Getting customers to convert is the key to any successful business. Show them that you value their convenience by providing a range of payment options and an effortless checkout experience.

Ready to get your business payments up and running in Denmark? Let's begin by exploring the payment landscape in Denmark. After all, selecting a payment gateway should be an informed decision-making process!

We've compiled the top 10 gateways with essential features to ensure you find an option tailored just for you. Plus, we included helpful considerations which will have you confident in making a perfect choice.

Payment Landscape in Denmark

The Danish Payments Market has been showing an uptrend in the past and is expected to follow the same pattern in the years to come.

According to Mordor Intelligence, the Denmark Payments Market is expected to grow at a CAGR of 7.5% from 2022-2027.

This growth in the payments market is fueled primarily by booming eCommerce. Customer preferences are changing, and more and more people are buying online and choosing online payment methods instead of cash payments.

Therefore, businesses considering operating and succeeding in Denmark should prioritize integrating digital payment solutions first. This will help you stay ahead of your competitors and offer the best experience to your customers.

Criteria to Look Out for Payment Gateways in Denmark

Here are some factors to consider when looking for a payment gateway in Denmark:

1. Reliability

You'll be accepting and managing payments via your payment gateway. Therefore, make sure it's completely reliable.

To select the most reliable payment gateway, it's best to conduct thorough research. Look for Google reviews and customer feedback - these are often sure signs of a trustworthy provider with quality services. Remember to chat with sales staff, too; they can answer any specifics you may have about features and performance!

2. Supported Currencies

International business requires an expanded payment gateway to ensure customer satisfaction globally. Look for gateways that support all major currencies, particularly those necessary in your region of operation; if you're targeting Denmark, make sure the Danish Krone is supported alongside other options--the more versatile, the better!

3. Payment Methods

Offering multiple payment methods, especially the local ones, adds to the customer's convenience and reduces the cart abandonment rate. So, when looking for a payment gateway, ensure it supports all traditional and alternative local and global payment methods.

Also, check if the payment gateway allows you to add more payment methods later. This will help you target more customers in different geographies when you expand without having to change payment service providers.

4. Market Integrations

An ideal payment gateway should offer integrations with different e-commerce, CRM, or other platforms you already use. This will help you manage your payments and other processes easily without having to refer to a single tool each time you want to make changes or draw some insights.

Therefore, look for a payment gateway that integrates easily with the existing tools or solutions you have in place. Common integrations include:

- Storefront

- Shopify

- BigCommerce

- WooCommerce

- Salesforce

- Microsoft 365

5. Security

If your payment gateway is not secure, it'll put both your customers and your business at risk. Security should be an essential factor to consider while looking for payment gateways.

Ensure your payment gateway follows the required regulations and is PCI DSS compliant, among other requirements. They should also have an effective anti-fraud system that could help detect and stop any fraudulent transactions.

6. Pricing and Other Fees

Pricing is another critical factor, especially if you're a new business. Certain payment gateways charge a hefty transaction fee which reduces the profit margin and impacts the business's overall revenue. So, make sure to calculate how much the payment gateway will cost. Here's what you can consider:

- Setup Fee

- Annual Maintenance Charges

- Chargeback Fee

- Monthly Fee

- Transaction Fees for local and international cards and other payment methods that they support.

Pro Tip: Several payment gateways charge a hidden fee. Make sure to explicitly ask about the same from the payment gateway's sales team.

