As Vietnam is emerging as a powerhouse in the Southeast Asian region for e-commerce, more and more businesses are looking to shop in this vibrant economy. With over 90 million people, Vietnam offers great potential for companies looking to grow their businesses. However, doing business in Vietnam can be complex, especially when it comes to payment methods.

On a regional scale, Southeast Asia (SEA) is well-positioned to fuel, the shift to cashless payments and even more significant innovations in the digital service ecosystem. With a consumer base of 623 million people by 2030, SEA is projected to be the fourth-largest economy globally. By 2025, the region will consist the world's third-largest middle class.

Factors Driving the Economic Boost in Vietnam

Vietnam is one of the most dynamic economies in SEA and is forecast to be the fastest-growing economy over the next five years. The country's gross domestic product (GDP) is projected to expand by an annual average of around 6% between 2018 and 2023.

The growth of the Vietnamese economy is being driven by several factors, including strong domestic consumption, continued foreign direct investment (FDI), and an expanding manufacturing sector.

Vietnam's rapidly growing middle class is increasingly embracing mobile commerce, and this is reflected in the country's e-commerce market. The value of Vietnam's e-commerce market is expected to reach US $15 billion by 2025, up from an estimated US $3 billion in 2018. The growth of the e-commerce sector is being driven by several factors, including the increasing penetration of mobile devices and rising internet usage.

This blog post will introduce you to the top payment methods in Vietnam.

Top Payment Methods in Vietnam

E-commerce is overgrowing in Vietnam. According to a recent report by eMarketer, Vietnam's e-commerce sales are expected to grow by more than 19% each year through 2021. There are many factors contributing to this rapid growth, including the increasing use of mobile devices and the growing middle class.

