Bahrain's payment landscape is undergoing sweeping changes. With the increasing adoption of digital payments, Bahrain has become one of the leading innovators in digital financial services. This small nation is home to an array of digital payment solutions driving convenience and efficiency for consumers and businesses.

Additionally, Bahrain has successfully developed several projects focusing on financial inclusion, providing easier access to banking solutions for those who previously had difficulty engaging with traditional banks.

As per Bahrain Fintech Bay's 'Fintech Ecosystem 2022' report, the country has 120 fintech, most of which operate within the payments and crypto fields. The Central Bank of Bahrain (CBB) is introducing new regulatory reforms to promote crypto-assets, crowdfunding, and open banking.

Criteria to Look Out for Payment Gateways in Bahrain

When looking at your business's various payment gateway options, you must consider a few points to ensure a successful selection. Here are some pointers to help you make the right decision:

1. Reliability

Reliability continues to be one of the first and foremost points to look for while selecting a payment gateway. When dealing with multiple payment gateways, chances are you will always want to associate with a brand that focuses on customer service and provides trustworthy payment options to end customers and merchants alike.

2. Supported currencies

The primary focus of a payment gateway relies on its ability to support and accept payments in multiple currencies. After all, when you provide services in numerous local markets, you should always have the facility to make and receive payments in various currencies without looking for alternate options.

3. Payment options

A good payment gateway will always make payment options available to the end customer. Some notable options include buy-now-pay-later, installments, currency settlement, payment withdrawal in local currency, etc. Irrespective of the payment gateway option, you should associate with a brand that promotes and provides an excellent array of options to the end users.

4. Market integration

A payment gateway helps businesses expand their horizons and venture into newer markets. A flexible payment plan can help you integrate your business with the local norms to offer plenty of payment options to consumers, who can make purchases in their local currencies without worrying about high conversion fees and transaction-based charges.

5. Security

Since payment gateways dabble in different customer payment data, they need to safeguard financial information by providing state-of-the-art security standards, which help preserve the integrity and confidential customer data.

6. Pricing and other options

Finally, a payment gateway should offer different pricing plans, depending on the currency in question, and a few other options to optimize the payment standards. When customers intend to make payments, they should always have the opportunity to pay in their local currency and make payments in different currencies, depending on the lowest conversion and transaction fee.

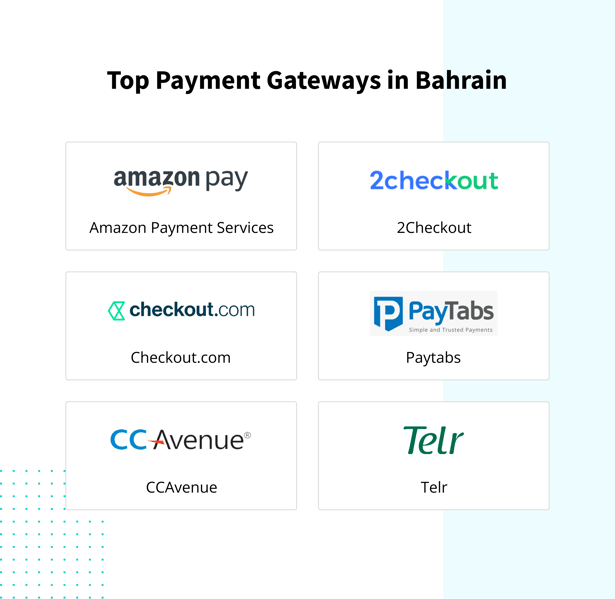

Top Payment Gateways in Bahrain

1. Amazon Payment Services (APS)

Amazon’s services are well-known all over the world. Amazon’s Payment Services is a famous name in the MENA region, and its existence in Bahrain continues to make it renowned

With APS, you can process payments seamlessly and offer your customers an option to pay in installments while collecting payments from any part of the world. There is a slew of other features which make APS one of the top payment contenders in Bahrain within the payments sector.