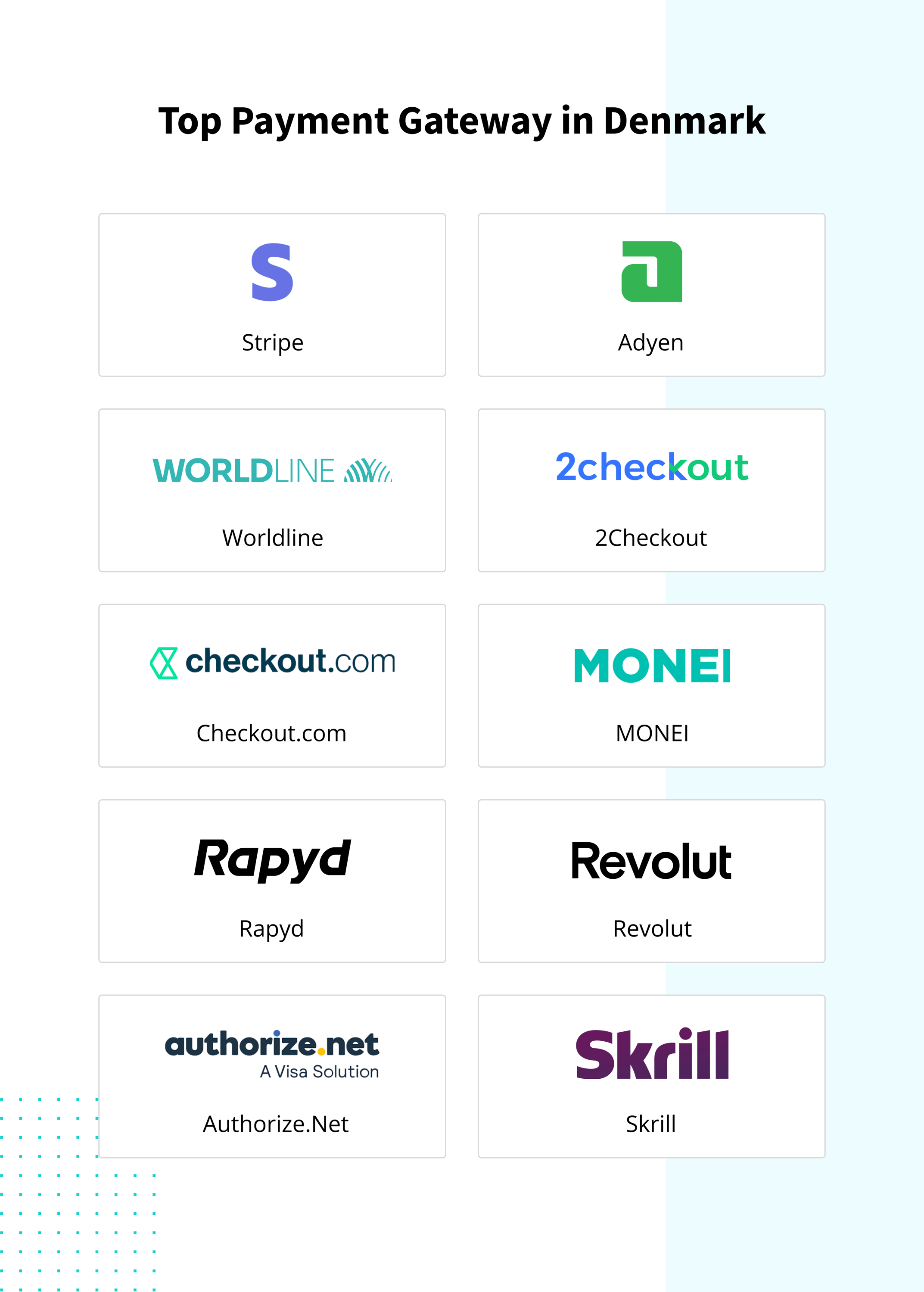

Top Payment Gateway in Denmark

1. Stripe

Stripe is a popular payment platform for budding startups and established enterprises. With Stripe, you can accept payments from your customers in Denmark and across the globe. Stripe comes with anti-fraud systems that help prevent fraudulent transactions and offer a safe checkout experience to customers. Here are some highlights about Stripe:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- The commission per transaction: 1.5% + 1.80kr for standard European cards and 2.5% + 1.80kr for UK cards.

Accepted Payment Methods:

- Credit/Debit Cards: Supports all popular debit and credit card brands.