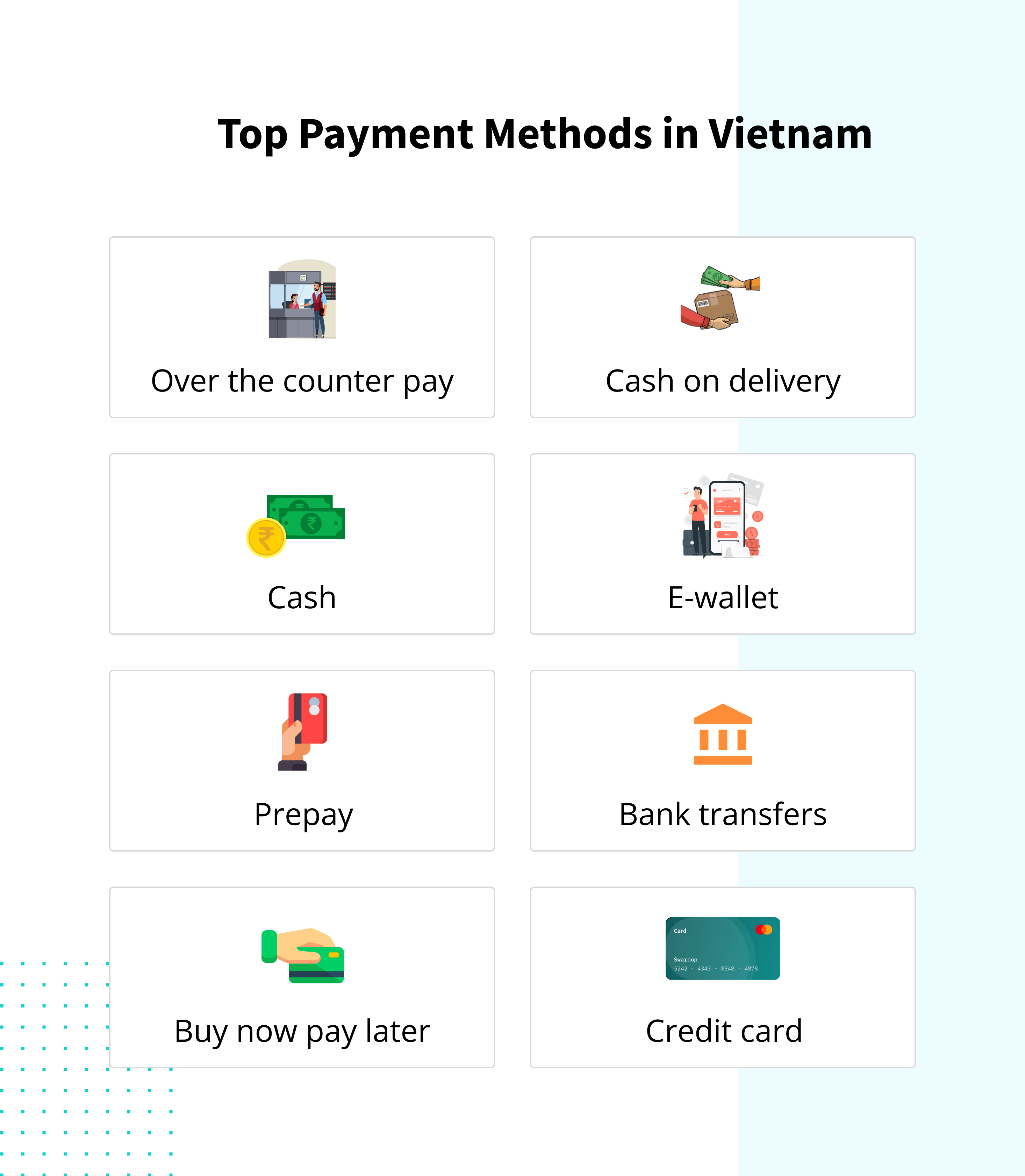

Several payment methods are popular in Vietnam. These include:

Over the Counter Payment (OTC)

This is the most common type of payment in Vietnam. In this method, a consumer receives a QR Code from a merchant and then takes the code to an authorized payment counter (physical location) to make the payment.

Cash-on-delivery (COD)

COD payments account for a significant percentage of transactions, and they're prevalent in Vietnam, where they're used for small purchases. According to statistics, COD sales make up 19% of e-commerce purchases.

Cash

This method continues to dominate as the most widely used payment method in Vietnam. COVID-19 severely limited this approach, and the government's efforts to encourage the use of digital payments have proven to be beneficial.

E-wallets

E-wallets, or digital wallets, have become the second-most popular payment method in Vietnam. It is estimated that since 2021, it has grown at a rate of 28% YOY. The rapid uptake of smartphones and the increasing use of mobile applications have been the primary drivers of this growth. Vietnam currently has more than 40 e-wallet providers. Here are some of the local E-wallets -:

-Momo

With over 23 million active users, MoMo is Vietnam's most popular digital wallet. Its main offering is a mobile app that allows clients to perform transactions straight from their phones. In Vietnam, it is accepted in more than 80% of food and beverage businesses and 70% of supermarkets.

-ZaloPay

ZaloPay is a ZION e-wallet. Users can send money, pay for things with QR codes (android users can also utilise NFC and Bluetooth), pay bills with Mastercard and Visa credit cards issued by Vietnamese banks, and add credit to their cell phone.

Almost 70% of Vietnamese are unbanked, with only 4% owning a credit card. Support for locally favoured alternative payment methods is critical to the success of e-commerce.

Prepay

Prepay is a type of payment where the consumer pays for goods or services in advance. This can be done online or offline. The prepaid card industry in Vietnam is anticipated to grow at a CAGR of 20.9% between 2017 and 2021. The market is projected to grow at a CAGR of 27.1 percent, reaching US $9.03 billion by 2026, up from US $3.46 billion in 2022. (Source)

Good Read: Top 12 Payment gateways In Vietnam That You Need To Know About

Bank Transfers

As a conventional payment method, bank transfers account for 22% of e-commerce payments. In Vietnam, there are two types of bank transfers:

- Interbank transfer: Also known as ACH (Automated Clearing House). This electronic network processes large batches of credit and debit transactions. The interbank system is managed by the State Bank of Vietnam (SBV) in Vietnam.

