Like any other e-business, the e-commerce domain is also flourishing in Sri Lanka. The internet has led to a revolution in online retailing, leading to accelerated economic growth post Covid'19. 2021 has seen plenty of changes in the way people shop online. There is no doubt about the time and effort the Sri Lankan government is putting in to strengthen the internet infrastructure, to meet the growing demand of trade requirements.

According to a recent survey, the eCommerce market revenue will touch US$2,682.00m in 2022. The economy is growing at an annual growth rate of 21.57%. By 2025, the projected market volume will stand at US$4,819.00m. In 2020, Daraz, a well-known e-commerce platform operating in Sri Lanka, released an e-commerce index highlighting critical demographic, consumer behavior, and purchasing trends of online shoppers.

Per the survey, there was a 1.5X YoY growth in total active consumers. Additionally, there was a 2.5X increase in the number of orders from 2019.

Importance of Payment Gateways in Sri Lanka

It's difficult to undermine the importance of a payment gateway in an e-commerce store. Not only is it an integral method to send and receive payments, but it is also necessary to assist in the smooth functioning of the economy. In Sri Lanka, the internet infrastructure, coupled with the literacy rate, is concentrated in the western peripherals of the island.

It isn't wrong to say that the entire infrastructural needs are catching up rapidly, as Colombo, Gampaha, Monaragala, and other cities are jumping on the technology bandwagon. There is an imminent need to initiate payment gateways to keep the flow of money intact between businesses and consumers.

A payment gateway primarily authorizes payments for eCommerce and online businesses to keep the facilitation intact and seamless.

Current Payment Landscape in Sri Lanka

The rise of information technology continues to propel the Sri Lankan economy towards a digitalization-driven era. As the number of FinTech organizations grows within the island country, there is a paradigm shift in the payment and settlement structures, which are evolving with the introduction of new payment channels and online facilities. In Sri Lanka, the entire payment cycle is supervised by the Central Bank of Sri Lanka (CBSL), which plays a pivotal role in stabilizing, monitoring, and handling the transmission of monetary policies. CBSL’s role in promoting developments within the national payment systems can’t be overlooked.

The payment structure is evolving by the day, increasing the benefits available to the local populace.

At present, there are a variety of payment options available, which include the following:

1. Cheques

2. Sri Lanka Interbank Payment System (SLIPS)

3. Credit/Debit/Charge/Stored Value cards

4. National Card Scheme

5. Customer account-based mobile payments

6. Internet banking

7. QR code-based payments

8. Online payment gateways

A few more payment options are available, as this list is not exhaustive. Irrespective of the method of transacting, various payment options are available to the people, making progress slow but secure for the economy.

What Should You Consider When Choosing a Payment Gateway in Sri Lanka?

Payment gateways play an integral role in the very functioning of an economy’s payment structure. Payment gateways facilitate payments from the customer to the business and vice versa. In the entire process, a lot of time, effort, and money are involved in ensuring the correct output for all involved parties.

As an online business, before integrating a payment gateway into your online business portal, you need to consider a few points, such as:

1. Cost:

There are various costs associated with every payment gateway. These costs are setup fees, monthly fees, and transaction fees. To shortlist a suitable option, consider the volume and value of transactions you plan to incur each month. Depending on the nature and frequency of payments, you should consider an option that provides the least fee type to enhance your profits per transaction.

2. Types of payment options:

There are various payment options available in Sri Lanka. A good payment gateway integrates well with different payment options, allowing you to send and receive payments via multiple channels. An ideal payment gateway option should provide easy methods of transaction handling and assist in sending and receiving payments from different channels. Since each payment type comes with its associated transaction fee, you need an option with the lowest cost.

3. Multi-Currency support:

An ideal payment gateway deals with multiple currencies simultaneously since you might deal with domestic and international customers. If a payment gateway cannot accept payments from international customers or in a global currency, there are high chances of losing customers in the bargain.

4. Security:

Finally, since you’re dealing with currencies and customer transactions, you should invest in a payment gateway that offers high-security standards to the customers. If you cannot narrow down an option that offers high-level security, you should avoid associating with such a payment gateway option.

Top 8 Payment Gateways in Sri-Lanka That You Need To Know

.png)

