So you’re looking for tried and tested ways to improve your checkout conversion rates in Southeast Asia? Well, you’ve come to the right place. This article will discuss Southeast Asia’s unique eCommerce landscape, how to calculate your cart abandonment rate, and ten easy ways to improve your checkout conversion rates in SEA.

E-commerce landscape in Southeast Asia

The eCommerce landscape in Southeast Asia is particularly unique, with diverse cultural, financial, and socioeconomic nuances. Spearheaded by the COVID-19 pandemic in Southeast Asia, 40 million people came online for the first time in 2020, bringing the total number of internet users to 400 million, up from 250 million in 2015.

As most consumers in Southeast Asia are late adopters of the internet, most have never had access to a desktop computer. Instead, smartphone penetration is high. By the end of 2020, 1.6 billion people subscribed to mobile services, representing nearly 60% of the region's population.

As such mobile devices are the main way to shop online. Indonesia emerged as the world’s largest adopter of mCommerce in 2021, with 79% of Indonesia’s internet users purchasing something online via a mobile device, followed closely by Thailand (74%) and the Philippines (70%).

Why is shopping cart abandonment a problem for merchants

As of 2022, the average cart abandonment rate stands at nearly 70%, that's over 3/4 of shoppers leaving the site without completing a purchase. While this estimation may not be the case for your business, it's a startling figure and is losing eCommerce retailers millions in revenue every year.

How to calculate your cart abandonment rate

Calculating your cart abandonment rate is simple. All you need to do is divide the total number of completed transactions by the number of transactions that was initiated.

The percentage will indicate the users who had purchase intent but did not move down the funnel. Of course, 100% of the people visiting your site won't convert. Some may be window shopping, others may have landed by accident, but those who've added a product to their cart have an intent to buy.

The good news is that there are many ways you can design your checkout flow to convert as many potential customers as possible. It's about designing your checkout process around trust and convenience for your buyers. If first-time customers have a great experience, then they are more likely to turn.

