When you purchase a product or service on a merchant site/app, the payment gateway's job is to conduct the payment securely. The payment is facilitated via debit/credit cards, net banking, e-wallet transactions, cash, etc. The payment gateway submits the relevant transaction responses for orders and intermediate requests. But how many such transactions is a payment gateway handling in an average year?

The eCommerce market is growing exponentially; in fact, the market's revenue will increase to $6.388 billion in sales by 2024. In Vietnam, merchants have disparate options for payment gateway integration. According to recent surveys, the Vietnamese eCommerce/mCommerce industry will grow by 30% between 2022 and 2025.

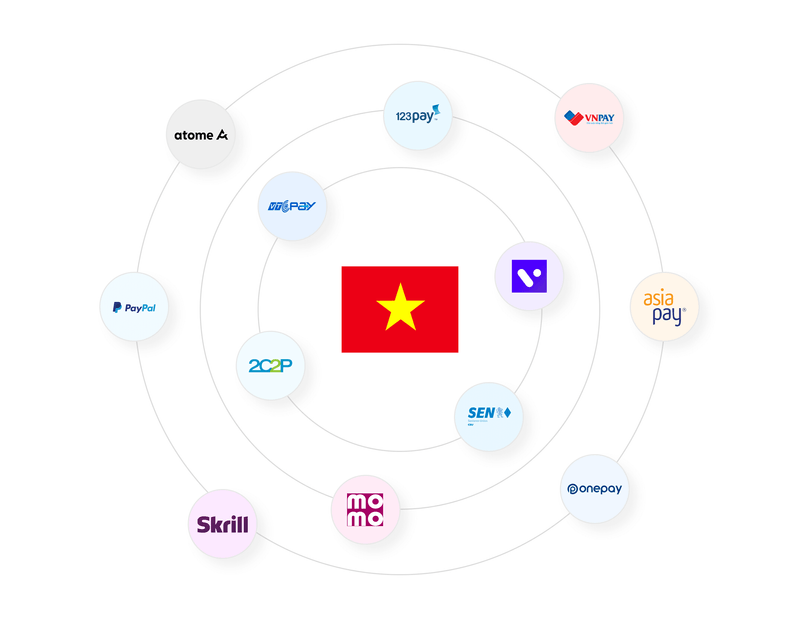

Current payment solution landscape in Vietnam

The eCommerce sector is rapidly investing in FinTech innovation to support smooth, secure digital transactions in Vietnam. Seamless connectivity between consumers and businesses continues to be one of the foremost objectives.

Vietnam relies on the following to envision such leaps and bounds by incorporating an adaptable payment solutions model:

Integrated e-Payments

eCommerce operators of varying scales can increase accessibility and conveniences for users by integrating digital payments into their software. It paves the way for successful conversions.

Mobile Wallets & Payment Platforms

mCommerce has flourished in Vietnam by integrating novel payment solutions like mobile wallets. Along with full-service payment platforms, these wallets offer merchants plenty of payment gateway options.

International Scalability

The integration of digital payment gateways allows Vietnamese businesses to adopt fintech for scalable domestic and international sales and transactions. Vietnam's current payment solution landscape supports cross-border transactions for start-ups, SMEs, etc., and large-scale enterprises. The Vietnamese government seeks to bolster the agro sector through eCommerce. eCommerce has become user-friendly, flexible, and robust, thereby gearing up to support the projected 18 million additional users in the country's eCommerce ecosystem by 2025.

Criteria to Look Out For Payment Gateways in Vietnam

1. Reliability

The payment gateway has a 3-step flow that encompasses multiple critical micro-steps:

- Authorization

- Settlement

- Security

When you place an order using the merchant's service, the merchant's server relies on the payment gateway to carry this order to and from the associated banking system. Rest assured, if you're able to navigate through these steps, you can safely trust a payment gateway.

2. Supported currencies

Various types of currency support ensure the best foot forward for handling multiple customer demographics. This payment gateway solution allows domestic and international users to purchase from Vietnamese businesses without exorbitant currency conversion charges.