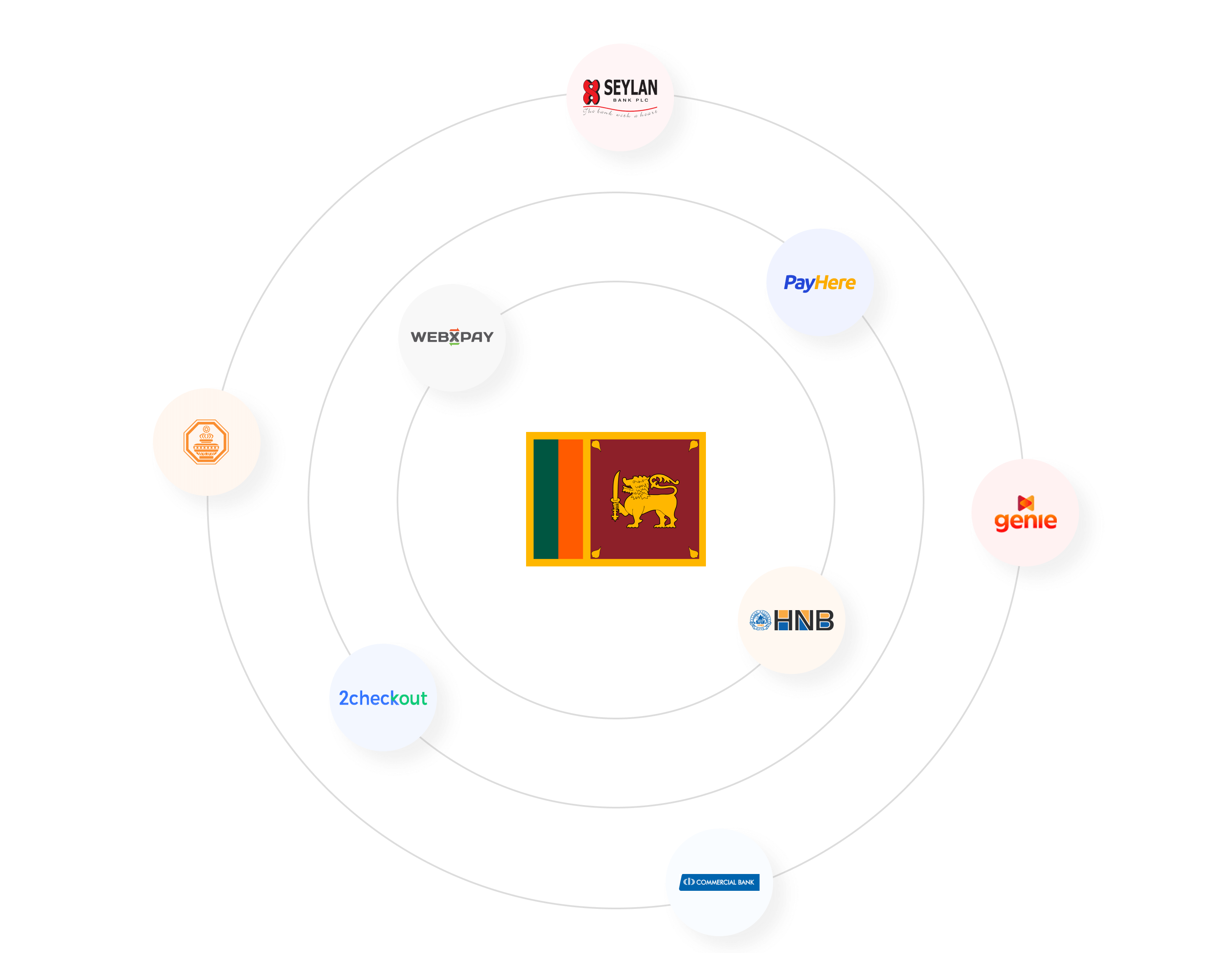

The following eight are currently some of the best payment gateways in Sri Lanka.

1) Sampath Bank

Sampath Bank, located in Colombo, offers a series of commercial banking and financial services. Some of their services include deposit provisions, trade financing, foreign currency operations, offshore banking, retail, and corporate credit, share brokering, and factoring, amongst other things.

The bank’s gateway channel is a widely accepted, secure payment gateway with high-end payment security for online transactions.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: 15,000 LKR

- Annual Fee: 45,000

- Transaction charges: Local - 3% | Foreign - 4%

Accepted payment methods: Visa, MasterCard, and Union Payment

Supported currencies: All Major currencies

Ecommerce integration: You can integrate Sampath Bank Internet Payment gateway, or SIPG, with eCommerce Shopping Cart websites such as Open Cart, Prestashop, Joomla, Magento, and other online membership websites.

2) Seylan Bank

Seylan bank is one of the oldest banks in Sri Lanka and provides a customized payment platform to help businesses and merchants with online payments.

The bank provides a variety of commercial banking and financial services all over Sri Lanka.

Their list of services includes:

- Fixed deposits

- Deposit certificates

- Saving accounts

- Foreign currency

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: 20, 000 LKR

- Annual Fee: 30,000

- Transaction charges: Local – 3-4%

Accepted payment methods: Visa and MasterCard

Supported currencies: All Major currencies

Ecommerce integration: Integration is available with all leading e-commerce platforms.

3) Commercial Bank

The commercial bank is another renowned name in the Sri Lankan financial market. Its dominance in the banking sector has enabled it to provide a secure payment structure to online users. It’s one of the only banks to offer a direct MasterCard internet gateway system to online businesses.

