As e-commerce continues to grow and evolve, businesses face the challenge of managing an increasingly complex array of payment options. From credit and debit cards to mobile wallets and digital currencies, customers expect a seamless and secure checkout experience. Payment orchestration offers a solution to this challenge, providing businesses with a centralized platform to manage and optimize their payment operations.

In this blog post, we’ll explore the benefits of payment orchestration for e-commerce businesses, including increased efficiency, improved customer experience, and reduced fraud risk.

6 Benefits of integrating with a payment orchestration

With the capability to offer various payment options, businesses can reach a wider audience of customers from diverse regions and cultures - all with distinct preferences in terms of how they pay.

1. Offering Multiple Payment Options To Your Customers

One of the main benefits of payment orchestration is that it allows businesses to offer multiple payment options to customers. This can increase conversion rates, as customers are more likely to complete a purchase if they can use their preferred payment method.

2. Reduce Cart Abandonment

Another benefit of payment orchestration is that it can reduce cart abandonment. Customers who encounter issues with their preferred payment method during checkout may abandon their cart and never return to the website.

Payment orchestration can mitigate these issues by offering multiple payment options and automatically redirecting customers to an alternative payment method if their preferred method is unavailable.

Good read: 10 Ways to Improve Your Checkout Conversion Rates in Southeast Asia

3. Improving Payment Experience

Another benefit of payment orchestration is that it can provide businesses with more detailed and accurate data on customer transactions. This can help businesses optimize their checkout process and improve their overall payment experience. In addition, it can also help businesses identify any potential fraud or security issues and take the necessary steps to mitigate them.

4. Increased Flexibility in Payment Options

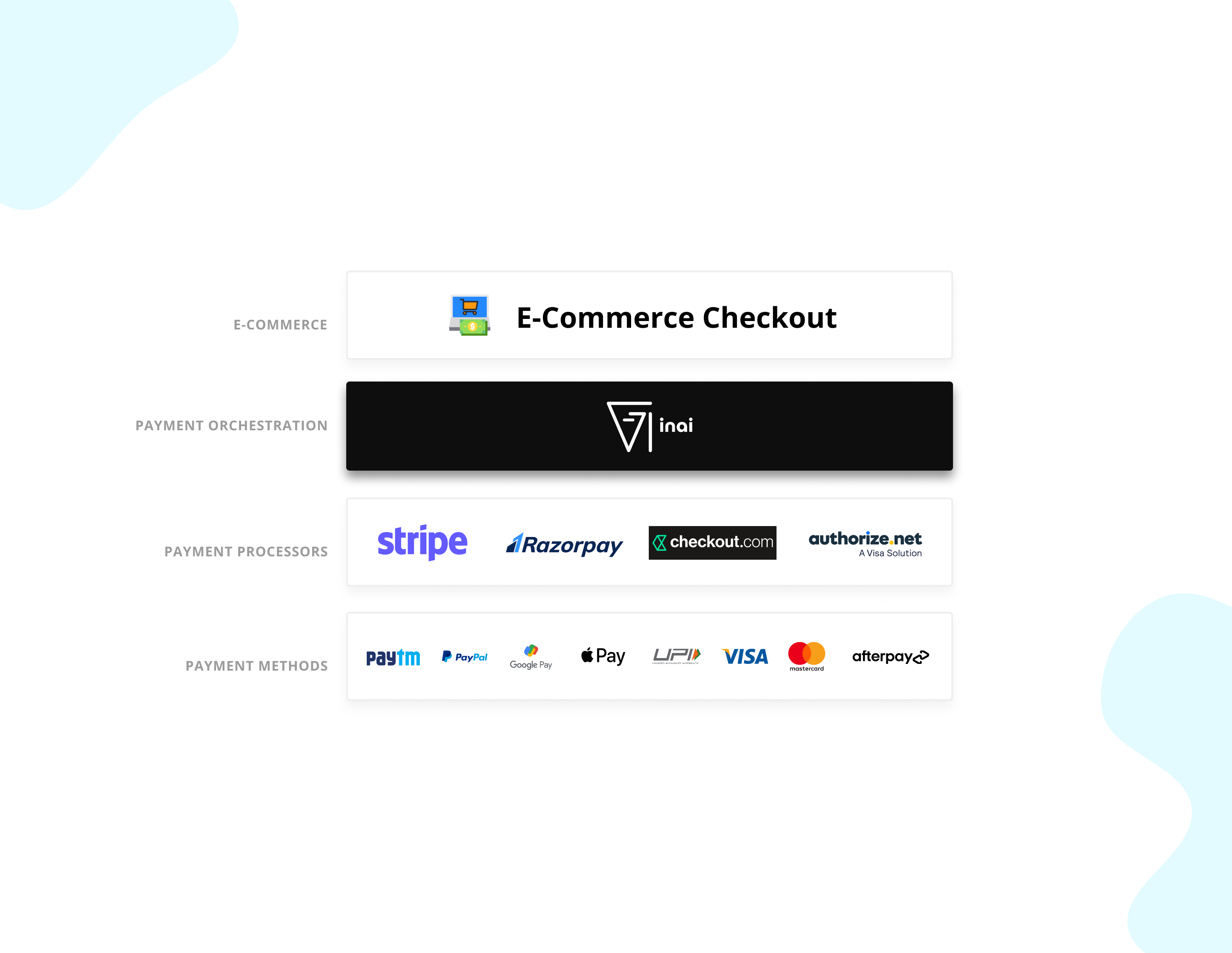

Payment orchestration allows businesses to easily integrate multiple payment methods, such as credit card, PayPal, and Apple Pay, into their checkout process, providing customers with more options to choose from. This increased flexibility allows businesses to offer customers a wider variety of payment options.

Payment orchestration also allows for the easy integration of new payment methods as they become available. Additionally, payment orchestration provides for real-time monitoring and management of transactions, giving businesses greater control over the payment process. This increased flexibility can also lead to increased sales and revenue for the business.

Good read: Why should you have multiple payment gateways?

5. Reduced Costs

By implementing payment orchestration, e-commerce companies can reduce costs by streamlining the payment process and eliminating the need for multiple, separate integrations with various payment providers. Payment orchestration can also help reduce fraud and chargebacks, which can lead to cost savings.

Furthermore, payment orchestration also enables the e-commerce company to offer customers a wider variety of payment options, leading to increased sales and revenue. Overall, payment orchestration can help e-commerce companies to improve the customer experience, increase revenue, and reduce costs.

6. Improved Security

Payment orchestration can help to improve security by centralizing the management of sensitive payment data and implementing fraud detection and prevention measures. Apart from this, many payment orchestration companies comply with industry standards to store and fingerprint various payment methods.

By centralizing the management of payments, e-commerce businesses can improve security by implementing a unified system for handling sensitive financial information. This can include features such as fraud detection and prevention, encryption, and compliance with industry standards such as PCI-DSS.

Conclusion?

Payment orchestration presents e-commerce businesses with various advantageous opportunities, including higher conversion rates and improved data visibility on customer transactions. However, companies must consider the cost implications of integrating this technology and managing compliance regulations and security protocols long after implementation.

inai is a payment orchestration platform that helps eliminate engineering efforts and saves up operational costs that help scale the business to the peak.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=2000&height=2407&name=Infographic%20-%201%20(3).png)

%20(1).png?height=400&name=Header%20-%20Top%20Payment%20Gateway%20in%20Belgium%20(1)%20(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)