Pricing and Other Fees:

- Setup fee: Free

- Annual Fee: None

- Monthly fee: None

- Charges on refunds: Information Available on request

- Commission per transaction: 2.8% plus extra charges

Accepted Payment Methods:

-

Credit/Debit cards: All major credit cards are accepted.

-

Other accepted payments: Digital wallets, Apple Pay, PayPal, Mada STC Pay, Visa Checkout, and Masterpass

Supported Currencies: Amazon Payment Services supports all major currencies.

Approvals and Onboarding Time: The integration process can take 3-5 business days.

eCommerce Platform Integration: You can integrate Amazon Payment Services with the following:

- Woocommerce

- Shopify

- Prestashop

- OpenCart

- CS Cart

- Open Cart 2

2. Verifone [2checkout]

With Verifone, you can monetize your platform and expand your business within the domestic and international markets. Verifone provides your business with various services, catering to different segments and customer types.

With PCI-compliant infrastructure and a minimal risk bank grade switch, you get access to a highly secure payment system, which allows you to access in-depth transaction reporting to make meaningful decisions.

Some standard services include the following:

-

Global Payments

-

Digital commerce

-

Subscription billing

-

Reporting and analytics

-

Risk management

Pricing and Other Fees:

- Setup fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on refunds: Information Available on request

-

Commission per transaction: There are three payment plans you can choose based on the following:

1. 2Checkout 2 SELL: 3.5% + $0.35

2. 2Checkout 2 SUBSCRIBE: 4.5% + $0.45

3. 2Checkout 2 MONETIZE: 6.0% + $0.60

Accepted Payment Methods:

- Credit/Debit cards: Skrill, PO, Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

- Other accepted payments: Apple Pay, Google Pay, AliPay, OPay

Supported Currencies: 87 major currencies

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: All major e-commerce platforms

Good Read : Top 6 Payment Gateways in UAE That Your Business Need To Know

3. Checkout

If you are operating a business in Bahrain, you will find Checkout an excellent payment platform catering to various customer and business needs. You can use Checkout’s free BenefitPay mobile app to make payments.

Some standard features include the following:

- Multi-channel payments

- Built-in security for payments

- Flexible payment options for customers and businesses alike

Pricing and Other Fees:

- Setup fee: Free

- Annual Fee: None

- Monthly fee: None

- Charges on refunds: Information Available on request

- Commission per transaction: AED 0.75 to 2.75 percent of the total volume

Accepted Payment Methods:

-

Credit/Debit cards: Visa, MasterCard, Diners Club, American Express, Discover, and JCB.

-

Other accepted payments: Apple Pay, Google Pay, Benefit, Fawry, SEPA, Klarna, SOFORT, Alipay, WeChatPay

Supported Currencies: All major currencies

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: All major e-commerce platforms such as:

- Astound Commerce

- WooCommerce

- 5874

- Shopify

- Cabiri

4. Paytabs

Paytabs is a known payment service provider that has been providing stellar services in

payment processing and fraud prevention. Some standard features include the following:

- Omnichannel Payment Solutions

- Simple Onboarding Process

- One-Stop solution for merchant information

Pricing and Other Fees:

- Setup fee: Free

- Annual Fee: None

- Charges on refunds: Information Available on request

- Commission per transaction: Three payment plans:

1. Start-up plan: Starts from $49.99 and ideal for businesses with a volume upto USD2000.

2. Growth plan: This plan is ideal for businesses with a volume upto USD 2000. The transaction cost is 2.85% + $0.27 per transaction.

3. Enterprise plan: This plan is ideal for businesses with a volume greater than $10000.

Accepted Payment Methods:

-

Credit/Debit cards: Visa, MasterCard, American Express, STCPay, Knet, Oman Net, and Mada.

-

Other accepted payments: Information not available

Supported Currencies: SAR, USD, AED, GBP, EUR, OMR, KWD, EGP, JOD, and IQD

Approvals and Onboarding Time: The integration process can take anywhere between 24 to 48 hours.

eCommerce Platform Integration: You can integrate Paytabs with the following:

- Magento

- CS-Cart

- WooCommerce

- Shopify

- Prestashop

- OpenCart

-

Expand Cart

5. CCAvenue

CCAvenue is a payment gateway that has recently started providing payment processing services in Bahrain. Despite its Indian roots, CCAvenue is a leading name in the market, and it is available for businesses with different sizes and sales volumes.