3. Payment options

The higher the number of payment options, the better is the B2B and B2C merchant prospects. A diverse payment gateway support lays the foundation for more significant user incentives for using eCommerce/mCommerce facilities.

Also read: "Top Payment Methods In Vietnam That Your Business Needs to Know"

4. Market integrations

A seamless seller and payment gateway integration boosts user engagement and enhances payment support. Businesses don't need to spend on tech skills to integrate a payment gateway into their platform.

5. Security

Contemporary payment gateways rely on HTTPS certified network protocols. They use HMAC signatures for request and response authenticity verification. All payment gateway services must comply with PCI DSS Level-1 security standards. Modern businesses employ payment gateways that use multi-factor authorization and encrypted transaction ledger databases. This helps prevent transaction level, account level, and network-level fraudulence.

6. Pricing and other fees

Well-metricized pricing and fee structure within a payment gateway helps in mass adoption.

The average payment processing solution has associative fees, such as:

- Start-up

- Transaction

- Chargeback

- Termination

- Lease charges for credit processing equipment.

Trumped-up transaction charges and tariffs detract users from completing the consumer journey. Fortunately, Vietnam's eCommerce ecosystem is privy to heterogenous payment gateway solutions.

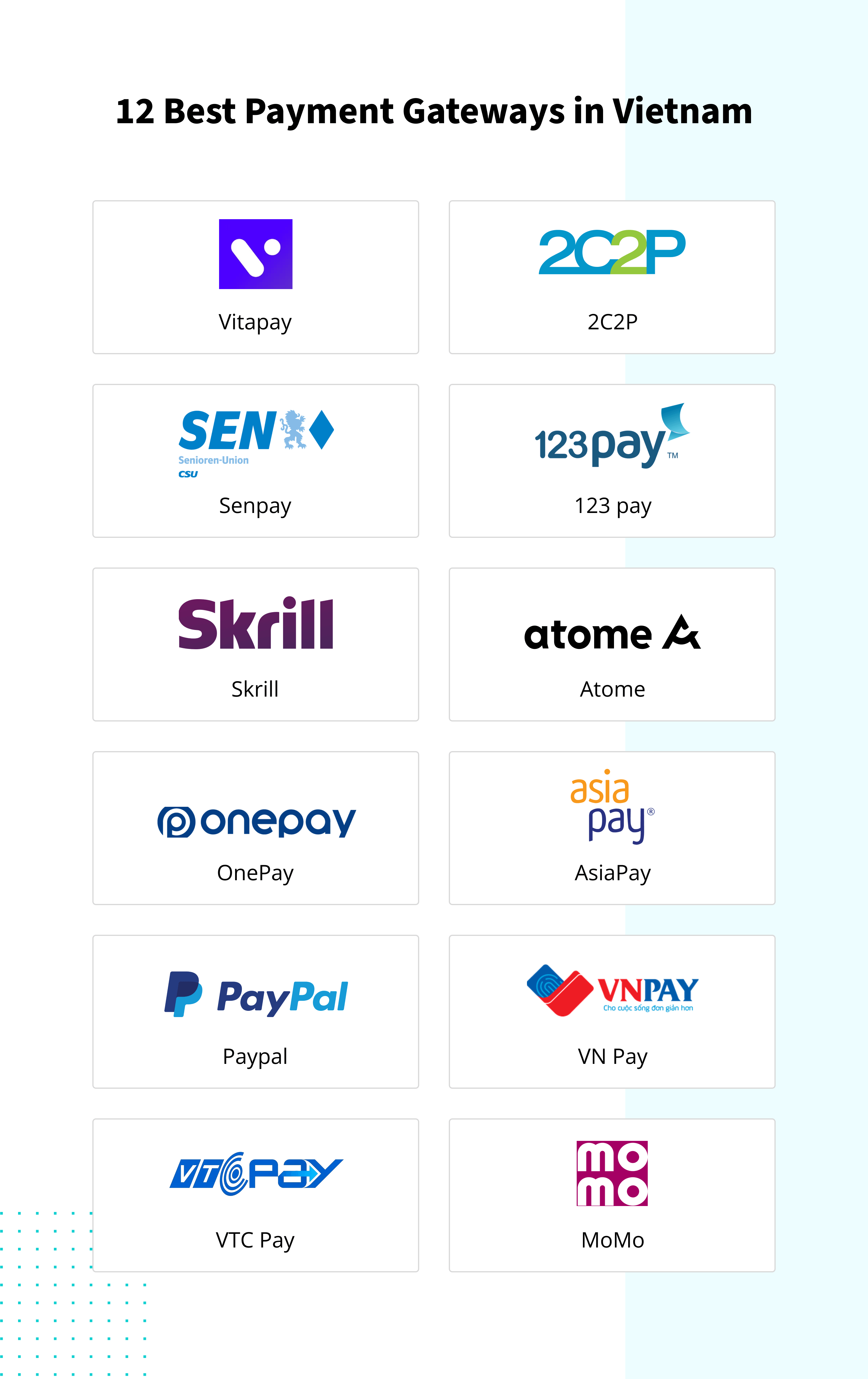

12 Best Payment Gateways in Vietnam

1. Vitapay

Vitapay is a New York payment gateway providing easy mobile payments on various platforms within the Vietnamese eCommerce sector. With Vitapay, you can connect your card reader to register for transaction services. Additionally, it allows you to auto-update customer financials in real-time and even host secure payment pages with tokenized information ledgers.

Pricing and other fees

- Setup fee: Available upon request

- Annual fee: Available upon request

- Refund charges: Available upon sign-up

- Commission per transaction: Available upon sign-up

Accepted payment methods

- Credit/Debit Card: Available upon sign-up

- Other Payment Method: Available upon sign-up

Approvals & onboarding time

Immediately upon application

eCommerce platform integration:

Readily integrates with retail businesses, F&B businesses, service-based businesses, digital businesses, etc.

