buy from you again. So, look for a payment gateway that offers your customers a wide range of payment methods.

Pro Tip: It's recommended that you study the market first and identify the payment methods customers prefer. Then, you can find a payment gateway that supports those payment methods.

3. Supported Currencies

Having a payment gateway that supports multiple currencies is essential to international expansion. It ensures you are ready for global audiences and positioned to seize new opportunities in diverse geographies. Consider investing in such technology today for long-term success!

Certain payment gateways might charge you extra when you need support for additional currencies. Also, there could be a higher conversion fee involved. Keep this in mind when looking for currency support in payment gateways.

4. Market Integrations

An eCommerce business stands to lose valuable person-hours if its payment gateway does not integrate with the platform they are using. Take Shopify, Magento, or WooCommerce, for example - finding a suitable payment gateway that integrates quickly and effortlessly can significantly reduce labor hours spent on manual connections and technical changes.

Avoid reactionary steps down this road by researching your options in advance; it's worth hunting around for one that seamlessly fits into your workflow!

5. Pricing and other Fees

Different payment gateways charge differently. For instance, some have an annual package, some charge based on the volume of transactions, and some charge for only successful transactions. Also, different types of fees can be involved, such as transaction fees, interchange fees, conversion fees, refund or chargeback fees, etc.

So, when you're looking for a payment gateway, consider all the different types of fees that you may incur. This will help you determine if the payment gateway is affordable.

6. Reliability

Finally, you need to look at the reliability of the payment gateway. Reliability includes everything from a good payment gateway uptime, authorization rate, and dedicated customer support to good customer reviews and ease of use. You can offer a consistent and good customer experience only if your payment gateway is reliable.

