Customers come and go; no matter how good your product or service is, chances are your customers will only stay loyal to your brand for a while. Since this is a universal fact, you need to learn how to manage your churn, whether you can control it or not. Customers' inflow and outflow are termed as churn within the business world, and this concept has a much broader connotation.

As a subscription-based business, it is pertinent for you to familiarize yourself with this quintessential concept, especially with respect to how retention is a competitive advantage and what you need to do to make this work for your business.

Voluntary vs. Involuntary Churn

You can classify the churn concept into voluntary and involuntary aspects. To understand the differences clearly, let's take a deeper dive into the constituents of these two methods:

Voluntary Churn |

Involuntary Churn |

Definition: When a customer consciously cancels a brand's products/services. |

Definition: Involuntary churn occurs when a customer's payment mode, payment details, server errors, or insufficient funds don't allow the subscription transaction to complete.. |

Common causes: Some common reasons for voluntary churn can be attributed to bad services, competition, deplorable customer service, and product-based dissatisfaction, amongst other reasons. |

Common causes: Involuntary churn is primarily caused by delayed payments, insufficient funds, failed payments, server/website errors, and outdated customer payment details, amongst others. |

Current Landscape on Involuntary Churn?

Imagine a situation wherein you are purchasing your favorite product online, and right at the time of making the payment, the payment gateway defaults, and you cannot pay for the product. The worse thing to encounter is a failed payment message screen. This is the reality of many online businesses, especially those offering a subscription-based service model to their customers.

As per research conducted by PYMNTS and FlexPay research, 27% of subscribers terminate their subscription due to a declined payment. The post-pandemic landscape is changing drastically, and there is a continuous evolution in customers' subscription patterns, which are driven by their changing purchasing and usage patterns. There is no denying the fact that the subscription market is expanding as new service providers are mushrooming all over the world.

The motto of such organizations is to capture the market by providing new, unique subscription-based products and services in the long run. With subscription-based services, involuntary churn continues to be a significant threat as companies battle it out in the market.

How to Calculate Your Business's Churn Rate?

The thought of losing customers is daunting, and there is a way to calculate your churn rate to prevent customers from leaving your business. To better understand the churning process, you need to look at two significant calculations:

1. Customer Churn Rate:

The customer churn rate is the ratio of the number of customers lost and the number of customers enrolled at the beginning of the period. This is usually expressed as a percentage.

Customer Churn = [(Customers at the beginning of a period) – (Customers at the end of that period)] / [(Customers at the beginning of that given period)]

Let's explain this with an example. Suppose you had 100 customers at the beginning of 2022, while at the end of the year, you have 90 customers.

Your customer churn rate is as follows:

Customer churn = 100-90/100 = 10%

2. Revenue Churn Rate:

The revenue churn rate gives a little more comprehensive view of your business's revenue statistics. To get a better understanding, you can calculate two different ratios within this category:

- Gross Revenue Churn

- Net Revenue Churn

- Gross Revenue Churn:

The Gross Revenue Churn shows you the total revenue you are losing while negating the revenue expansion and upgrades within your customer base. Gross revenue churn is an excellent measure of revenue leakage through customer loss.

Gross Revenue Churn Rate = [(Downgrade MRR + Cancellation MRR) / (Total MRR at the beginning of the period)] * 100

For example, if a customer had $200,000 monthly recurring revenue at the beginning of June, with the downgrades and cancellations totaling $20000, then your gross revenue churn is 10%.

- Net Revenue Churn:

The gross revenue churn isn't a very accurate way of measuring your revenue standards for a specific period. The Net Revenue Churn measures the actual reality, as it measures what's lost and what's gained.

Net Revenue Churn Rate = [(MRR beginning of the month – MRR end of the month) – (Expansion MRR)] / [(MRR beginning of the month)] * 100

The result can either be positive or negative; a negative churn value is a good indicator of your business's standing.