The Commercial Bank has also introduced a state-of-the-art process known as ComBank Simple Pay.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: 10, 000 LKR

- Annual Fee: 36,000

- Transaction charges: Local - 3% | Foreign - 4%

Accepted payment methods: Visa, MasterCard, and Union Pay

Supported currencies: All Major currencies

Ecommerce integration: Integration is available with all leading e-commerce platforms.

4) Hatton National Bank (HNB)

Given the high authority of the bank, their payment gateway enjoys plenty of authority within the market. The bank’s payment channel offers secure payment and utilizes state- of-the-art-technology. However, despite their authority and market acceptance, charges are relatively higher than some of the other providers in the market.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: 15, 000 – 20, 0000 LKR

- Annual Fee: 60,000 – 108, 000

- Transaction charges: 4%

Accepted payment methods: Visa, MasterCard, and all locally issued debit/credit cards

Supported currencies: All Major currencies

Ecommerce integration: Integration available for Shopify, WooCommerce, WordPress, and LANKAQR-integrated HNB SOLO mobile payment app.

5) Genie

Genie is a digital wallet and Sri Lanka’s first PCI-DSS payment gateway, which allows you to save all your credit/debit card information.

You can also save your savings and current account information in one app for convenient payments.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: None

- Annual Fee: None

- Transaction charges: 1.5%

Accepted payment methods: Visa, MasterCard, all locally issued debit/credit cards, mobile money, and savings/current accounts

Supported currencies: 12 foreign currencies

Ecommerce integration: Integration is available with all leading e-commerce platforms.

6) WebXPay

WebXPay has around 1000+ business customers in and around Sri Lanka. They offer a large variety of payment options to customers and are one of the largest SaaS payment gateways in the country.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: 15000

- Annual Fee:

- XGateway Enterprise – 2.3% Processing Fee and an annual subscription fee of LKR 8,990.

- XGateway – 2.8% Processing fee and an annual subscription fee of LKR 2,490.

- XWallet – 2.5% Processing fee and an annual subscription fee of LKR 1000.

- Transaction charges: 2.3-2.8%

Accepted payment methods: Visa, China Union Pay, MasterCard, American Express, Discover, Diners Club, Alipay, Wechat, DFCC virtual wallet, FriMi, Upay, Genie, Ezcash, Mcash, and Sampath Viswa.

Supported currencies: All Major currencies

Ecommerce integration: Integration available with WooCommerce, Magento, PrestaShop, PHP, Shopify, and OpenCart.

7) PayHere

PayHere is a central bank-approved payment gateway that accepts local and global payments.

Since it supports multiple currencies, you need to have an association with Sampath Bank (Current account) to access PayHere.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: None

- Annual Fee:

- LKR 3.9%/transaction (basic)

- LKR 35,880 (plus)

- LKR 119,880 (premium)

- Transaction charges: 3.99% | 2.99% | 2.9%

Accepted payment methods: Visa, MasterCard, American Express, Discover, Diners Club, Genie, Frimi, Ezcash, Mcash, and Sampath Viswa.

Supported currencies: LKR, USD, EUR, GBP, and AUD

Ecommerce integration: Integration available with WooCommerce, Magento, PrestaShop, PHP, Shopify, ShopHere, CSCart, Moodle, and OpenCart.

Good Read: Top 12 Payment Gateways In Singapore That You Need To Know About

8) 2Checkout

2Checkout is a monetization platform that lets online businesses make the most of their international and domestic payments. You can easily integrate the payment gateway with multiple e-commerce platforms to send and receive payments.

Pricing (Setup fees, Annual fees, and transactional charges):

- Setup fee: None

- Annual Fee: Pay-as-you-go model

- Transaction charges: 3.5% + $0.35 | 4.5% + $0.45 | 6.0% + $0.60

Accepted payment methods: Visa, MasterCard, and all locally issued debit/credit cards

Supported currencies: Over 200 currencies

Ecommerce integration: Integration is available with all leading e-commerce platforms.

How inai Helps You Address Multiple Payment Gateway Integrations in Sri Lanka?

Handling multiple payment gateways is nothing short of a task. This is one of the primary reasons you need a single platform to manage multiple domestic and international payment gateways seamlessly. This is where inai steps in; the platform is built to handle 300+ payment gateways all over Sri Lanka. inai’s platform is designed to provide a user-friendly platform for eCommerce and online digital marketplaces.

Since inai’s platform handles multiple gateways, you can link to domestic and local platforms and accept payments in the local currency. Local customers can make the most of such an arrangement, as they can purchase products in the local currency without worrying about currency conversion costs and high transaction fees.

Additionally, when looking for a user-friendly platform to manage such gateways, you need a fully customizable front-end CXO dashboard to manage payments from your customers.

Inai’s platform offers avant-garde security standards, customizable integration capabilities, and PCI-DSS and GDPR-compliant standards. Manage all your gateways and their associated reports from one place to ensure you never miss out on any payment-related data.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=4068&height=1080&name=CTA%20(35).png)