When merchants want to accept payments from customers, they typically have to choose from two payment processing solutions: a Merchant Acquiring Model (MEAMI) and Payment facilitator Model (PayFac). While both these solutions help merchants accept payments, they're quite different from each other.

In this blog, we take a deep dive into what merchant accounts and PayFac are, how they work, and what advantages they offer. This way, you can differentiate between the two and choose the best option for your business.

What is a Merchant Acquiring Model? How Does it Work?

In a merchant acquiring model, the merchant (you) applies for a merchant account with the payment processor or bank. This merchant account, once approved, allows you to accept payments (wallets, credit cards, debit cards, etc.) from your customers.

How Does it Work?

Let's say you have an active merchant account and are ready to accept payments. Now, when a customer uses their credit or debit card to pay, the payment processor will send the details to your merchant account. The merchant account provider will confirm whether sufficient funds are available with the customer's card provider. If sufficient funds are available, the merchant account provider will transfer the funds into your merchant account. And that's how a typical merchant account functions.

Good Read: The Mechanisms of Payins and Payouts

What are the Functions of a Merchant Account?

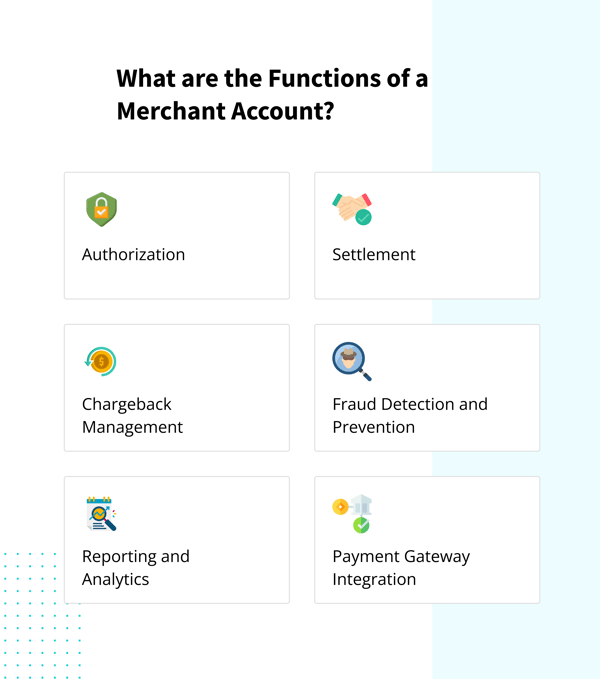

Here are some essential functions a merchant account performs:

1. Authorization:

A merchant account allows merchants to authorize (checks if sufficient funds are available with the customer) debit or credit card transactions.

2. Settlement:

After authorization, the merchant account provider settles the funds from the customer's account to your account.

3. Chargeback Management:

The merchant account provider also helps merchants effectively manage chargebacks. As a merchant, you receive support in every way, including investigating the dispute, producing documentation, and even reversing the charges if required.

4. Fraud Detection and Prevention:

Most merchant account providers also have fraud detection systems that help identify and mitigate fraudulent transactions. Such systems look for signs such as high volume of transactions etc., to detect potentially fraudulent transactions.

5. Reporting and Analytics:

Merchant account providers offer businesses access to analytical and reporting tools to help track customer behavior, potential issues, and sales.

6. Payment Gateway Integration:

Using a merchant account, businesses can also enjoy integration with a payment gateway, making accepting even easier.