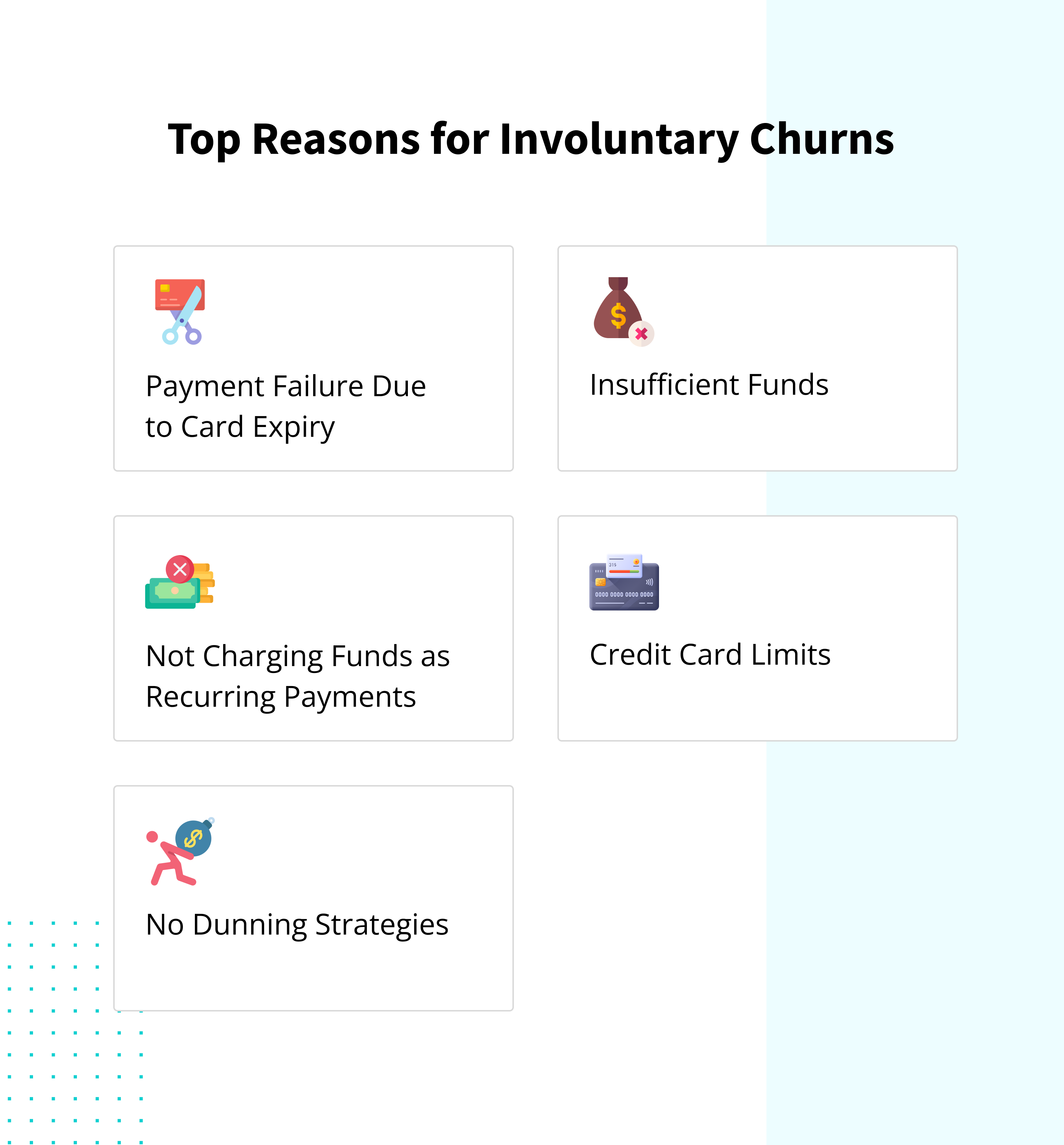

Top Reasons for Involuntary Churns?

There are a few reasons why customers leave your business involuntarily. Here are the top five reasons you should look out for:

1. Payment Failure Due to Card Expiry:

Approximately 14% of card transactions that fail are directly related to expired card details. As a customer, if your card is lost, stolen, or expired, it will not work on automatic subscription renewals.

Since cards have a specific expiry period (three years), there is a high possibility you will end up with a customer loss, especially when the customer has been with you for more than three years.

2. Insufficient Funds

People use a variety of accounts to serve different interests. Depending on your subscription's billing dates, you might lose customers who don't have funds in a specific account. If your subscription billing cycle falls toward the end of the month, you might lose customers due to insufficient funds.

Insufficient funds might mean the payee is going through a financial crunch or still waiting for the salary to be credited. Whatever the reason, in the end, it all boils down to having insufficient funds in the subscription payment account.

3. Not Charging Funds as Recurring Payments

There are a lot of fraudulent transactions online, and credit card systems are usually wary of untimely payments. As a subscription company, if you aren't flagging your payments as recurring payments, each of which has a pre-allocated date and time, the issuing company might block the transactions, causing the payments to fail.