- Cross-border transfer: A transfer of funds between two banks located in different countries. The most popular cross-border payment providers in Vietnam are PayPal and Western Union.

Here are some of the :

1)Vietcombank : is a Vietnam-based financial institution active in the banking business.

2)VietinBank : is a state-owned Vietnamese bank. It has strategic partnerships with the International Finance Corporation and Mitsubishi UFJ Financial Group.

3)BIDV : is a Vietnamese state-owned bank in Vietnam. It is the country's biggest bank by assets as of June 2021.

4)VIB : Vietnam International Commercial Joint Stock Bank, abbreviated as Vietnam International Bank (VIB), was founded on 18th September 1996, with its head office based in Hanoi. Today, VIB is one of the leading commercial joint stock banks in Vietnam

5)ACB :Asia Commercial Bank, often abbreviated to ACB, is the largest private bank in Vietnam by assets

6)MB : Military Commercial Joint Stock Bank (MB Bank) is a Government Bank located in Hanoi Vietnam, Asia, and was founded in 1994.

7)TPBank : provides commercial banking products and services in Vietnam. It offers retail banking products and services.

Buy Now Pay Later (BNPL)

As a new payment method, this form of payment is gaining attraction in Vietnam. Unlike other cards, it is easier to set up a BNPL account. The customer does not need to provide documents or go through a credit check. Consumers can enjoy interest-free installments. BNPL is becoming popular among young people and is used for small purchases such as clothes, cosmetics, and food. BNPL schemes are touted to provide SMEs with post-payment financing, promoting economic growth.

Credit Cards

Introduced in Vietnam in 1997, credit cards are the third-most-popular payment method, accounting for 15% of e-commerce payments. Credit cardholders have been growing steadily, reaching 11 million in 2019. This growth is driven by the increasing purchasing power of Vietnamese consumers and the expanding network of merchants who accept credit cards. (Source)

Local Payment Methods and Rising Complexity for Businesses

As with any growing e-commerce market, one cannot overlook the challenges businesses face when introducing these methods.

Cross-border transactions come with a unique set of risks, chief among them being the possibility of fraud. When businesses deal with customers in other countries, they may not have the same level of information or protection as if the transaction took place within their borders. As a result, businesses in Vietnam must be extra diligent in screening customers and verifying their identities. The process of KYC (know your customer) can be costly and time-consuming, but it is essential for protecting against fraud.

In addition to the financial costs, businesses must also be aware of the reputational risks associated with cross-border fraud. Any instance of fraud can damage a company's reputation and make it harder to do business in the future.

Furthermore, in second-tier and rural cities, logistics continue to be a problem in Vietnam. But, with a rapidly growing market and adapting, these issues are being resolved quickly.

How Does inai Help You With Vietnam Payment Methods?

The inai platform was created to accommodate various payment options, including those used in Vietnam. Our payment platform is a one-stop integration that simultaneously links to numerous payment gateways and different local payment options. The developer-friendly payment integration approach of Inai supports a variety of business models, including e-commerce and other digital marketplaces.

Aside from allowing for smooth pay-ins and pay-outs, our platform aids firms in enhancing their checkout conversions by providing a tailored checkout environment (whether it's payment options, language, or currency). Fully customizable front-end and best-in-class CXO dashboards help you maintain alignment with your brand design while tracking refund claims and analyzing failed transactions.

Our checkout solutions will be fully integrated on your site or in your app so that you can provide payment-free shopping for customers. We also use PCI DSS compliance to ensure the data is scrubbed during processing. This means that your payments are safe and secure, with a high level of protection from fraud.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?height=400&name=Header%20-%20Top%20Payment%20Methods%20In%20France%20(1).png)

.png?height=400&name=Header%20-%20Top%20Payment%20Methods%20in%20South%20Africa%20(1).png)