Benefits of the Merchant Account Model

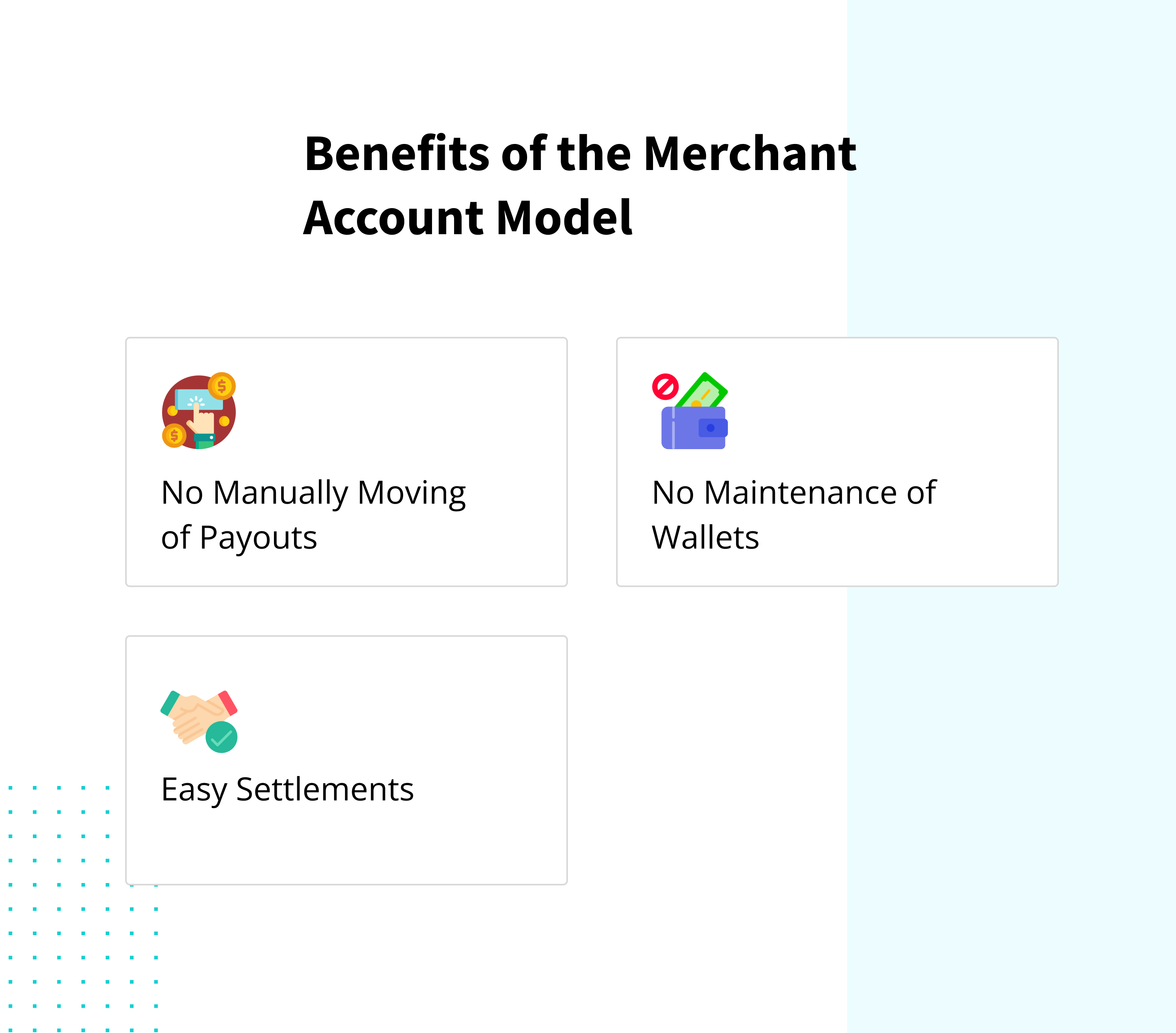

Here are some advantages merchants can experience with the merchant account model:

1. No Manually Moving of Payouts:

Traditionally, businesses had to manually move payments to their bank account from the merchant account. Not only was this process complex, but also time-consuming. However, companies need not manually move payments with the merchant account model. The merchant account provider will automatically transfer the payment to your bank account, offering you quick access to funds.

2. No Maintenance of Wallets:

Merchants can offload the responsibility of maintaining a separate digital wallet by opting for a merchant account. Merchant account providers hook you up with a payment gateway that usually supports numerous digital wallets, making your job easy.

3. Easy Settlements:

A merchant account helps settle the funds in real-time or near real-time, making the funds accessible quickly.

What is PayFac Model and How Does it Work?

Creating a merchant account and onboarding a payment service provider is pretty hard. And that's when PayFac comes into the picture.

PayFac (Payment Facilitator) is the better version of the traditional merchant model. It's a third-party service that acts as a mediator between the merchant and the payment processor. Being a mediator, the payment facilitator handles the underwriting process and enables merchants to accept payments quickly.