2. 2C2P

2C2P is a Singapore-based platform that is a cross-border payments gateway. Spanning its services over Cambodia, 2C2P looks to catalyze digital payments in Vietnam massively. 2C2P is owned by internet services and eCommerce giant Alibaba's subsidiary concern, Ant Group.

Pricing and other fees

- Setup fee: Available upon request

- Annual fee: Available upon request

- Refund charges: Available upon sign-up

- Commission per transaction: Available upon sign-up

Accepted payment methods

- Credit/Debit Card: Available upon sign-up

- Other Payment Method: Available upon sign-up

Approvals & onboarding time

Immediately upon application

eCommerce platform integration

Merchants can connect to financial institutions like Lotus, Big C, Family mart, Bangkok Bank, Krungsri Bank, Kasikorn Bank, Siam Commercial Bank, and Government Savings Bank.

Supported currencies

All commonly supported currencies

Approvals & onboarding time

Immediately post-application, merchant accounts are assigned a unique ID

eCommerce platform integration

The payment process and gateway integrate easily with numerous mobile application types and offer a full range of dev tools so merchants can customize the gateway as per their UX targets.

3. SenPay

SenPay wallet is an electronic payment gateway extending its support for flat and cryptocurrency.

Pricing and other fees

- Setup fee: Free

- Annual fee: Free

- Refund charges: Free

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: You can pay conveniently with Master/Visa cards issued by domestic and international banks.

- Other Payment Method: MoMo, and Zalo Wallets

Supported currencies

Senpay only supports Vietnamese Dong (VND)

Approvals & Onboarding time:

Immediately upon application

eCommerce platform integration

Merchants can connect to financial institutions like Lotus, Big C, Family mart, Bangkok Bank, Krungsri Bank, Kasikorn Bank, Siam Commercial Bank, and Government Savings Bank.

4. 123 Pay

123 Pay is an India-based payment gateway integration launched by the Reserve Bank of India. The payment gateway doesn't require an internet connection. The service platform features IVR functionalities, proximity sound-based payments, and missed call functionalities. It consists of vehicular FAST tags, utility, and bill payments, amongst other things.

Pricing and other fees

- Setup fee: Free trial available for a month; the service is chargeable thereafter.

