Customer churns are hard to ignore when they directly impact your business’s bottom line. Retaining old customers is costly, as it exceeds the costs of acquiring new customers.

Repeat customers spend 67% more than new customers, which is reason enough for you to make every possible effort to retain them. As the average customer retention rate across the various industries stands at 75.5%, it’s imperative to ensure every company and service provider offers nothing but their best to their customers.

If you are still losing customers after making all possible efforts to retain them, you are doing something wrong. Considering this, it’s essential to understand the potential causes of churn and what you can do to manage them.

What is Involuntary Churn?

There are two types of customer churn—voluntary and involuntary. The former is straightforward, as it is extremely noisy and apparent. The latter tends to be an invisible force, which can be hard to detect without the proper tools.

Involuntary churn refers to customers leaving your business due to failed payments, incorrect/invalid payment details, insufficient funds, invalid subscription details, or any other unavoidable reason (s).

How Does Involuntary Churn Impact Subscription Businesses?

Did you know that 5% of subscription customers are lost yearly due to failed legitimate payments.

Although invisible, involuntary churns substantially impact your profits and revenue generation mechanisms. As a rule, they originate mainly from subscription-based services, which are the highly impacted business elements.

Here are the two possible scenarios that can occur due to an involuntary churn.

1. Negative ImpactAon Customer Lifetime Value

Customers vouching for a subscription enjoy easy checkouts and auto-debits for their products and services. However, a decline due to a failed payment, invalid card details, outdated payment method, wrong address, or a server issue can cause problems in customer retention.

While most customers will try to rectify the payment issue on their own accord, many others might seek the help of the merchant for an immediate solution. However, many others might silently remove the subscription, citing irreconcilable payment issues.

What can you do in such a scenario? The apparent blame falls on the merchant, as the customer seldom takes the onus of a failed payment. The result is that your business takes a hit on its revenues.

Such involuntary subscription issues negatively impact your customers' lifetime values as they move away to other service providers in search of a better product/service.

2. Higher Customer Acquisition Cost (CAC) to Keep Up With Churn

Let's look at a business model scenario. When you acquire 10 new customers a month but have 10 customers canceling their subscriptions simultaneously, you aren't raking in any financial benefits.

Alternatively, when you acquire ten new customers but have 15 canceled subscriptions, you are sailing in a proverbial sinking boat. If your customer churns are out of hand, you are losing money through churns.

If your churn is out of control, your two most important metrics, Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC), won’t matter.

Customer Acquisition Cost (CAC) is your business's cost to acquire a new customer. In fact, the lower the CAC, the better. Retaining a new customer is 5 to 25 times more expensive than retaining existing ones.

As more customers continue to leave your business, the cost of customer acquisition will increase gradually while the LTV will decrease. In such a scenario, your best bet for success is to keep the churn rate controlled while extending your LTV rate for best results.

What Are the Causes of Involuntary Churn?

In all its shining glory, involuntary churn isn't hard to fight, especially if you know the causes and how to plug them. Here's what you should start with:

1. Payment Failures

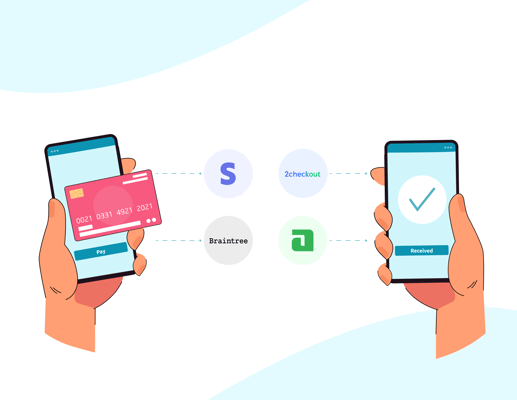

Payment failures are a noteworthy cause of involuntary churns. Card and their network infrastructure are the most significant contributors to payment failures. Unfortunately, credit/debit cards weren't designed to support recurring payments.

Cards have expiry dates; alternatively, they can stand canceled, lost, or even maxed out. Subscription-based services are useless as soon as the cards stop allowing payments.

Another reason for such payment failures is maxed-out credit limits on cards. When customers spend more than their permitted limits, it leads to failed payments, as the issuing bank doesn't allow customers to charge more than their pre-approved limits.

2. Absence of Payment Retry Option

Customers try to pay via an alternate payment channel or using the revised credentials when a subscribed payment fails.

Even though customers will receive decline notifications, the merchant needs to be proactive and offer customers alternate payment options. Nonetheless, the merchant is responsible for providing a payment link.

