The cross-border e-commerce market has reached new global heights. Every day, a significant number of cross-border payments are made by online shoppers. By 2023, an estimated 4.2 billion e-commerce users will be active. Plus, the demand for goods from overseas will boom as younger generations join the internet. All in all, this means the potential for growing your online sales is huge. In preparation for a truly global customer base, it’s more important than ever for businesses to facilitate international payments. How? Offering popular payment methods is one of the most effective ways to keep up.

Before we dive into the top payment methods in Indonesia - we’ll check out some of the trends that have been taking hold of the Indonesian payment landscape.

Indonesia payment trends for 2022

Like the vast majority of countries, Indonesia was hit hard during the COVID-19 pandemic with social distancing and restrictions. As such this had an effect on the Indonesian payment landscape. The pandemic adversely affected card payments to decline by 22.4 percent in 2020.

However, in 2022 the card payments market is anticipated to grow by 10.7 percent and reach IDR 619.5 trillion (US$ 44.2billion). While Indonesia was primarily a cash-driven economy, using methods such as cash-on-delivery, which constituted 16% of the total e-commerce payments market in 2019. This number is expected to continue declining to 11% by the end of 2022 and to 6% by 2025.

Such a radical decrease in cash was due to a countermeasure to stop the spread of germs, and government incentives to increase the adoption of contactless and mobile payments. Due to their ease of registration and setup, mobile wallets recorded the most significant growth among all the digital payment methods adopted in Indonesia during COVID-19.

Mobile wallets are predicted to jump in percentage proportion of Indonesia’s gross transaction value (GTV) from 23% in 2019 to 28% in 2022. Why mobile wallets? Well, Indonesia is a mobile-first e-commerce market, with over 58 percent of transactions completed on a mobile device. Ensuring that your eCommerce store is optimised for mobile, is therefore crucial when entering the Indonesian market.

So let’s get into it - here are the top payment methods in Indonesia that you need to know about!

Top payment methods in Indonesia

The most popular payment methods used in Indonesia include:

1. Cash

Indonesia is APAC’s most valuable untapped e-money market: 66% of its population are “unbanked” (don’t own a bank account). So, like many other countries in South East Asia, Indonesia is primarily a cash-driven society. In fact, cash accounts for 77 percent of point-of-sale purchases. Mainly driven by low-value transactions.

2. Credit Cards

The most widely accepted card in all merchants in Indonesia is Visa and Mastercard. Card penetration is at 0.64 debit cards per capita and just 0.06 credit cards per capita. Which amounts to 16.71 million cards as of 2021. Indonesia saw the number of credit cards fall during the COVID-19 pandemic, however, the Central Bank of Indonesia has cut the maximum interest rate for credit cards from 2.25 to 2 percent per month to boost Indonesia's economic recovery. As such, Card payments in Indonesia to grow by 10.7% in 2022.

3. Bank Transfers

Bank transfers are electronic payment transmissions from one bank account to another. They can be used for debit and credit cards, and also digital wallets. They are managed through networks of partnering financial institutions known as automated clearing house (ACH) networks. While bank pentation in Indonesia is low, which leaves room for growth in the debit/card market.

However, bank transfers are the second most-used e-commerce payment method in Indonesia, accounting for just over a quarter (26 percent) of sales. Bank transfers are expected to be overtaken by digital wallets. Some popular Banks in Indonesia are -

- Bank Central Asia (BCA)

- Bank DBS Indonesia.

- Bank Mandiri.

- United Overseas Bank (UOB)

- Bank Syariah Indonesia (BSI)

- Citibank.

- Bank Jago.

- BCA Syariah.

4. Digital/mobile wallets

Over the past 2 years, Southeast Asia added more than 70 million online shoppers, primarily from Indonesia. From a combination of a largely unbanked population, high smartphone penetration, and a mix of the COVID-19 pandemic and tech-savvy youth, there’s been a significant rise in the use of digital wallets.

Digital wallets allow users to make online or mobile payments using funds from credit and debit cards linked to their accounts. Usually, the app will supply the user with their own digital cards, which don’t require a bank account and are relatively easy to set up. Digital wallets are used for one in five of all online shopping in Indonesia.

There are 6 major digital wallets used by Indonesians:

-Unipin

Universal Pin (UniPin) is the leading Digital Content Enabler for online games and digital products across the world. Simple. One Credit for users to use and play from multiple publishers across the platform.

-OVO

OVO is an e-wallet owned by the Indonesian conglomerate, Lippo Group. Customers simply load funds to their OVO wallet via bank transfer, debit or credit card, and/or cash deposits.