Such transactions usually fail at the payment gateway since the issuing company is wary of accepting such payments without prior intimation/confirmation from the card owner.

4. Credit Card Limits

As a user customers use credit cards with limits issued by the issuing company. Other times, customers set limits to save themselves from online fraud. Either way, if the credit cards are already beyond the defined limits, there is a high possibility subscription payments will fail immediately.

5. No Dunning Strategies

As a subscription business, you know the expiry limits on a customer's credit card account. While many companies proactively inform their customers about their near-expiry dates, many others overlook this, causing an unwanted increase in failed transactions.

Causes of Voluntary Churns & How to Fix Them?

several reasons cause voluntary churns within a business's customer lifecycle:

1. Product/Service Doesn't Meet the Customer Needs

Customers pay for products and services which they find helpful. What happens when customers feel a specific product or service does not meet their requirements? They cancel the product immediately, leading to a voluntary churn.

As a business, you must perform adequate checks repeatedly to ensure your products and services meet the customer's demands.

You can request regular feedback from your loyal customers with an intent to understand their requirements, their feedback on the current suite of products, and any scope for improvement.

When you receive feedback, make it a point to incorporate it into your product suite so that customers feel you acknowledge and appropriately actioned their feedback.

2. Mismatched Brand and Audience

You will have a mismatched base when you try to fit circular pegs in square holes. Customers look for tailor-made products that cater to their needs and wants. However, when you try to sell your product to the wrong demographic, you only set your business up for failure.

To avoid such circumstances, it's necessary to do the required groundwork before offering your product to the broader audience. For example, you can't provide a media streaming service to teenagers, who might not be able to afford it directly.

Subsequently, in a similar situation, you can offer such media services to their parents since the customer population can afford and subscribe to your services on time.

3. Allow Pausing of Subscriptions

Since change is the only constant, you must offer your services with a plug-in solution. Put yourself in your customers' shoes and see what you can do differently.

Imagine a situation wherein you have enrolled for a gym membership but can't avail of the service due to a busy schedule. Instead of letting the membership expire, you can ask the gym to pause your subscription until you feel ready to resume it again.

Similarly, your customers need a pause option on their subscription so they don't feel obliged to go ahead with their entire subscription. By offering such a plan, you can ensure their loyalty and allow them to plug and play as they deem fit.

Good read: What is the Difference Between Recurring Payments and Subscription Payments?

