Credit card fees depend on several factors, ranging from negotiable costs levied by the payment processor to card network and issuing bank fees.

As a business, it is essential to choose the fee structure that works for your business model so that you can assimilate how much money you spend on covering fees.

To correctly judge these parameters, you must know about the different types of fees, the varying costs, and the cost of international transactions.

How Do Payment Processing Fees Work?

You must pay processing fees for your transactions whenever you use a credit card. There are different fees, especially since the merchant must pay these to the payment processors to process and accept payments via cards.

The fee amounts depend on the payment processor’s pricing model and the transaction’s risk factors. For example, e-commerce and online payments are considered high-risk transactions with higher payment costs.

So, how do payment processing fees work?

There is a slew of processing fees, which you need to keep in mind at the time of accepting payments. For example, these include payment processing fees, card network fees, and card issuer fees. Other fee instances include Fixed Acquirer Network Fee, Brand Usage Fee, Network Access, and Acquirer Processing Fee.

The average credit card fee can range between 1.5-3.5%. A merchant’s transaction fee consists of three major fee types, which includes:

-

Interchange Fee

-

Assessment fee

-

Payment processing fee

The first two elements comprise 70-80% of your base rate, while the third element accounts for 20-30%. The base rate will vary depending on your card issuer and payment processor.

What Different Fees Do Merchants Pay?

As mentioned above, merchants are required to pay different fees:

-

Network/ Card Scheme

There are a few renowned card networks, including American Express, Visa, Mastercard, and Discover. These network providers facilitate debit and credit transactions between the merchant and the card issuer.

Each of these charges the following fee amounts:

- American Express: 1.58-3.3%

- Visa: 1.29-2.54%

- Mastercard: 1.29-2.64%

- Discover: 1.53-2.53%

Card networks also facilitate some of the significant perks available on debit and credit cards, along with the offers issued by the issuing bank.

-

Interchange Fee

The issuing bank collects the interchange fee for the swiped transactions. The costs vary based on the card type, transaction amount, and business industry.

The credit card companies set interchange fees and include (on average) about 2% of the transaction amount with an additional 30-cent flat fee. The payment processing company lists the interchange fees initially and deducts them every time a payment is processed.

-

Acquirer Fee

The payment acquirer imposes acquirer fees, which cater to the services they provide for electronic payments.

Whenever merchants and businesses accept card payments, acquirers authorize the transactions with the customer’s bank. They also help settle the funds in the accounts to fight fraud.

An acquirer’s fee is a percentage of the transaction amount; alternatively, it can also be a combination of a fixed per-transaction amount and a percentage of the transaction amount. Nonetheless, the fee structure may vary based on the acquirer and the agreement with the merchant.

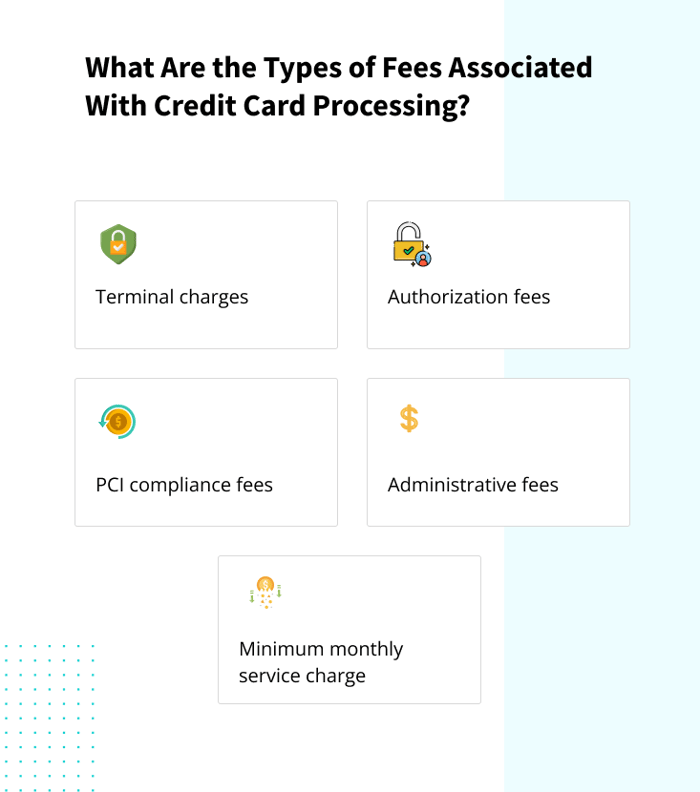

What Are the Types of Fees Associated With Credit Card Processing?

