The Indian Government's past efforts to create a financially-emancipated society and an IT knowledge-driven economy gave birth to newer payment methods. So much that digital payment in the Indian digital space will hit the $1 trillion mark by FY23. The COVID-19 pandemic and the demonetization bill seek to reorient the business.

Now, India is gravitating towards becoming a Fintech-driven society that is 'faceless, paperless, and cashless.' These payment methods are helping shape the country's payment ecosystem to transition away from payment modes with paper trails.

So, which payment method and provider should you choose for your business? The aggressive 'destructive creation' of digital payment modes has demonstrated some exciting trends that can give you valuable insights into the payment options that could prove profitable for your business.

Indian Payment Trends for 2022

The Indian digital payment methods sector has demonstrated some interesting trends in FY2022.

According to industry statistics and observations:

- There has been a large-scale opportunity catering to the financial inclusion of the unbanked population.

- A blossoming Fintech start-up ecosystem Is emerging nationwide that is disrupting the conventional trends with modern services and payment features.

- The birth of diverse business models and prepaid cards.

- Consumer payments via mPayments have increased utilities, such as electricity, on-demand services, OTT services, etc.

- Since 2016, the UPI payment method exhibited a CAGR of 414% until FY19–20. This number is expected to multiply seven times by 2025.

- The BBPS and NETC sectors have grown at 500% and 123%, respectively.

- Many businesses have subscribed to easy payment method aggregation to manage payment conversions when customers pay via different methods.

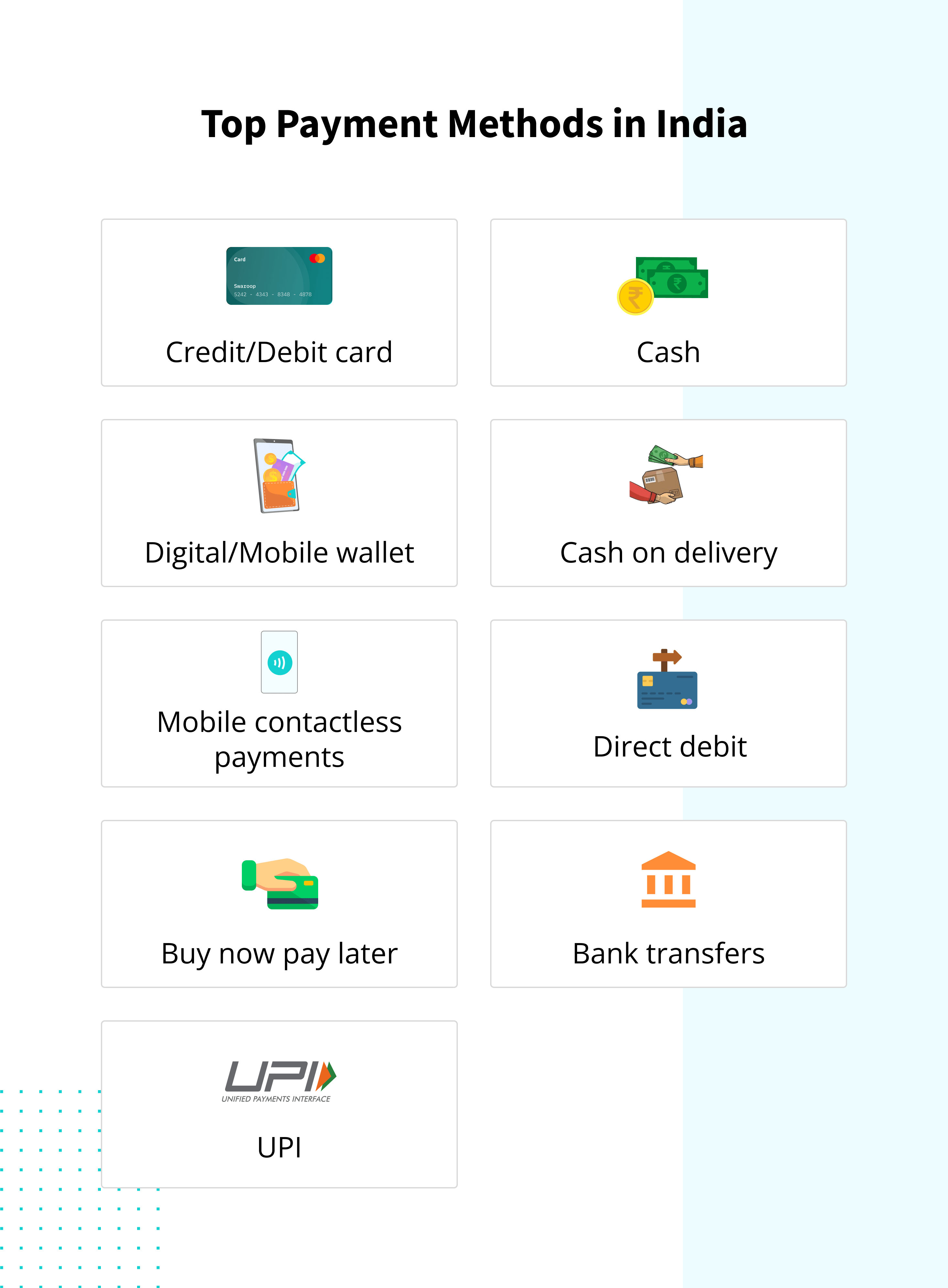

Top Payment Methods in India

Currently, new entrants in the Indian payment method ecosystem is forcing the older brands to re-evaluate their game. As a result, experts estimate new payment revenues to reach 13% per annum.