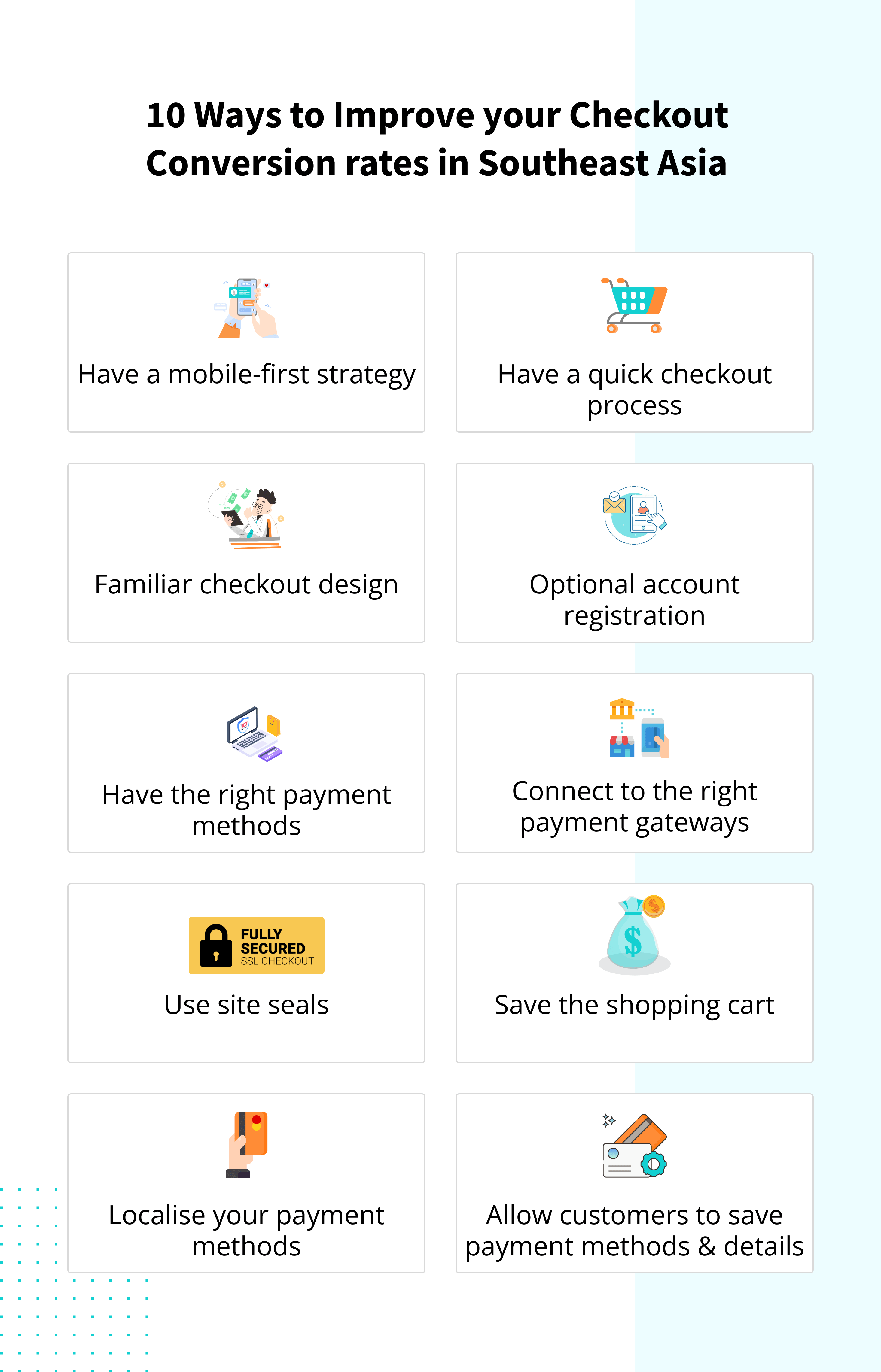

10 ways to improve checkout conversion rates

1. Have a mobile-first strategy

In the four Southeast Asian countries with high mobile penetration, Indonesia, Thailand, Philippines, Malaysia; over 72% of shoppers did mobile online shopping the past month — compared to the global average of 55.4%

And if people have a negative experience on your mobile site, they’re 62% less likely to purchase from you in the future. Merchants shouldn’t just be creating mobile-friendly experiences in Southeast Asia, but prioritizing mobile traffic. Speed matters too: just one second of delay in mobile load times can impact mobile conversions by up to 20%.

2. Have a quick checkout process

Nobody likes a long payment process. In fact, one-third (34%) of Asia Pacific consumers say they would abandon a purchase if it takes more than two minutes to complete the checkout process. Merchants should make the process as smooth and pain-free for their users as possible. Removing unnecessary barriers such as long forms, unnecessary account creation, or turning on one-click payments can help create a speedy checkout that doesn't leave customers feeling frustrated.

3. Familiar checkout design

If you are not well known in a market, first-time customers may not fully trust your brand. Having a checkout design that incorporates the look and feel of your branding and offers familiar payment methods is an easy way to combat this.

4. Optional account registration

It's usually the priority of many merchants to capture as much information about their customers as possible and secure repeat purchases. However, allowing customers to skip the account creation process, also known as 'guest checkout', speeds up the checkout process. You will be removing a step and encouraging new customers who may be on the fence to complete their sales.

If the customer is happy with their experience, they will be more than happy to create an account next time.

5. Have the right payment methods

It goes without saying that including local payment methods in your checkout ensures that customers can pay you. But it also goes beyond local payment methods. Including a range of alternative methods will ensure that you're helping all demographics who land on your website to pay the way they prefer.

For example, digital wallets are popular among unbanked populations, Gen-Z and Millennials are jumping on the Buy Now Pay Later wagon; while others may wish to subscribe to your services so that they don't have to think about paying.

Learn more about: Alternative payment methods in Southeast Asia.

6. Connect to the right payment gateways

To provide your customers with the correct local payment methods, you’ll first need to connect to multiple payment gateways and processors. Unfortunately, not all payment gateways offer full market coverage or all of the payment methods you require.

