You must've heard of interchange fees if you're a business owner who accepts card payments for online or offline transactions. It's the fee merchants pay for accepting card payments. But how is it calculated? And can it be reduced? If you have these questions on your mind, this blog can help.

In this blog, we'll dive deeper into the concept of interchange fees and how they work and learn how it's calculated. And in the end, we'll discuss how you can reduce your interchange fee and boost your profit margin. So, read in full.

What Is an Interchange Fee and How Does It Work?

Every merchant that accepts card payments knowingly or unknowingly pays an interchange fee. Interchange fee is the transaction fee merchants pay when accepting customer payments for online and offline transactions.

Although deducted as a single amount, the interchange fee is an amalgamation of fees from three players:

- Acquirer: This is the merchant's bank or the payment facilitator.

- Card Issuer: The customer's credit card company or the bank.

- Card Network: The card network includes the card's brand, such as Visa, Mastercard, Discover, etc.

Let's now learn how interchange works. Suppose a customer makes an online purchase using their credit card. Here's what happens:

- The merchant's bank sends the transaction data to the customer's card network.

- The card network sends the data to the card issuer.

- The issuer performs the necessary checks to confirm the user has sufficient funds.

- The card network submits the data to the merchant's bank if everything adds up.

- The acquirer or merchant's bank processes the transaction.

- The funds are sent from the issuing bank to the merchant's bank, depending on the settlement time.

When a transaction is processed, the acquirer (merchant's bank) pays the card network and issuer a fee. The merchant pays this fee (interchange fee) in addition to a markup fee for handing the transaction to the acquirer.

Most of the merchant's payment goes to the issuer to cover the credit card risks. And a portion goes to the card network and the acquirer.

Good Read: How Can Pre-Authorization Help You Save MDRs and Chargebacks?

How Much Is the Interchange Fee?

The actual amount of interchange fee that applies to a transaction usually depends on the intermediaries, card scheme, card type, transaction regionality, etc. However, here's a rough estimate of interchange fees for different card types in the USA and the UK:

|

Card Issuer |

Types of Cards |

Transaction Fee (UK) |

Transaction Fee (USA) |

|

Visa |

Consumer Credit Secure, Non-secure or Contactless |

0.30% |

1.15% + $0.10 |

|

Visa |

Commercial Credit Secure, Non-secure or Contactless |

1.40% |

2.10% + $0.10 |

|

Visa |

Corporate and Purchasing Credit |

1.70% |

2.50% + $0.10 |

|

Visa |

Consumer Debit |

0.20% |

0.05% + $0.22 |

|

Visa |

Commercial Debit Secure, Non-secure or Contactless |

0.30% |

0.80% + $0.15 |

|

Mastercard |

Consumer Credit |

0.30% |

1.15% + $0.01 |

|

Mastercard |

Commercial Credit Corporate |

1.50 - 1.90% |

2.00 - 2.95% + $0.10 |

|

Mastercard |

Commercial Credit Business cards |

1.25 -1.65 % |

1.55 - 2.50% + $0.10 |

|

Mastercard |

Commercial Purchasing |

1.35% |

1.90 - 2.50% + $0.10 |

How is Interchange Fee Calculated?

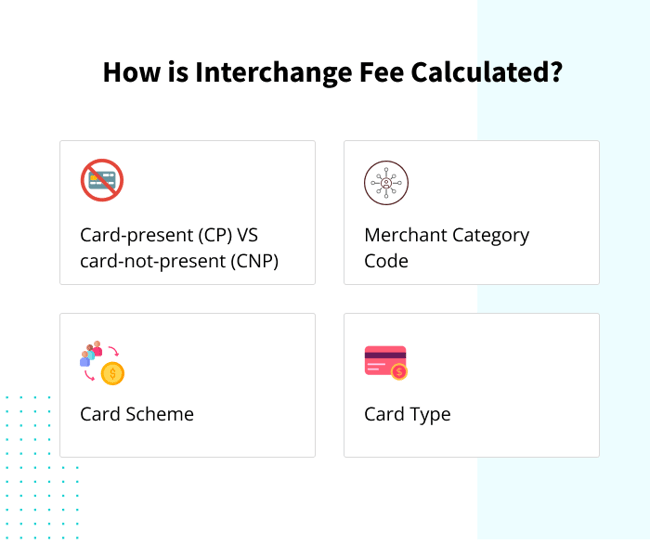

How much interchange fee a merchant will pay depends on different factors, including:

-

Card-present (CP) versus card-not-present (CNP):

In-person card payments are less expensive for merchants in terms of fees as compared to card-not-present or online transactions. This is because the risk of fraud is higher when the card is not present. -

Merchant Category Code (MCC):

MCC is a 4-digit code every merchant is assigned that tells the type of business they're doing. And different MCC codes mean different fees. For instance, charities pay a lower interchange fee than high-risk businesses such as casinos, airlines, etc. -

Card Scheme:

Different card networks have different rates. For instance, Visa charges a different fee than Amex or Mastercard. -

Card Type:

Credit cards incur more merchant fees than debit cards. It's because of the risk involved in credit card transactions as opposed to debit cards that take the money directly out of the customer's bank account.

Some card companies offer reward points or cashback to consumers. In such cases, merchants have to pay an even higher interchange fee. However, as customers tend to spend a little more when using such reward programs, accepting such cards is beneficial for merchants.

- Card Regionality: If the card was issued in a country different from the acquirer or merchant's bank, the interchange fee will be higher. This is because cross-border transactions carry their own risk.

- Security: Merchants implementing network tokenization, card security codes, and other security protocols are compensated with lower interchange fees.

- Consumer Vs. Commercial Cards: Commercial cards incur a higher fee than consumer ones.

- Transaction Location: The interchange fee depends on where the transaction is happening. For instance, in the UK, the interchange fee is 0.30% for consumer credit cards, while in the USA, the interchange fee is 1.15% + $0.10.

Example (How to calculate interchange fee):

Let's say you sell cookies at your store for $5 each. The customer pulls out their Visa credit card to make the payment. And the interchange fee, based on the above factors, is around 0.30% of the overall transaction.

Based on the fee, you'll be paying $0.015 (($5*0.30)/100) as an interchange fee. And after paying, you'll get $4.985 in your merchant account.

Interchange++ vs. Blended (Pricing Models)

Interchange ++ or Interchange Plus Plus and Blended are the most commonly used pricing models for card transactions.

Interchange++ gives you a breakdown of the interchange fee, card scheme fee, and the acquirer markup. However, you only pay the interchange fee charged by the issuer. And as the interchange fee depends on multiple factors, the actual amount you pay might be lower than the fixed fee.

The blended pricing model charges merchants an average processing fee in addition to a markup fee. While you pay the same markup fee for every transaction, you cannot see the split of the costs.

Can Interchange Fees be Negotiated?

Card issuers and banks set the interchange fee standard across every payment processing provider. So, whatever credit card processor you choose, you cannot negotiate interchange fees. But does that mean you cannot reduce the overall payment costs? Surprisingly, you can. Let's learn how.

How to Reduce Interchange Fees?

While you cannot reduce the interchange fee, you can decrease your overall payment costs by choosing payment service providers that charge a lower markup or additional fee. And you can do that by using payment routing.

Payment aggregator solutions such as inai connect you to 30+ payment gateways, allowing you to choose the most affordable option for every transaction. This way, you can ensure you're paying the lowest possible transaction fee each time, decreasing the overall payment costs.

How inai Helps?

With inai's reconcile you can simplify complex financial operations, manage reconciliations, and optimize fees. Get a 360° breakdown of all your fee components including:

- Scheme Fees

- Interchange Fees

- Commission Fees

- Markup Fees

- Blended Rates

- Processing Fees

- Outlier Fees

With a 360-degree breakdown of all fee components, you can compare multiple payment gateway fees and discover excess fees. Actively reduce costs with actionable insights

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?height=400&name=Header%20-%20How%20Do%20Payment%20Orchestrators%20Solve%20Payment%20Settlement%20Issues%20for%20Merchants_%20(1).png)

.png?height=400&name=3DS%20(1).png)