There are a series of fees associated with credit card processing. Some of the most commonly occurring transaction fees include:

-

Terminal charges: There are two types of businesses: online and brick-and-mortar. If you own the latter, you must pay a terminal hire charge. This fee covers the cost of the PIN pad and the chip reader. Other factors associated with the terminal charge include the length of the contract and terminal type.

-

Authorization fees: Whenever you have to approve your payment, you must pay an authorization fee. This per-transaction cost tests your card for validity, fraud, and relevance.

-

PCI compliance fees: All major credit card issuers must comply with the Payment Card Industry Data Security Standards. This is a monthly charge, and every issuer needs to pay it.

-

Administrative fees: This is an additional, optional charge, the payment processor’s prerogative. Such a fee type relates to the initial setup or chargeback costs.

-

Minimum monthly service charge: Whenever a business falls short of the agreed monthly transactions, it has to pay a minimum monthly service charge.

A few other transaction fee varieties aren’t included in the above list.

How Are Payment Processing Fees Determined/Calculated?

There are countless factors determining the overall cost of payment processing fees. These factors include:

-

Card type: The card type is integral to determining your fees. For example, credit and business cards have their unique interchange rates.

-

Card Network: Different card networks have different associated merchant fees. For example, Amex charges a fee of 1.58-3.3%.

-

Merchant Category Code: Your Merchant Category Code (MCC) is linked to your business type as it’s directly linked to the risk levels of the business.

-

Card Present / Card Not Present: Whenever the cardholder is not physically present, there are increased chances of fraud, which attracts a higher risk.

-

Data Level: You qualify for higher/lower interchange fee limits depending on your requirements and business transaction threshold.

-

Chargeback Rate: You will be a risky merchant if you have a high volume of chargebacks. This will automatically lead you to pay higher processing fees.

What Are the Different Types of Pricing Models?

Payment processors fall under four different pricing models, which include:

-

Tiered Pricing:

As the name suggests, tiered pricing is divided into three tiers, that are split into:

- Qualified

- Mid-qualified

- Non-qualified

The essential part of the tiered pricing model is to condense the interchange fee into three tiers and charge a flat rate per tier.

The Qualified category applies to debit card transactions made in person at the point of sale. Such transactions are made in physical businesses and carry the lowest fees since they rank low on the risk meter.

Mid-qualified transactions include transactions made via a credit card, including redeeming rewards and loyalty points.

Non-qualified transactions include transactions where the card is absent, including foreign transactions. These transactions are the least desirable, as they demand the highest fees.

-

Flat Pricing:

Flat-rate pricing blends all fee types into a single category, which proves to be costlier than some of the other fee types. The flat pricing model's most common and valuable feature is its predictability, and the fee amount remains constant.

-

Blended Pricing [ Discounted ]:

The blended or discounted pricing model offers merchants a lumpsum rate, which includes Interchange rates, card association fees, processor fees, and gateway fees. The best part about this model is that the rate will remain fixed no matter how much the underlying rates change during the period. There is no dependency on the card type, the network, or the issuing bank on the rate changes.

-

Interchange plus pricing:

The interchange plus pricing model charges the current, prevalent pricing cost plus a markup fee. The most apparent benefit of this model is transparency, while the most prominent issue is forecasting the exact amount. This model can prove to be tricky. If your interchange rate is low, you will benefit from the advantages offered by this model. However, you will always be at a loss if your interchange rate is higher.

What Are the Factors That Influence Payment Processing Fees for International Transactions?