Some standard features include:

- Omnichannel Payment Platform

- Dynamic Routing

- Easy to integrate and customize

- Multiple Channel Processing

Pricing and Other Fees:

-

Setup fee: Free

-

Annual Fee: None

-

Monthly fee: None

-

Charges on refunds: Information Available on request

-

Commission per transaction: 3%

Accepted Payment Methods:

-

Credit/Debit cards: All major credit and debit cards are accepted.

-

Other accepted payments: Net banking, Easy payment plans, and reward payments.

Supported Currencies: All major currencies are supported by CCAvenue.

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: All major e-commerce platforms.

6. Telr

Telr, as a payment platform, is omnipresent in 120 countries and available in 30 languages. A few notable features include:

- Social Commerce

- Anti-Fraud Protection

- Buy Now Pay Later

- QR Code Payments

- Online Store Creation Tool

-

Pricing and Other Fees:

-

Setup fee: Free

-

Annual Fee: None

-

Charges on refunds: Information Available on request

-

Commission per transaction: Commissions are decided basis of the levels, which include the following:

1. AED 349 (entry-level) – No transaction commission

2. AED 149 (small level) - 2.69%

3. AED 99 (medium level) - 2.49%

Accepted Payment Methods:

-

Credit/Debit cards: Visa, MasterCard, American Express, UnionPay, STCPay, Mada, and SADAD.

-

Other accepted payments: Apple Pay, PayPal, digital wallets, and Net Banking in India.

Supported Currencies: The gateway supports 120 global currencies, including USD, GBP, EUR, and many others.

Approvals and Onboarding Time: The integration process can take anywhere between 24 to 72 hours.

eCommerce Platform Integration: You can integrate Telr with the following:

- WooCommerce

- Shopify

- Prestoshop

- OpenCart

- Magento

Local Payment Gateways and the Rising Complexities for Businesses

The pandemic has changed how the world functions, making various countries usher in a wave of digitalization. Today, Bahrain is standing tall as it dismantles tangible financial services, paving the way for an ecosystem that provides greater flexibility and diversity and is available instantly.

With a rapidly growing e-commerce industry and digitization of payments, businesses in Bahrain are increasingly turning to local payment gateways as the preferred payment processing method. These online payment gateways provide many benefits to businesses, including faster transaction times, reduced costs, and more secure transactions.

However, these advantages come with rising complexities ranging from customer authentication mechanisms to compliance regulations that must be adhered to. Despite this, the use of local payment gateways provides several advantages to businesses in Bahrain when it comes to digital payments.

How Can inai Help You Integrate Multiple Payment Gateway Integrations in Bahrain?

At inai, we are always promoting excellence in customer satisfaction, merchant handling, or simply expanding the horizons of payment processing.

Our ever-expanding services cater to businesses, from small and medium-sized businesses to large corporations looking to ease their payment processing woes.

Our multi-faceted platform allows you to manage multiple payment gateways for your business from a single platform. Additionally, you can enhance your reporting and leverage advanced analytics to make meaningful decisions from your past transactions.

Here are a few other services that sweeten the deal:

-

Manage numerous subscriptions from a single platform just like your payment gateways.

-

Make use of our no-code integrations to onboard your payment solutions in a few clicks.

-

Seamlessly integrate your online stores and accept 300+ payments for your customers and merchants.

-

Successfully route payments to merchants to make the most of the transaction and conversion fee.

Our team at inai are experts in the field of payment aggregation, and we provide an excellent set of services to help our customers at every step. With inai by your side, you can excel in your services field and propel your business forward by making the best possible use of cutting-edge technology. Book a demo now!

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=693&height=184&name=62b09da6666bd7d473b08bee_CTA%20(3).png)