The merchant's proactiveness will help maintain customer loyalty and assure the customer of the merchant's involvement. The absence of a retry option becomes an immediate cause of customer loss.

3. Payment Method Limitation

As a service provider, providing plenty of alternative payment method options to your customers is a great approach to keep them locked in. However, to save processing and transactional costs, merchants tend to avoid associating with expensive payment options, which curtails the available payment options.

Each customer has different payment behaviors and patterns. Customers may only subscribe to a particular service if they find their favorite/preferred payment option. This is majorly applicable when there are no alternate ways to repay in case of a decline.

4. Payment Risks and Fraudulent Transactions

In 2016, 15.4 million Americans lost $16 billion. That's the impact of fraudulent transactions on a customer's financial health. Hard declines are a factual reality that impacts every customer's account.

Payment details are often compromised, making hard declines an unnatural truth worth reckoning.

When a fraudster enters invalid information multiple times, it leads to an account block, which renders the payment mode useless.

In such cases, since the issuing banks work in a 'play safe' mode, even legitimate transactions are subsequently declined.

How to Calculate Involuntary Churn?

To calculate involuntary churns, you take the total volume of involuntarily churned customers within the specific period and the total number of customers at the beginning.

You can use the following formula for calculations:

Customer churn rate = (Number of customers who involuntarily churned in a given month / total customers at the start of the month) x 100

What Are the Strategies to Fix Involuntary Churn?

While most customers will try to rectify the payment issue on their own accord, many others might seek the help of the merchant for an immediate solution. Here's what you can do to fix Involuntary churn:

1. Payment Run Timing

Payment retry timings are crucial to reducing involuntary churns. When facing payment downtime, you should avoid retrying payments, as multiple attempts can create frustration and chaos on the customer's, issuing bank's, and payment processor’s part.

Instead, use the smart retry option, which determines the right time to retry a payment based on past failures. This feature can significantly improve your payment approval rate.

2. Payment Retry

Payment retries are an excellent method of resolving any payment-related concerns. During the investigation phase, you can work with the customer to rule out invalid card details, offer alternate payment methods, and advise the customer on the best way to secure their funds and procure your services.

During the payment retrials, you can ensure the customer weeds out any invalid card and checks their payment details stored within your platform while addressing any spending limit challenges on their account.

3. Optimizing the Payment Instruments

Payment channels are your best bet to boost customer loyalty. When you offer easy-to-access payment methods to your customers, subscriptions become more accessible, and the sign-up process is seamless.

Use simple, effective payment methods that provide less downtime and more productivity. Customers with a hassle-free payment cycle will stick to the basics without running around helter-skelter to make payments.

4. Automatic Card Updater

Per Visa, 30% of all cards change annually, and 35% of customers must remember to update their details. Since an expired, lost, stolen, or invalid card is one of the primary contributors to an involuntary churn, you need to invest in an automatic card updating service.

inai is a standalone data intelligence solution that provides automatic account updating services. These services source and update card details, resulting in fewer missed payments and a better customer experience.

5. Leverage Insights With Data

Data and insights are pivotal in understanding problems and deriving solutions. When faced with recurring issues, well-established trends can do wonders for your business. Such trends are usually available from your past issues, as you can analyze the common causes of payment failures, such as invalid card details, failed payment timings, downtime, etc.

With such valuable and actionable insights, merchants can more easily nip problems in the bud and establish foolproof solutions to enhance customer experiences.

6. Dunning Process

The dunning process is helpful, especially when tailoring it to your needs. You can use various options, such as sending out personalized emails to nudge customers about failed payments, grouping customers into similar failure categories to create batch solutions, or simply using it to automate the notification process.

With the help of a stable, well-crafted dunning process, you can achieve almost anything, reducing the churning process manifold.

Conclusion

Payment Data Intelligence Platform like inai offers services to reduce and curb involuntary churns. Many merchants fail to pay adequate attention to the most obvious reasons, leading to involuntary churns.

inai offers a series of payment services to your customers, including intelligent retries, dunning facilities, in-depth payment visualization, Payment Error Breakdown Analysis, and payment failure reporting, amongst other features.

To measure the impact of the involuntary churn and how it is impacting your business, we offer a complimentary Payment Health Analysis, which presents the current number of failed payments that can potentially be recovered and the primary causes of these failures. Utilize inai's payment failure solution for deeper insights into these matters.

Seeing is believing; create your free inai account to associate your business with the best.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)