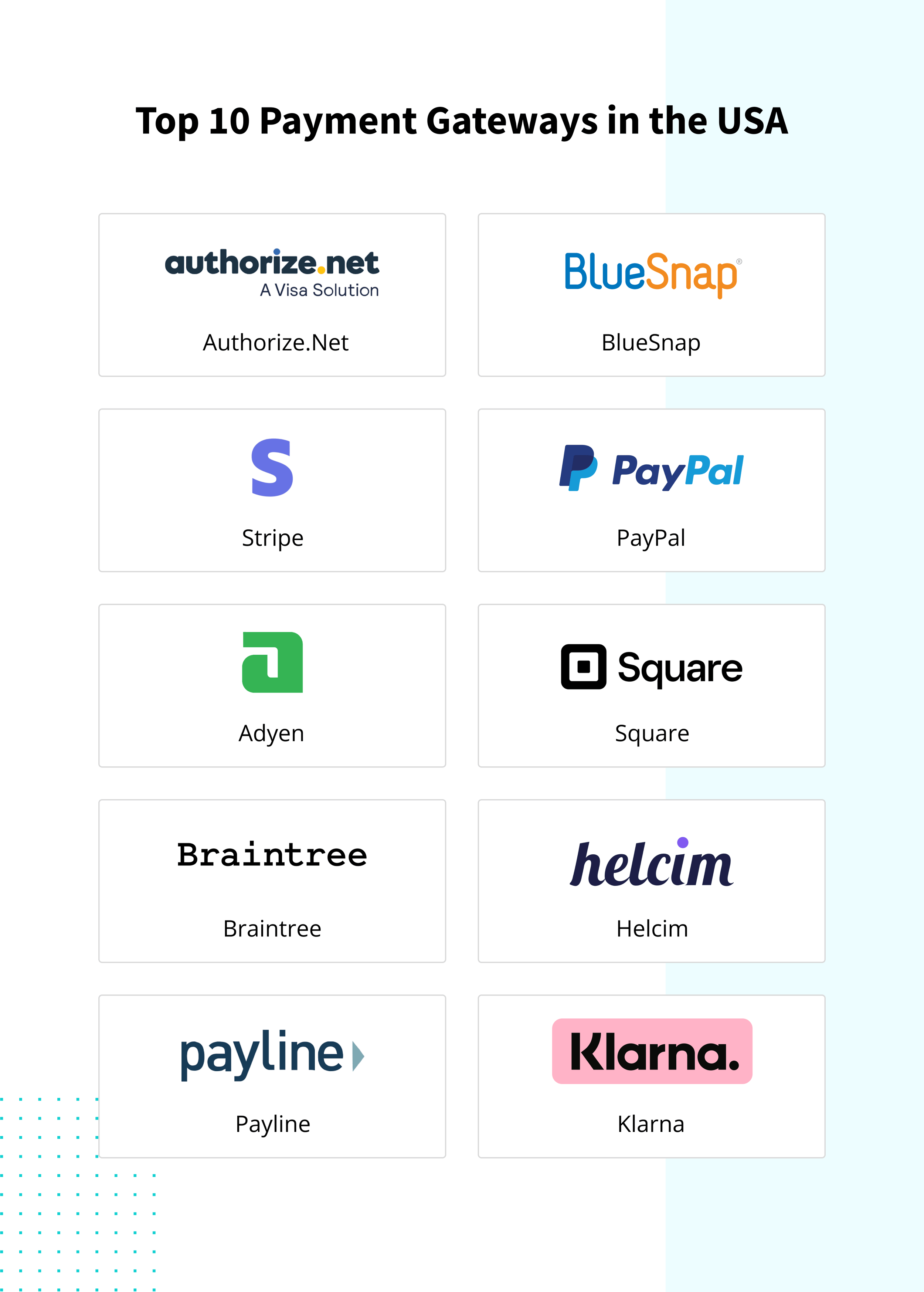

10 Best Payment Gateways in the USA

1. Authorize.net

Authorize.net is an ideal payment gateway for small businesses. You can accept both online and offline payments using this payment gateway via cards and other payment methods. Here are some key highlights:

Pricing and Other Fees:

-

Annual Fee: None

-

Setup Fee: None

-

Monthly fee: $25

-

Charges on Refunds: Information Available on request

-

The commission per transaction: 2.9% + 30¢

Accepted Payment Methods:

-

Credit/Debit Cards: It supports all major card brands such as MasterCard, Visa, American Express, Discover, etc.

-

Other methods: Alternative payment methods include Apple Pay, PayPal, etc.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

-

Magento

-

WooCommerce

-

BigCommerce

2. BlueSnap

Bluesnap is a comprehensive payments platform using which you can accept payments from customers not only in the US but across the globe. You can set up subscriptions and manage virtual terminals and POS payments using a single platform. Moreover, Bluesnap is PCI certified, has fraud prevention tools in place, and is easy to integrate as well. Here are some key highlights:

Pricing and Other Fees:

-

Annual Fee: Free

-

Setup Fee: None

-

Monthly Fee: None

-

Charges on Refunds: Information Available on request

-

The commission per transaction: 1,4% + €0,25 per successful card transaction

Accepted Payment Methods:

-

Credit/Debit Cards: It supports all major card brands such as MasterCard, Visa, American Express, Discover, China UnionPay, etc.

-

Other methods: Alternative payment methods include Apple Pay, PayPal, Google Pay, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

-

Magento

-

WooCommerce

-

BigCommerce

3. Stripe

Stripe is a well-known payment platform that is trusted by thousands of brands across the globe. You can customize the checkout experience, make it local for your customers, and offer a wide range of payment options. Here are some highlights about Stripe:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 2.9% + 30¢

Accepted Payment Methods:

-

Credit/Debit Cards: Supports all major credit and debit card brands.

-

Other methods: Supports alternative payment methods such as bank redirects, wallets, BNPL, and more.

Supported Currencies: It supports 135+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- NetSuite

- Shopify

- WooCommerce

4. Payflow Payment Gateway (PayPal)

Payflow Payment Gateway is a service from PayPal that helps you accept payments from customers via different payment methods such as PayPal credit, debit, and credit cards. It’s affordable and secure and allows you to increase sales. Here are some primary features:

Pricing and Other Fees:

-

Setup Fee: None

-

Monthly fee: $0 - $25

-

Charges on Refunds: Information Available on request

-

Commission per transaction: $0.10 per transaction

Accepted Payment Methods:

-

Credit/Debit Cards: Supports all major credit and debit card brands.

-

Other methods: Supports alternative payment methods such as PayPal, PayPal credit, and more.

Supported Currencies: It supports 135+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms.

5. Adyen

Adyen allows you to accept both online and in-person payments from your customers in the USA and across the globe. You can add more payment methods with Adyen and protect your customers from fraud. Here are some key highlights:

Pricing and Other Fees:

-

Setup Fee: None

-

Annual Fee: Free

-

Monthly Fee: None

-

Charges on Refunds: depends on the payment method used.

-

The commission per transaction: €0.10 per transaction + payment method fee.

Accepted Payment Methods:

-

Credit/Debit Cards: Major debit and credit card brands such as VISA, MasterCard, Diners Club, etc.

-

Other methods: Other methods include Alipay, Amazon Pay, Google Pay, PayPal, and a lot more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms, including:

-

Microsoft 365

-

Big Commerce

-

Vue Storefront

-

WooCommerce

Good Read: What is a Payment Gateway? | Everything you need to know

6. Square

Whether you’re a small business thinking of expanding your operations or an established enterprise wanting to streamline payments, you must try Square. It’s a comprehensive payment gateway using which you can start accepting remote, online, phone, or in-person payments.