- Annual fee: Free

- Refund charges: Free

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: Visa, MasterCard, American Express (AMEX), Discover Financial Services, and JCB International

- Other Payment Method: Not applicable

Supported currencies

Indian rupees (INR)

eCommerce platform integration

Rapid integrations are available immediately

5. Skrill

Skrill is an online payment wallet integrator suitable for commercial and personal digital financial transactions. It supports 100s of sites already, which means you can readily purchase/refund payments. It engages users with its innovative loyalty program that allows them to collect points and reap benefits and rewards as incentives.

Pricing and other fees

- Setup fee: Free of charge

- Annual fee: None

- Refund charges: None

- Commission per transaction: Varying degrees of commissions, depending on nature of transaction.

Accepted payment methods

- Credit/Debit Card: Atome also accepts most credit/debit cards issued by a financial institution.

- Other Payment Method: BankPlus, Neteller, debit card, Paysafecash, Bank transfer via Sofort/Klarna

Supported currencies:

35+ leading currencies supported

Approvals & onboarding time

Immediate

eCommerce platform integration

Rapid API integrations

6. Atome

Atome, as a service provider, allows merchants and customers to break-down transactions into three easy payments. This incentive will enable consumers to follow the 'buy now, pay later' ethic. Its API can be integrated with online eCommerce services and with physical store POS systems.

Pricing and miscellaneous fees

- Setup fee: Free of charge

- Annual fee: The account is free for personal use; as a practice, you need to make a transaction every 6 months to retain your free status.

- Refund charges: Information not available

- Commission per transaction: Varying degrees of commissions, depending on nature of transaction.

Accepted payment methods

- Credit/Debit Card: Easy integrations with all renowned financial institution’s cards

- Other Payment Method: Apple Pay

Supported currencies

35+ leading currencies supported

Approvals & onboarding time

Immediate

eCommerce platform integration

Integrations available with Easy Store, Magento 1 & 2, Opencart, Salesforce SFRA and Site Genesis, Shopify, Wix, and WooCommerce.

7. OnePay

OnePay makes digital payments easy for businesses within varying verticals. It allows merchants to pay bills, vault and tokenize finances, etc. The gateway always provides an effective service by invoicing memos with rich transaction details and auto-approving payments to the correct recipient.

Pricing and miscellaneous fees

- Setup fee: Free of charge

- Annual fee: Free

- Refund charges: Information not available

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: Visa, MasterCard, American Express (AMEX), JCB International, and UnionPay

- Other Payment Method: Electronic wallets like MoMo, ZaloPay, Viettel money, Moca, etc.

Supported currencies

VND

Approvals & onboarding time

Immediate

eCommerce platform integration:

Integrations available with WooCommerce.

8. AsiaPay

The multi-channel transaction gateway is one of Asia's best answers to existing alternatives like PayPal. The platform prioritizes regional payment processing.

AsiaPay offers multi-lingual support, allowing international users to use it seamlessly.

Pricing and miscellaneous fees

- Setup fee: Free of charge

- Annual fee: Free

- Refund charges: Information Available upon request

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: RuPay, MasterCard, JCB, Discover, Diners Club International, Amex, UnionPay, Visa

- Other Payment Method: Bank accounts, net banking, digital wallets, and other commonly accepted payment platforms.

Supported currencies:

There are around 144 currencies supported by the platform

Approvals & onboarding time:

Immediate

eCommerce platform integration:

Various e-commerce integration plug-ins available for use.

9. Paypal

PayPal is a worldwide online shopper's payment solution, used in over 200+ international markets. The consolidated payment solution service provides analytical tools to help businesses strategize new growth solutions based on sales demographics.

Pricing and miscellaneous fees

- Setup fee: Free for personal users, year-round; business accounts are chargeable

- Annual fee: Free for personal users, year-round; business accounts are chargeable

- Refund charges: $1.99 (2.99% plus 49 cents)

- Commission per transaction: Based on currency received

Accepted payment methods

- Credit/Debit Card: MasterCard, JCB, Discover, Diners Club International, Amex, UnionPay, Visa

- Other Payment Method: PayPal balance, PayPal credit, and rewards balance

Supported currencies

Supports all major currencies in operative nations

Approvals & onboarding time

Immediate

eCommerce platform integration

Various e-commerce integration plug-ins available for use.