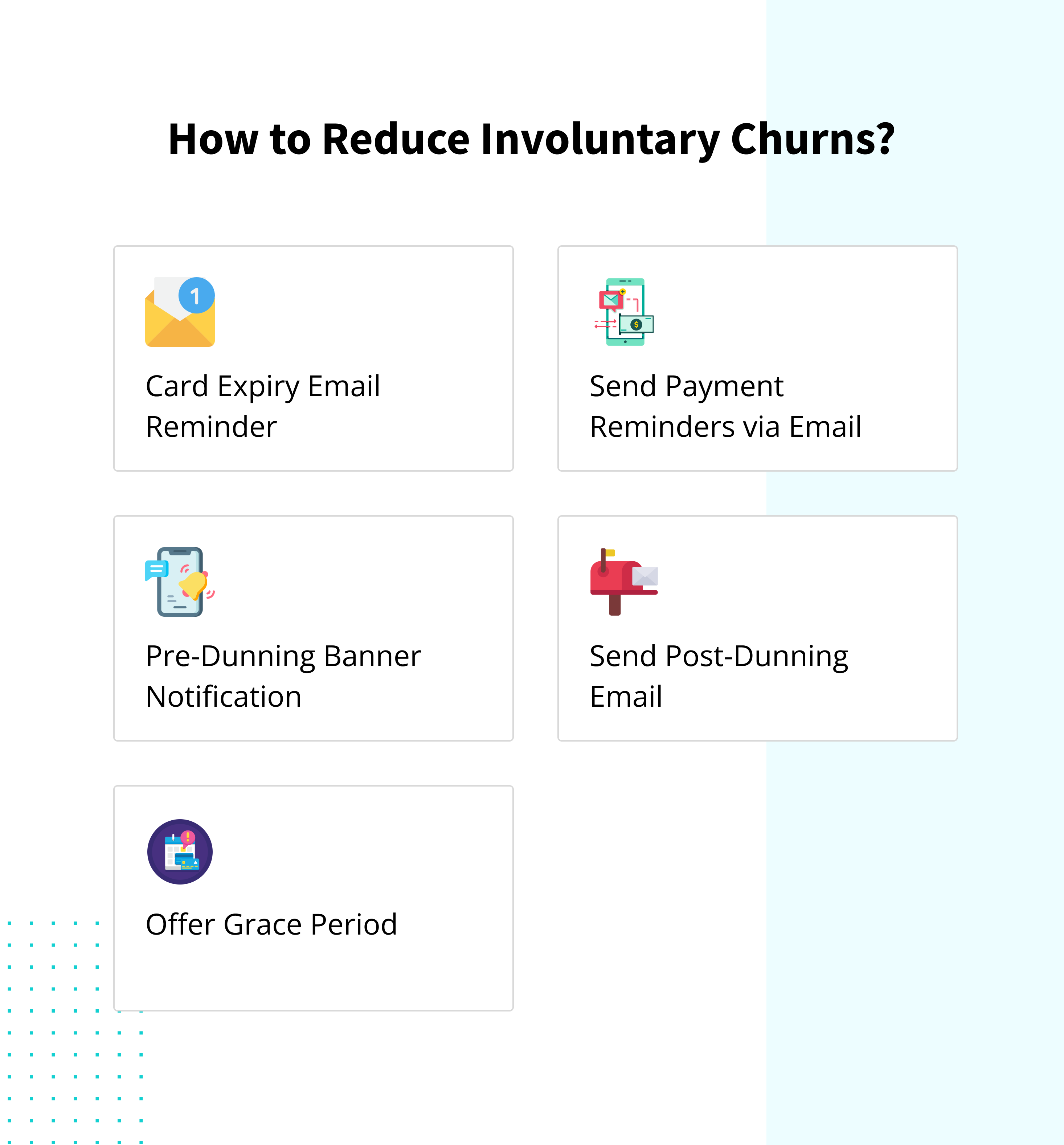

How to Reduce Involuntary Churns?

Several reasons cause involuntary churns within a business's customer lifecycle:

1. Card Expiry Email Reminder

During the sign-up process, you request that the payer share their credit card details to subscribe to your product/service. It's pertinent to keep track of the card's expiry details and send regular reminders to let consumers know about their card's nearing expiry.

Such a practice allows you to build a connection with your customers, retain them, and ensure their subscriptions don't time out.

2. Send Payment Reminders via Email

Even though you offer recurring payment subscriptions to your customers, it's often a good practice to avoid any charge-related disputes on your customers' accounts.

For example, when offering a recurring subscription option to your customer, it's advisable to send timely payment reminders via email so that the end user knows the date, time, and amount that will be deducted from his account.

3. Pre-Dunning Banner Notification

When customers regularly use your app, you can use pre-dunning banner notifications and prompts to inform them about any pending/upcoming payments. With this method, there is a high possibility of ensuring customer satisfaction while reducing voluntary churn.

It's necessary to engage with the customer so that they are familiar with the billing process and any relevant updates that come as a part thereof.

4. Send Post-Dunning Email

Assuming your subscription charges are already collected from the customer, sending them an acknowledgment via email is essential so that the end recipient knows the costs and has an invoice to utilize as and when needed.

Additionally, in case of known defaults within your payment structure/website, you can inform your customers via your banner notifications, text messages, and emails so that they can make alternate payment arrangements for the subsequent month. This is only some of it; you can even share an alternate link to help them make the payment.

5. Offer Grace Period

Assuming your subscription charges are already collected from the customer, sending them an acknowledgment via email is essential so that the end recipient knows the costs and has an invoice to utilize as and when needed.

Additionally, in case of known defaults within your payment structure/website, you can inform your customers via your banner notifications, text messages, and emails so that they can make alternate payment arrangements for the subsequent month. This is only some of it; you can even share an alternate link to help them make the payment.

Good read: Comprehensive Guide to Subscriptions Management

Wrapping Up

It does not matter what kind of churn is affecting your business. Until you don't have a steady revenue flow, a customer loss caused by any reason will impact your business adversely.

However, it goes without saying that you need to have a retention plan before offering any services to the end users. Retaining an existing customer is cost-effective and beneficial compared to acquiring new customers.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20Top%2010%20Payment%20Gateways%20in%20Italy%20(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20The%20Thin%20Line%20Between%20Cart%20and%20Checkout%20Abandonment_%20(1).png)