Pricing and Other Fees:

-

Setup Fee: None

-

Annual Fee: None

-

Monthly fee: $0-$79

-

Charges on Refunds: depends on the payment method used.

-

Commission per transaction:

-

2.6% + 10¢ per transaction for card present.

-

2.9% + 30¢ per transaction for card not present.

-

3.5% + 15¢ per transaction for keyed-in.

Accepted Payment Methods:

-

Credit/Debit Cards: Major debit and credit card brands such as VISA, MasterCard, Diners Club, etc.

-

Other methods: Other methods include ACH.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms, including:

-

Magento

-

Mailchimp

-

GoDaddy

-

WooCommerce

7. Braintree

Braintree is another reliable service from PayPal that makes accepting payments easy. You can accept payments via different popular payment methods using simple integration. Also, Braintree is completely secure and innovative, allowing you to scale your business easily.

Pricing and Other Fees:

-

Setup Fee: Free

-

Monthly Fee: None

-

Charges on Refunds: Information Available on request

-

The commission per transaction: 1,9% + €0,30

Accepted Payment Methods:

-

Credit/Debit Cards: All popular credit and debit card brands are supported.

-

Other methods: Numerous APMs such as ACH, Ideal, Google Pay, Apple Pay, Pay Pal, and more are supported.

Supported Currencies: It supports all major currencies

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

-

3dcart

-

Primer

-

BigCommerce

8. Helcim

Helcim is a complete payments platform that helps you accept payments online, over the phone, or even in person using debit or credit cards. It allows you to set up recurring or subscription payments, manage invoicing, inventory, and a lot more. Here are the key highlights of this gateway:

Pricing and Other Fees:

-

Charges on Refunds: 0 if the dispute is in your favor or $15

-

Setup Fee: None

-

Monthly or annual Fee: None

-

The commission per transaction: 0.50% + ¢0.25 to 0.20% + ¢0.10

Accepted Payment Methods:

-

Credit/Debit Cards: All major card brands are supported.

-

Other Payment Methods: ACH payments.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

-

QuickBooks

-

Magento

-

WooCommerce

9. Payline

Payline is an ideal payment gateway for both small and large eCommerce businesses. You can accept online and in-person payments and even access the funds one day after they’ve been transferred. Here are the key highlights of this gateway:

Pricing and Other Fees:

-

Charges on Refunds: 0 if the dispute is in your favor or $15

-

Setup Fee: None

-

Monthly fee: $10-$20

-

The commission per transaction:

-

0.4% + $0.10 per transaction for in-person payments

-

0.75% $0.20 per transaction for online payments.

Accepted Payment Methods:

-

Credit/Debit Cards: All major card brands are supported.

-

Other Payment Methods: ACH payments.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms.

10. Klarna

Klarna is a renowned fintech company that makes accepting payments from customers easy. Whether you want to expand in the USA or across the globe, Klarna can help. It has the most comprehensive range of payment methods and is known to boost sales and, thus, revenue substantially. Here are some highlights:

Pricing and Other Fees:

-

Charges on Refunds: Information Available on request

-

Setup Fee: None

-

Monthly Fee: None

-

The commission per transaction: Information Available on request

All fee is highlighted during merchant onboarding.

Accepted Payment Methods:

-

Credit/Debit Cards: All major card brands are supported.

-

Other Payment Methods: You can offer the following options to your customers via Klarna:

-

Interest-free installments.

-

Additional 30 days to pay.

-

Thirty-six months to pay in easy installments.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

-

Adobe

-

Shift4Shop

-

WooCommerce

-

Shopify

US Payment Gateways and the Complexities They Pose to Businesses

Businesses often integrate a local payment gateway because of low transaction fees and familiarity with the local market, among other reasons. While doing this may seem the right choice, there must be more. Why?

Local payment gateways often lack support for multiple currencies and global payment methods, limiting your ability to expand your business. Moreover, in case of downtime, your entire payment infrastructure will fall, leading to failed transactions and poor customer experience. So, what's the solution?

Integrating multiple local and global payment gateways at the same time. But that can be financially and logistically painstaking. That's when inai comes in.

How inai Can Help You Integrate Multiple Payment Gateways in the US?

inai is a global payment orchestration platform that can help you integrate 50+ payment gateways and offer 300+ payment methods to your customers with a few clicks. You can start small and add more gateways or methods as your business scales. This way, you can save money and scale more smoothly.

Ensure your business never sees a moment of downtime. With inai's multi-gateway payments, you can easily route transactions through alternate payment gateways if one fails or increases its transaction fees – giving you greater control over the success and efficiency of your operations. %20(1).png?width=4068&height=1080&name=CTA%20(20)%20(1).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)