Payment gateways are integral to a growing economy, and Qatar’s payment landscape is no different. From using cash to adopting other digital payment methods, Qatar’s rapidly ushering in the digital era with this new trend. The pandemic has changed how people shop; this has marked a paradigm shift in consumers’ buying patterns, as more and more people are moving to the internet to make regular purchases.

Looking at the 5-year CAGR numbers, you will notice that Qatar’s market will grow by 14.21% from 2022-27. This is fueled by the Qatar government, as they are taking a lot of initiatives towards developing the digital landscape.

How to Choose a Payment Gateway in Qatar?

Payment gateways pave the way by facilitating payments between buyers and sellers. But as a business, if you want to employ the services of a payment gateway, you need to look for a few criteria before taking the plunge.

Here are some things to look out for before shortlisting a payment gateway:

1. Reliability: When dealing with financial and monetary standards regularly, you need to consider a reliable payment gateway with a reputable market standing. This way, whenever you or your customers transact online with your business, you know your business is in safe hands, and you won’t be tricked.

2. Support currencies: As you expand your business to other countries, you must accept payments in different currencies. However, not every payment gateway accepts payments in multiple currencies, which can often be a deal breaker. Every country’s payment gateway provides various local and international currency options, allowing the local population to receive/send payments via their preferred mode.

3. Payment options: A good, reliable payment gateway offers plenty of opportunities for users to make payments via different payment methods.

These might include payments via the following channels:

-

Credit cards

-

Debit cards

-

Net banking

-

Digital wallets

The list is not exhaustive; what’s important is that you need to have the facility for your customers to make payments without worrying about transaction safety.

4. Market integration: The first sign of a successful business is expansion and market integration. As you develop your business and venture out into newer markets, you will always want a payment option that works well with the inherent local currency. The idea is to provide convenience to your customers to pay in the local currency.

5. Security: The internet is full of fraudulent scamsters who leave no opportunity to hack into financial accounts and steal confidential information. A secure payment gateway needs several layers of encryption that prevent hackers from stealing customer information. Plenty of payment gateways in the market provide secure transactional level security to businesses and customers alike.

6. Pricing and other options: You need to consider the different pricing, transactional, and conversion fee applied to payments received via the payment gateways. As a business, you can even employ multiple payment gateways to choose the one that offers the best pricing and transactional fee when sending/receiving payments.

Good read : Top Payment gateways in UAE

Top Payment Gateways in Qatar

.png?width=800&height=780&name=6%20Best%20Payment%20Gateways%20in%20Qatar%20(1).png)

1. 2Checkout [Verifone]

2Checkout is a global brand with a notable presence in 211 countries. You can expect full-fledged PCI compliance, which supports around 87 currencies and 15 languages.

Some additional features include Address Verification, 300+ CVV, and plenty of rule checks.

Pricing and Other Fees:

Setup fee: Free

Monthly fee: None

Charges on refunds: Depends on users

Commission per transaction: There are three payment plans you can choose based on the following:

- 2Checkout 2 SELL: 3.5% + AED 1.28

- 2Checkout 2 SUBSCRIBE: 4.5% + AED 1.84

- 2Checkout 2 MONETIZE: 6% + AED 2.2

Accepted Payment Methods:

- Credit/Debit cards: Skrill, PO, Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

- Other accepted payments: Apple Pay, Google Pay, AliPay, OPay

Supported Currencies: 87 major currencies

Approvals and Onboarding Time: N/A

eCommerce Platform Integration: All major e-commerce platforms

2. Checkout

It’s worth noting that Checkout is a different entity and bears no resemblance to 2Checkout. Checkout, as a platform, offers various customization options so that you can scale your business as and when you want.

Pricing and Other Fees:

Setup fee: Free

Monthly fee: Free

Charges on refunds: Depends on users

Commission per transaction: AED 0.75 to 2.75 percent of the total volume

Accepted Payment Methods:

- Credit/Debit cards: Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

- Other accepted payments: Apple Pay, OPay, Google Pay, AliPay

Supported Currencies: All major currencies are supported by Checkout.

Approvals and Onboarding Time: N/A

eCommerce Platform Integration: All major e-commerce platforms, such as:

- Astound Commerce

- WooCommerce

- 5874

- Shopify

- Cabiri

3. Amazon Payment Services

Amazon Payment Services (APS) is quickly becoming a reputed name in the world of online payments, and it is becoming the go-to option for small and medium-sized businesses.

You can access their full-fledged fraud protection service with the APS gateway in tow. The entire model is built on APIs, providing users with free eCommerce plugins. You can even use Alexa’s services to engage your customers and make their experience pleasurable.

Pricing and Other Fees:

Setup fee: Free

Monthly fee: None

Charges on refunds: Depends on users

Commission per transaction: 2.8% plus extra charges

Accepted Payment Methods

- Credit/Debit cards: All major credit cards are accepted.