-Gopay

GoPay is an Indonesian e-wallet that is a part of the Gojek super app. GoPay, like ShopeePay, focuses on empowering the unbanked and underbanked making it an inclusive and convenient choice for Indonesian consumers.

-DANA

Dana is an Indonesian e-wallet that allows customers to make in-store and online payments faster and more conveniently.

-LinkAJA

LinkAja is an Indonesian e-wallet that allows customers to pay for goods in-store and online. Customers simply load funds to their LinkAja wallet via bank transfer, credit or debit card, and/or cash deposits to start making purchases

Adding payment method can’t get any more simpler

5. Cash on delivery

Despite the Indonesian government's pushing for the adoption of digital payments, 73% of online shoppers still prefer cash on delivery (COD). With COD, customers can buy products online and pay for them in the store upon delivery.

6. QRIS (QR Code Indonesia)

A QR code is a barcode that stores information such as credit card or bank account data which can be scanned by a smartphone camera. The user is then taken to the relevant banking app or digital wallet to complete the payment. According to Xendit, a popular payment gateway, QRIS has seen 150% Quarter on Quarter (QoQ) growth on their platform since they integrated it.

Meaning that more customers are preferring to use QRIS when they shop online.

7. Direct debts

The Automated Clearing House (ACH) network allows for direct debits. This is when an electronic payment is deducted automatically on a recurring basis.

As such, it's a popular method to pay for utility bills or subscriptions. Indonesia's major banks have been rolling out Direct Debit features to compete with the convenience of digital wallets.

8. Buy Now Pay Later

Buy Now, Pay Later (BNPL) is a type of short-term financing that allows consumers to make online purchases and pay for them at a future date, often interest-free using either split payments or paying in full after delivery. BNPL is becoming an increasingly popular payment method, a staggering 40 percent of the global consumers used the split payment service such as BNPL in 2020, primarily because they had no access to a credit card.

As more than half of Indonesia's population is unbanked, BNPL payment adoption is expected to grow steadily, recording a CAGR of 29.2 percent during 2021-2028.

Popular buy now pay later services in Indonesia are:

-Atome

Atome is a leading buy now, pay later brand in Asia that splits consumers' bills into three equal, zero-interest payments over time.

-Kredivo

Kredivo offers customers instant loan financing for e-commerce purchases and personal loans based on real-time decisions. Buy now and pay later, or borrow at the lowest interest rates from any digital lender in the country.

-Afterpay

Afterpay is a leading buy now, pay later provider in the US, UK, Europe, Australia, and Asia. Afterpay incentivizes consumers to earn rewards and budget their spending online and in-store.

Good Read: Top 12 Payment Gateways in Indonesia that you need to know

Local payment methods and rising complexities for businesses

For every market, there is a constant stream of new payment methods that are being introduced, which often is a big headache for businesses.

To stay ahead of the curve, payment managers need to be on top of which payment methods are popular in each of their markets and what gateways offer them which usually takes a of time and effort if you are scaling into new markets. Being armed with the wrong information can be costly.

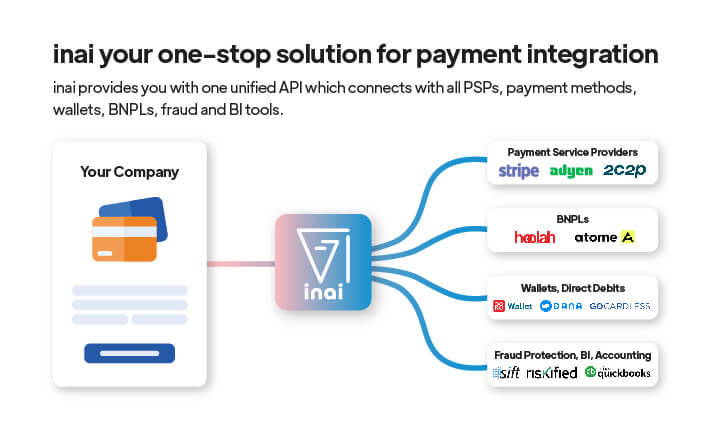

How inai helps you integrate Indonesian payment methods

Luckily, there are payment orchestrators out there that help businesses integrate with many payment gateways at once - arming you with a wealth of popular local payment methods and currencies for your checkout. Which improves your checkout conversion rates and allows you to easily scale your businesses without the hassle of managing many payment gateways.

The inai payment integration platform supports over 300+ international payment methods from countries around the world, including Indonesia and many other countries in South East Asia. You can get set up and running without any advanced coding knowledge within 60 minutes.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)