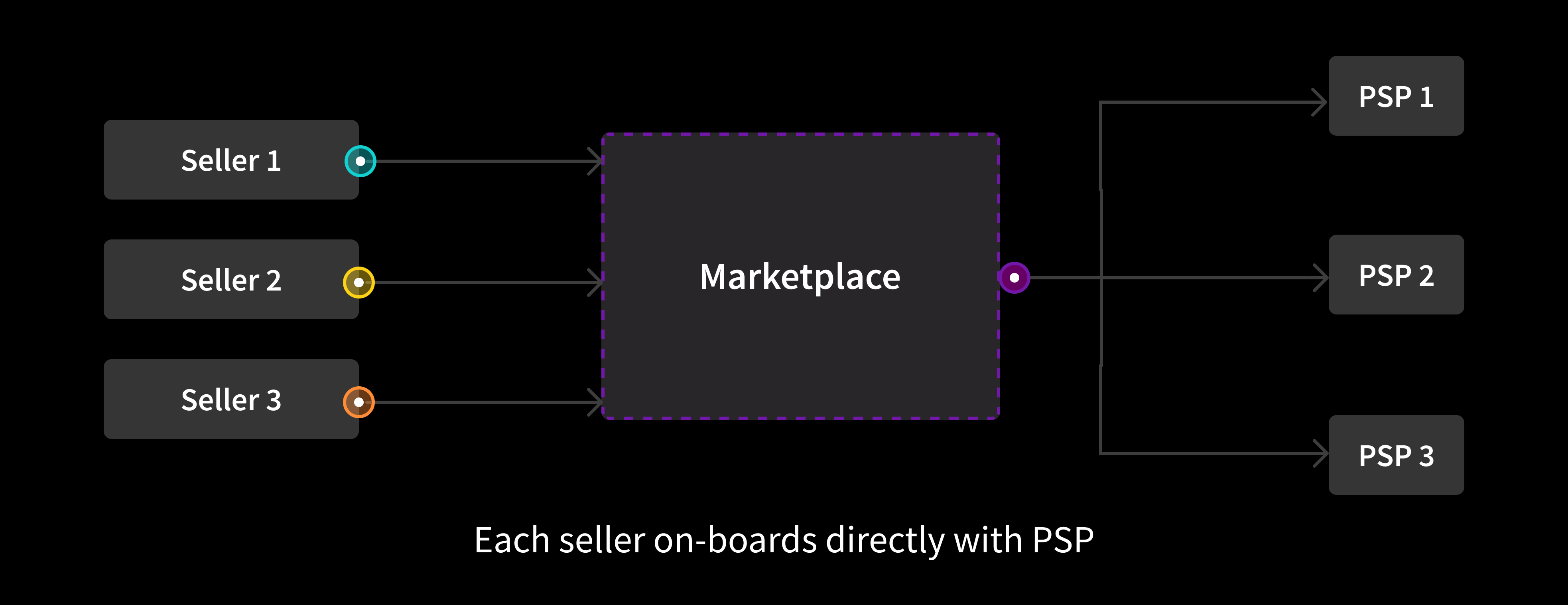

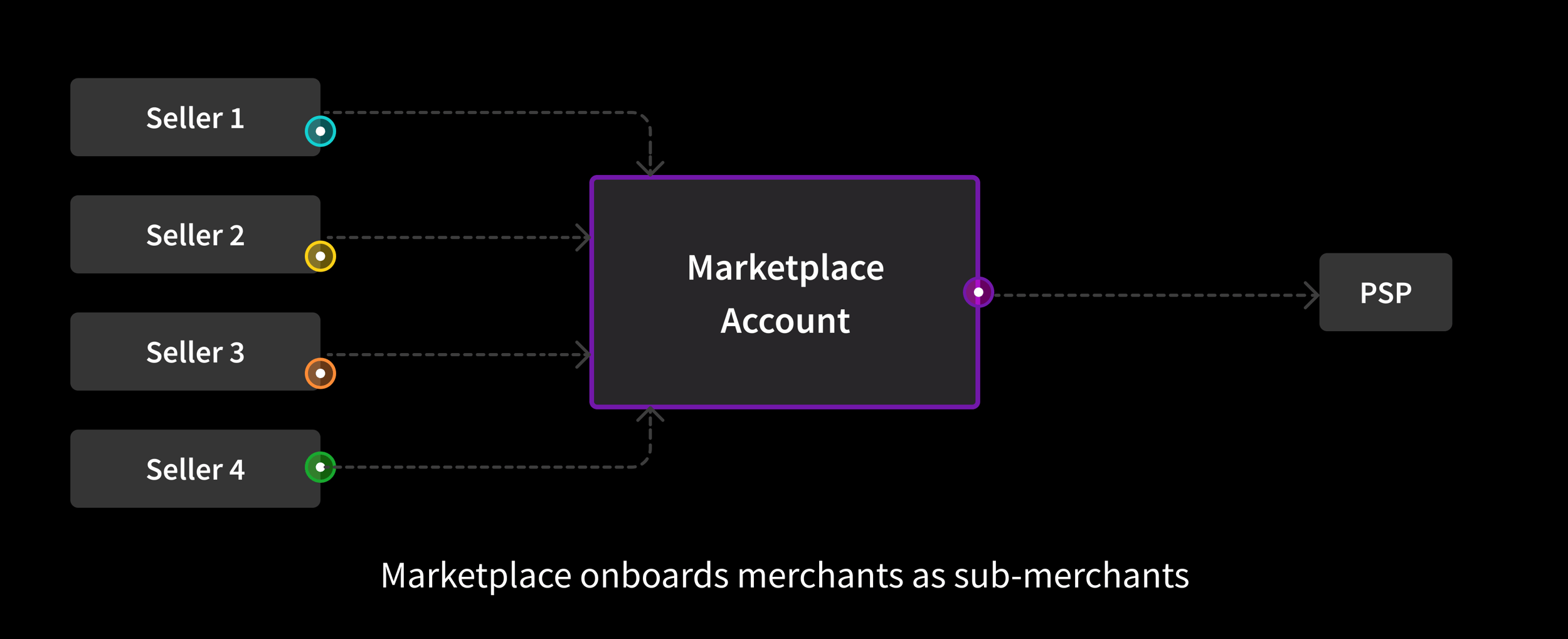

Basically, there's a master merchant account owned by the payment facilitator, under which different merchants can operate as sub-merchants. The setup process is easier and faster.

How Does it Work?

PayFac allows merchants' or retailers' sub-merchant accounts without having to apply for their merchant identification number. PayFac has a master merchant account with the acquiring bank., probably because of their good relationship. And this allows them to onboard sub-merchants and operate under the master merchant identification number.

In a nutshell, PayFac Model is slightly easier, more convenient, and time-saving for merchants. Merchants don't have to undergo the underwriting process, which makes onboarding quite faster.

What are the Functions of PayFac?

1. Onboarding Process:

The underwriting process is way shorter than in the MEAMI Model, as PayFacs allows numerous sellers to operate under one MID. And if a scammer is onboarded, it could jeopardize the master merchant account.

This helps them determine if the merchants/businesses are actually who they claim to be. And as most PayFacs use solutions that require slightly less documentation and the entire process takes place almost instantly, doubling down to the convenience.

2. Monitoring:

Once the seller/merchant has been onboarded as a sub-merchant, PayFac monitors all the transactions thereafter. The PayFac ensures all the transactions follow card network and government guidelines and are compliant. However, if a transaction looks suspicious, PayFac will forward it to the concerned department for investigation.

3. Chargeback Control:

Along with monitoring the transactions, PayFacs also help merchants effectively manage chargebacks. They take care of the entire chargebacks process, from producing the documentation to investigating the matter and coordinating closely with the acquiring bank.

Good read: What is payment chargebacks and how to reduce the risks of chargeback?

4. Funding/Settlement:

PayFac is responsible for clearing or settling the amount the sub-merchant has made over time. As PayFac handles this process, the sub-merchants have more control over their funds and get access to them quickly.