You must pay an associated international payment processing fee whenever you transact in a currency other than your local currency. Such processing fees are levied whenever you buy a product or service from your home country or while travelling.

There are a few factors which determine the fees levied on international payments, which are as follows:

-

Currency Conversion

As a merchant, you are dealing with multiple currencies simultaneously. In such cases, the card issuer will charge a foreign transaction fee, and the payment processor will charge a conversion fee to process the transaction.

Alternatively, a few merchants offer dynamic currency conversion, which allows users to see the exchange costs and make payments in the local currency.

-

Markups for Increased Risk

Various interchange and assessment fees and other relevant associated fees are higher for foreign transactions, as there is a reasonable amount of risk and fraud involved in these transaction types.

-

Fees for Non-Domestic Cards

Cards issued by non-domestic banks attract higher payment-related fees. Such fees cover handling transactions, which bear a transaction cost relating to different countries and their regulatory costs.

Each issuing company has its fee standards, varying from country to country.

How Can Merchants Minimize and Optimize Transaction Fees With inai?

As a payment orchestration platform, inai offers a series of benefits to end users in terms of merchant services and transaction fees. Here are some of the benefits of associating with inai for your payment processing needs:

-

Guage the difference in processor’s fee: As a payment orchestration firm, inai offers excellent options for merchants to review and compare the processor fees associated with various transactions in real-time.

Such a feature allows merchants to review their options and route the payments to the lowest payment processor. -

Optimize for international transactions: International transactions come with their dedicated costs, such as higher interchange fees, foreign transaction fees, currency conversion, issuing bank costs, etc.

However, with inai, you can optimize your foreign transactions with their dynamic currency conversion model and region-specific payment methods to make the best of the available fee models.

-

Incorporate fraud prevention measures: inai’s payment orchestration platform’s state-of-the-art technology and fraud prevention measures are geared towards enhancing the existing payment structures and preventing fraudulent transactions for merchants and customers alike.

-

Identify the most suitable pricing model: As an online business, you can employ multiple payment gateways with inai’s platform. However, to make the most out of the routing fee, it’s best to review the available options in real-time and then decide where to route your payments and make the most the best use of the available pricing models. With their intelligent routing technology, you can make quick payments and seek benefits from different pricing models.

-

Eliminate Chargeback: There are plenty of reasons for merchant chargebacks. Some standard methods to reduce chargebacks include:

-

As a merchant, define your return, refund, and cancellation policies

-

Offer order confirmations to customers

-

Use strong customer authentication rules

-

Cancel recurring transactions promptly

-

Route payments: inai's intelligent payment routing engine allows you to optimize incoming and outgoing transactions while routing them through the best available payment gateway. inai offers 300+ payment methods and 30+ gateways to make your transaction routing process more accessible and fruitful.

-

Leverage network tokens to minimize interchange fees: inai uses an innovative network tokenization technology to ensure an optimal payment routing experience for merchants and fraud-free transactions.

Numerous transaction failure points exist since a credit card's information passes through multiple channels before the final authorization. The customer's details can be leaked from any of these points, making the entire transaction cycle vulnerable.

However, with intelligent tokenization technology, the payment card data is replaced with network-issued tokens to mask the sensitive information and protect the underlying data.

How Can inai Help With Payment Processing Fees?

inai’s unique services include customized processing, payment orchestration, and intelligent merchant routing facilities. When dealing with multiple currencies, especially foreign transactions, you must deal with plenty of fee varieties.

This includes interchange fees, foreign transaction fees, and currency conversion fees.

For handling international transactions, you need a payment service provider to help you make real-time decisions, reduce these fee types, and increase profits.

You can sign up for a free trial account to make the most of Inai’s payment model. With a free account, you can try the various international payment options and choose the best pricing model for your business.

The free account lets you discover our platform can help your business with cost-effective solutions and advanced features. It’s time to take the first step toward maximizing your profits in the global marketplace!%20(1).png?width=2000&height=531&name=CTA%20(35)%20(1).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20Top%208%20Payment%20Gateways%20in%20Iceland%20(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20What%20Is%20UPI%20Lite_%20(1).png)