10. VN Pay

Vietnam Payment Solution Joint Stock Company established VNPay over 10-years ago to revolutionize electronic payment and FinTech in Vietnam. It boasts 15 million monthly active users who rely on the gateway for billing, grocery shopping, and commuting.

Thanks to its localized demographic, VN Pay is one of the largest homegrown unicorn service providers in the Vietnamese FinTech ecosystem, with over 20000 businesses in its clientele.

Pricing and miscellaneous fees

- Setup fee: Free

- Annual fee: Free

- Refund charges: Available upon request

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: No information available without sign-up

- Other Payment Method: Not available

Supported currencies

No information available without sign-up

Approvals & onboarding time

No information available without sign-up

eCommerce platform integration

No information available without sign-up

11. VTC Pay

VTC Pay is a leading payment gateway solution, noted for its PCI-DSS level security. It facilitates secure credit card transactions between merchants and customers and supports a litany of domestic and international banking systems.

The innovative service has no setup or transaction costs that detract customers. This is an added incentive for merchants as more customers are likely to complete conversions with lower tariffs.

Pricing and miscellaneous fees

- Setup fee: No information available without sign-up

- Annual fee: No information available without sign-up

- Refund charges: No information available without sign-up

- Commission per transaction: No information available without sign-up

Accepted payment methods

- Credit/Debit Card: No information available without sign-up

- Other Payment Method: Not available

12. MoMo

MoMo is a digital e-wallet with all the boilerplate features that one can expect from a payment gateway service. The brand derives its name from the abbreviation 'Mobile Money.' MoMo is a progressive payment service with rapid integration plugins for CMS eCommerce. It boasts extensive documentation for low-tech extensibility, disbursements, collections, widgets, remittances, etc.

Pricing and miscellaneous fees

- Setup fee: Free version with limited features

- Annual fee: $50 per website

- Refund charges: Available upon request

- Commission per transaction: Available upon request

Accepted payment methods

- Credit/Debit Card: No information available without sign-up

- Other Payment Method: MoMo eWallet funds, and MoMo eWallet postpaid

Supported currencies

No information available without sign-up

Approvals & onboarding time

Immediate

eCommerce platform integration

No information available without sign-up

Local payment gateways and the rising complexities for businesses

The Vietnamese eCommerce market boasts of technologically sound, large-scale businesses. Such businesses can't afford to lose audience targets for the lack of seamless, performant payment solutions. At the same time, even small businesses need a low/no-code solution that they can easily set up to launch their services ASAP.

Thus, Vietnamese businesses face a lot of challenges in the field of digital transactions, which include:

a. Multi banking vendor support lacking

b. Technically complex payment solutions

c. High tariffs and fees detract customers, thereby reducing profitability

d. Dismal success rate, speed, and customer satisfaction in successful transactions

Vietnamese businesses deserve a unified payment gateway that acts as a one-size-fits-all solution to their digital transaction woes.

How inai helps you address multiple payment gateway integrations in Vietnam?

inai is a multi-payment gateway integration service that helps businesses in Vietnam launch their service faster, at optimized transaction costs. Users can experience extremely fluid, localized checkouts for every transaction.

The payment gateway is a low-code utility that empowers teams with low tech skilling availability to enhance customer conversion numbers. The inai API has drop-in widgets and invoicing systems to generate dynamic, highly-secure payment links for every user. inai is SCA-compliant and GDPR-ready, and PCI level1 DSS certified, making it safe for store integration. With over 300+ payment methods in availability, merchant scan chooses their payment methods on a market basis.

Your team can quickly build custom workflows using inai's WYSIWYG step-builder and optimize these payments on a market basis. You can also customize your checkout flow as per your bespoke business needs.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=4068&name=62a343e65ffcf9c7f719e7ed_CTA%20(1).png)