Benefits of the PayFac Model

Here are the advantages of the PayFac model:

1. Hassle-Free Onboarding:

When it comes to signing up for a traditional merchant account, it's a tedious process. Merchants must submit many documents, undergo an underwriting process, KYC, PCI compliance, and whatnot. In a nutshell, this process is time-consuming and painstaking.

However, the PayFac model makes onboarding a breeze. Everything from KYC to merchant underwriting is handled by the PayFac company. This way, the compliance regulations reduce significantly, making the entire process hassle-free and fast.

2. Ease of Accessibility:

Along with handling the underwriting, KYC, and compliance, the PayFac model also manages the movement of money through the payment flow. This way, merchants can easily access and track their funds and have better control over the entire payment flow process.

3. No Admin Request Required for Moving Money:

As stated earlier, PayFac handles the movement of funds across the payment flow. This enables merchants to automatically receive funds in their respective accounts without requesting or initiating the transfer of funds.

How inai Bridges the Gap?

inai is a payment orchestration platform that can help you integrate 30+ payment gateways and 300+ payment methods, including domestic and international. This way, you can expand your business to whatever location you like.

Also, say goodbye to worrying about expensive payment gateways because even if things don't go as planned with one gateway, you can quickly switch over for a seamless and cost-effective solution. This helps you offer better uptime and saves you money as you can route each payment through an affordable payment gateway.

Merchants can enjoy split payments (with PayFac only), easy settlements, reconciliation, and an overall smooth payment flow. So, if you want to make accepting payments more fun, hassle-free, and profitable for your business, reach out to inai now!-1.png?width=4068&height=1080&name=CTA%20(1)-1.png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20Why%20Is%20the%20Subscription%20Model%20Gaining%20Popularity%20in%20India_%20(1).png)