- Other accepted payments: Digital wallets, Apple Pay, PayPal, Mada STC Pay, Visa Checkout, and Masterpass.

Approvals and Onboarding Time: The integration process can take 3-5 business days.

eCommerce Platform Integration: You can integrate Amazon Payment Services with the following:

- Woocommerce

- Shopify

- Prestashop

- OpenCart

- CS Cart

- Open Cart 2

4. Sadad

Established in 2018, Sadad’s payment gateway is a secure payment gateway specializing in providing third-party services to businesses and customers in Qatar. The payment service provider is aligned with Qatar Central Bank’s regulations, providing the utmost security for conducting domestic and international transactions.

Pricing and Other Fees:

Setup fee: Free

Monthly fee: None

Charges on refunds: 2 QR per refund

Commission per transaction: 2.5% or 2.5 QR

Accepted Payment Methods:

- Credit/Debit cards: Naps, Visa, MasterCard, Amex, JCB,

- Other accepted payments: Digital wallets, Apple Pay, PayPal, Mada STC Pay, Visa Checkout, Masterpass, GPay

Supported Currencies: Saudi Riyal only

Approvals and Onboarding Time: Information not available

eCommerce Platform Integration: You can integrate Sadad with the following:

- Woocommerce

- Shopify

- Prestashop

- OpenCart

- CS Cart

- Open Cart 2

- Magento

- Xcart

5. Fatora

With Fatora, you get payment links, along with some other features like invoice generation, point of sale, and a slew of other features. Using this payment gateway, you can establish a meaningful link between businesses and merchants to send and receive payments.

If your business is based in Qatar, you can benefit immensely from Fatora, as it allows you to generate invoices and generate payments within the MENA region.

Pricing and Other Fees:

Setup fee: Depends on users needs

Monthly fee: None

Charges on refunds: Depends on users needs

Commission per transaction: Information not available

Accepted Payment Methods:

- Credit/Debit cards: Naps, Visa, MasterCard, Amex, JCB,

- Other accepted payments: Stripe, OTap, PayPal and Vapulus.

Supported Currencies: Multi-currency support is available

Approvals and Onboarding Time: Information not available

eCommerce Platform Integration: You can integrate Fatora with the following:

- Woocommerce

- Shopify

- Magento

- Wix

Local Payment Gateways and the Rising Complexities for the Businesses

Despite a lot of government regulations, Qatar’s payment methodology is changing rapidly. With the introduction of new laws and the global pandemic pressure to shift to a digital view, businesses are increasingly moving to the internet to sell their goods and services. On the other hand, consumers accept this change readily, as they feel reducing cash purchases can help keep the pandemic at bay.

With efforts from the government, businesses, and consumers, the shift towards digital platforms is on the rise, leading to an all-rounding development within the country.

Some other factors have made this shift possible:

- With the advent of the Covid’19 and the FIFA World Cup, financial institutions are giving up cash and going digital. This has led to an increase in cashless payments, which the Qatar Mobile Payments System backs.

- Qatar has one of the highest smartphone penetration rates; mobile shopping and banking are snowballing, and customers are purchasing their products online.

- Qatar Central Bank is using electronic wallets to develop the payment environment to encourage merchants and customers to transact online willingly. The bank has also issued a QR code specification to aid users in making payments easier and faster.

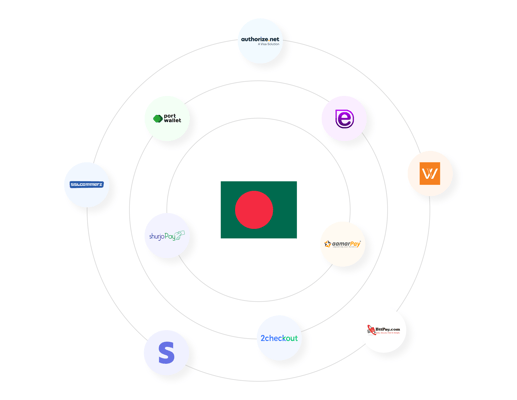

How Can inai Help You Integrate Multiple Payment Gateway Integrations in Qatar?

Payment aggregators like inai have considerable experience in managing multiple payment gateways. No matter if you’re the owner of a small or medium-sized business, or the CEO of a large conglomerate, if you are using multiple payment gateways, you need someone to manage your payment gateways for you.

As a payment aggregator platform, inai offers various services to the end customers by managing everything from a single dashboard. As a business, you need to work with multiple gateways to ensure you get suitable pricing models for your transactions while routing transactions between the customer and the merchant to avoid payment hassles.

If you spend all your time and effort on such menial tasks, you will waste a lot of unnecessary time sorting out such admin tasks. Instead, inai can handle these for you so that you can concentrate on your business insights to make meaningful decisions for the betterment of your business.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png)

.png?width=4068&height=1080&name=CTA%20(2).png)