1)Credit/Debit Card: VISA, Mastercard, American Express, RuPay

Credit and debit banking cards are popular methods of digital payment across India. VISA, Mastercard, American Express, and RuPay provide flexible, Omni-banking vendor support to their customers.

These banking card vendors provide premium-grade PCI DSS-compliant services alongside 2-factor authentications with PIN and OTP verification. As a customer, you can make secure payments for your online and offline purchases within a few minutes. There are lucrative incentives like zero transaction fees for customers. Transaction limits also help them regulate payments for EMIs and other recurring bills. Other C2B to C2G payment transactions include Balance Inquiry, Cash Withdrawal, and Cash Deposit Services.

2)Cash

Cash continues to remain a popular choice, especially after the demonetization in India. It would be incorrect to say that, paper finance has completely dissipated from the Indian economy, as it remains the oldest and most valid form of currency among the unbanked masses. Cash payments are primarily in practice in the large and small-scale industries where the vendors do not have any digital payment infrastructure.

Cash is also standard for demographics that lack the know-how to operate digital payment systems, mobile wallets, QR code scanners, or banking investments.

Cash has made a significant comeback with the recession of the pandemic. However, the COVID-19 pandemic gave impetus to public sentiments w.r.t. more contactless options.

3)Digital/Mobile Wallet:

Paytm, PhonePe, MobiKwik, etc., are some of the most popular mobile wallet alternatives that will allow users to add money to their digital wallets. They can also load money into their mobile wallets for sundry payments of utilities. Google Pay gives you upto 1000 INR in transaction cashback.

Paytm offers discounts with mobile recharges above INR 99. PhonePe provides coupons for all users and monetary cashback to new users. AmazonPay is a nifty mobile wallet aggregated with the eCommerce platform itself. It also offers several services like issuing banking credit cards with cashback, flexible utility payment options, etc.

Usually, there is a limit to how much you can pay through any given mobile wallet. Some mobile wallets offer premium features like QR-based payments for POS and P2P payments. There are also cashback and lottery-based rewards for payment transactions.

-Google pay

It was previously known as Tez, and despite being a late entrance in the mobile wallet business, it quickly grew its user base. It is the best cashback online payment app or money transfer app. Google Pay works with your existing bank account, which means your money is safe with the bank and you won't have to worry about recharging your wallet every month. Send or receive money directly to your bank account from a friend. There is also no such difficulty with KYC, which makes it even more popular.

-Paytm

Paytm is one of India's largest online trading platforms, offering its customers mobile wallets to store money and make quick transactions. Considered by many to be the best mobile app in India.

-PhonePe

From UPI payments to mobile top-ups, money transfers and online bill payments, it's easy with PhonePe. With a great user interface, PhonePe has provided the safest and fastest online transaction experience in India.

-AmazonPay

Owned by Amazon, this online payment processing service was launched in India in 2017. Amazon Pay has made customers more Amazon-oriented, offering users the possibility to pay using their Amazon account on external merchant websites, including apps such as BigBazaar. service.

-Mobikwik

Mobikwik is one of the independent mobile payment networks with a user base of 32 million. This e-wallet allows users to deposit funds using debit cards, credit cards, internet banking and even doorstep cash services.

4)Cash On Delivery (COD)

Between 2015 and 2020, cash on delivery (COD) saw recent expansions in eCommerce operations, allowing this payment method to climb the popularity ranks steadily.

eCommerce vendors like Amazon offer COD payments to users on a nominal or no-cost basis. There has also been a significant demand for COD, allowing enterprises to extend their services to tier-2 and tier-4 cities. According to recent statistics, 90% of rural India still prefers to pay via COD. Thus, Non-Cash payment methods are yet to replicate the invasive market dominance that they have already demonstrated in the more metropolitan parts of India.

Good Read: Top 12 Payment Gateways In India That You Need To Know About

5) Mobile Contactless Payments

POS terminals and QR code payments lead the charge in mobile contactless payments. Indian retail stores conduct sales through physical, mobile, and virtual POS terminals.

In India, several payment gateway businesses provide contactless payments securely through mobile wallets and QR scans. Micro ATMs are an excellent alternative that’s been adapted quickly for contactless payment across the country. Rest assured, each of these services integrates well with different banking providers. However, mobile contactless payments require a device capable of receiving and accepting payments. Added benefits like one-touch payments for regular retail destinations and omnichannel FinTech service aggregation are fuelling this payment trend.