Alternatively, you can connect to multiple payment gateways at once through a payment orchestrator platform. Doing so ensures that you have the right payment methods in your checkout, guaranteed uptime, and a dynamic payment flow. Dynamic transaction routing means that payments are diverted to the best processor that gives you the best price and conversion rates for each payment method in your checkout.

7. Use site seals

According to a study by Baymard, 17% of respondents said that they abandoned their cart as they didn't trust the website with their credit card information. Merchants can increase their websites' trustworthiness by including site seals. These are icons that symbolize that you're working with other brands to make your website secure. Such site seals include the Secure Socket platform (SSL) seal from Norton or Google’s Trusted Store badge.

8. Save the shopping cart

Distractions happen in real-life as well as online, all the time. Allowing your customers to save their cart and return at a moment that's right for them, will increase your conversion rates. An easy way to do this is by using cookies to save customers' carts without forcing them to create an account. Doing so means that you can retarget the users with online advertising to push them to purchase.

9. Localize your payment methods

Localizing payment methods means offering the methods that are trusted and used by your customers in each market on a local level. Even if you're offering global ways to pay, such as Visa and Mastercard credit cards, these won't always resonate with your customers. Integrating with a payment orchestration platform ensures immediate access to a range of local and alternative payment methods without putting in the legwork.

Learn more about the most popular alternative payments in Southeast Asia

10. Allow customers to save payment methods and details

If your customers do decide to register for an account, having the ability to save their preferred payment methods and details for each one allows them to safely checkout faster when they return. It's a convenient way to ensure repeat purchases and for your loyal customers to check out quickly.

How payment orchestration platform helps to improve checkout conversion rates

There are many ways to improve your checkout conversions in Southeast Asia. But, ultimately improving conversion rates can require time, effort, and resources.

Luckily, there are advanced payment technologies, such as payment orchestration platforms that manage the entire payment process, that can help to improve your checkout conversions. Here’s how:

1. Connects you to multiple payment gateways at once

Incorporating a payment gateway is costly in time, resources, and can make scaling your payments infrastructure - a pain. A payment orchestration platform connects you to many gateways through one integration. Therefore, giving you full market coverage from the get-go.

Learn more about : "Why do you need multiple payment gateways"

2. Gives access to the right payment methods

Managing gateways means being in touch with multiple third parties. And some will offer more payment methods than others. As payment orchestrators connect to many gateways at once, you’ll have access to local and alternative payment methods across Southeast Asia immediately.

3. Easier to scale internationally

As payment orchestrators are a "one-stop" shop, making it easier for merchants to scale internationally. You can enjoy immediate access to payment methods and local currencies in new markets without spending time researching and integrating with multiple gateways in every country you do business.

4. Immediate tokenization

Somewhat like encryption, tokenization replaces the original payment data with randomly generated unique tokens that do not contain any of the original data. Therefore, keeping your customer's data safe and minimising fraud. Not all payment gateways offer tokenization, but integrating with a payment orchestration platform that does gives you the flexibility to route payment data via a single integration point.

5. Higher conversion rates

The main benefit of a payment orchestration platform is that you will see higher conversion rates on your checkout. The orchestrator dynamically pushes each transaction to the gateway with the best payment acceptance rates and lowest transaction fees. If a payment gateway is down, the transaction will be routed to the next best gateway.

inai : The ideal payment orchestrator for Southeast Asia

At inai, we focus on helping merchants scale their businesses in Southeast Asia. The inai platform provides a single source of integration and connects to multiple payment gateways and processors at once, which gives immediate access to +300 international payment methods!

Our platform makes it easy to offer your customers a fully localised checkout experience with a range of payment methods, languages, and currencies. The fully customizable front-end ensures that your checkout maintains the look and feel of your brand, allowing you to make changes as you see fit.

Dynamic payment routing with each gateway and processor gives you the highest conversion rates possible. While best-in-class CXO dashboards assist in refund management and assessing conversion rates.

With immediate access to tokenized payment technology, you can trust that payment data is in safe hands and makes PCI-DSS and GDPR compliance simple.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

%20(1).png?width=637&name=62bd6c199c082a5cc7343164_CTA%20(3)%20(1).png)

.png?height=400&name=Header%20-%20Top%20Payment%20Gateways%20in%20Finland%20(1).png)