6)Direct Debit

Direct debit systems are like physical or virtual extensions of your bank's debit card. They directly integrate with your bank and offer highly secure and multi-step authenticated direct debiting from your banking account.

You can save your debit card details with essential identification and KYC within any payment system. The direct debit option is ideal for paying at POS terminals, QR code transactions, fund transfers to other bank account holders on cross-app digital payment platforms, etc.

Direct debit has risen as a cashless payment method duringCOVID times, as it is faster to transact and document without any contact.

Direct debit is beneficial for the vendors as it does not espouse any headaches with handling or keeping physical cash at the shop. It also helps skip the scrutinization for authenticity and bank deposit queues. Debit cards do charge small transaction fees. Plus, vendors must own POS machines that facilitate direct debit and cashless payments in various forms.

7)Buy Now Pay Later:

Some Fintech aggregators like ePaylater, FreeCharge, ZestMoney, and PostPe offer more simplified, digitized credit methods. Buy Now Pay Later allows you to pay with a credit balance to over 10,000-75,000 different retail vendors. This includes eCommerce platforms and on-demand service providers.

ZestMoney's credit limit of up to two lakhs goes a long way to attract unbanked demographics. Some of these platforms offer 3-4 month long extensions to customers.

FreeCharge offers easy one-touch payments with incentives for payment transactions committed to vendor partners.

PostPe allow users to register easily with their Whatsapp accounts. Such conveniences have set these BNPL service providers apart as the key players in this FinTech category in the Indian market.

MobiKwik ZIP also counts as a BNPL service that helps you set up a monthly credit wallet with nominal documentation.

8)Bank Transfers

Businesses can conduct online transfers these days using UPI payment systems through PCI-DSS compliant secure systems, depending on the financial service provider.

Bank Transfers are among the oldest RTGS, NEFT, and IMPS payment transfer methods. The speed of the transactions depends on the banking server and how well that scales to support its customers. Some payment applications offer safeguard against payment detail errors, banking detail errors, and other perks.

Some popular banks in India are -

- HDFC Bank

- State Bank of India (SBI)

- ICICI Bank

- Axis National Bank

- Kotak Mahindra Bank

- IndusInd Bank

- Yes Bank

- Punjab National Bank

9. Unified Payment Interface ( UPI )

Unified Payment Interface, commonly known as UPI, is leading India towards a better, technology driven future, where cashless payments are becoming the new norm.

You can transfer money real-time from one account to another, with just a simple payment address, without fulfilling endless transaction facilitation requirements. The best thing about UPI is that most of the common payment gateway providers readily provide UPI features on their platforms, so that the end user can benefit without going flitting from one platform to another.

Local Payment Methods and Rising Complexities for Businesses

The stage is set to demonstrate some fabulous payment method trends and statistics. The consumer demand for a diverse spectrum of payment method systems has set the stage for a gargantuan-scale change to the existing financial transaction practices.

Disruption to these systems creates as many benefits for users as it does for businesses through conversion. However, there are potential challenges that companies can't overlook when they focus on the benefits of digital money since millions of merchants have never subscribed to any digital payment methods prevalent here. For instance, they must scrutinize the best payment method alternative to regularization so they do not incur transaction charges, refund charges, and rental service costs on multiple payment methods. Contradictorily, multi-payment method support translates into better conversion rates.

Lastly, there are also concerns of up-skilling and securely implementing these payment methods daily without any cybersecurity risks when phishing/social engineering, compromised/stolen device attacks, system breaches, and identity theft are on the rise in 2022. So, how can you integrate modern payment methods for the ongoing Fintech revolution while availing all the benefits? inai has got just the solution for your payment method aggregation woes.

How Does inai Help you with Indian Payment Methods?

inai is a unique payment method aggregator with over 300+ international payment methods. It helps you support customers from different geographies in their native currencies and other payment method preferences.

inai is ideal for both large-scale international and small-scale enterprises with nominal tech-knowhow. With inai, your business can avail yourself of a low-code/no-code payment method integration service. It helps you render a unified payment system that gives your customers a personalized transaction experience. This payment integration tool guarantees PCI-DSS and GDPR-compliant service for your business, sales protection for you and your customers, and even a dashboard to maintain an end-to-end watch on sales and conduct analytics, amongst other things.

As a developing sub-continent, an Indian exodus to the digital payment space can help catalyze a digital payment zeitgeist for South Asia and eventually create a successful case study for the rest of the globe.

With inai, you can see a data-driven uptick in your conversions and revenues.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

%20(1).png?width=4068&name=62ac2c3000fdd4aeb0d80c34_CTA%20(2)%20(1).png)

.png?height=400&name=Header%20-%20Top%20Payment%20Methods%20In%20France%20(1).png)

.png?height=400&name=Header%20-%20Top%20Payment%20Methods%20In%20Nigeria%20(1).png)