- Other methods: Supports alternative payment methods such as wallets, bank redirects, buy now, pay later, and more.

Supported Currencies: It supports 135+ currencies.

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- Shopify

- NetSuite

- WooCommerce

2. Adyen

Adyen is an end-to-end payments platform that allows you to accept payments and manage & control your finances like never before. It also allows you to add support for more payment methods and protects your customers by preventing fraud. Here are some key highlights of Adyen:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Varies with the payment method used.

- The commission per transaction: €0.10 per transaction + payment method fee.

Accepted Payment Methods:

- Credit/Debit Cards: Major debit and credit card brands such as VISA, Diners Club, MasterCard, and AMEX are supported along with Dankort: a local debit scheme.

- Other methods: Other methods include PayPal, Google Pay, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms, including:

- Big Commerce

- Vue Storefront

- Microsoft 365

- WooCommerce

3. Worldline

If you're an eCommerce business in Denmark and want to take your business online or want to expand your business in Denmark, Worldline can help. Worldline is a reliable payment solution for all eCommerce merchants, making accepting and managing international payments easy.

Pricing and Other Fees:

- Setup Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Annual Fee: None

- The commission per transaction: Information Available on request

Accepted Payment Methods: More than 150 global and local payment methods are supported.

Supported Currencies: More than 140 currencies supported

Approvals and Onboarding Time: Information Available on request

eCommerce Platform Integration: Offers integration with major eCommerce platforms.

4. 2Checkout

2Checkout is a flexible payment platform that can help you grow your business. Whether your small business or an enterprise, you can easily scale 2Checkout per your needs. Also, it allows you to customize the checkout experience, which is essential for reducing the cart abandonment rate. Here are some highlights about 2Checkout:

Pricing and Other Fees:

- Setup

- Fee: Free

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- Commission per transaction: 3.5% + $0.35 for every successful sale

Accepted Payment Methods:

- Credit/Debit Cards: All popular credit and debit card brands, such as Discover, JCB, American Express, Diners Club, Visa, PO, MasterCard, and Skrill, are supported.

- Other methods: Alternative payment methods such as PayPal and Skrill are supported.

Supported Currencies: It supports +100 currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- Drupal

- Shopify

- BigCommerce

- WooCommerce

Checkout : Top 12 payment gateways in Germany that your business need to know

5. Checkout

Checkout is a full-stack payments solution that can help you scale your business globally. It protects you and your customers from fraud and allows you to add more payment methods as your business expands. Here are some highlights about Checkout:

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly Fee: None

- Charges on Refunds: Information Available on request

- The commission per transaction: Information Available on request

Accepted Payment Methods:

- Credit/Debit Cards: All major cards from JCB, Discover, Visa, Diners Club, and MasterCard, American Express are supported.

- Other methods: Alternative payment methods such as Apple Pay, Alipay, and PayPal are supported.

Supported Currencies: It supports 150+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- Shopify

- WooCommerce

- SAP Commerce Cloud

- Salesforce Commerce Cloud

6. MONEI

MONEI is yet another popular payment gateway in Denmark that can help you accept and manage payments. It offers numerous payment methods and allows you to add more as and when required. You can also customize the checkout experience for your customers and achieve a better conversion rate. Here are some highlights about MONEI:

Pricing and Other Fees:

- Setup Fee: Free

- Daily fee: €0.10

- Charges on Refunds: €17.00 Per Chargeback

- The commission per transaction: smallest plan charges 0.15% to 1.19% + €0.24 per transaction

Accepted Payment Methods:

- Credit/Debit Cards: Major cards such as JCB, Mastercard, Diners Club, Discover, and Visa are supported.

- Other methods: Supports numerous alternative payment methods such as Apple Pay, Google Pay, PayPal, giroPay, iDEAL, Klarna, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- Shopify

- Magento

- Spreedly

- Wix

7. Rapyd

Rapyd is a payment gateway capable of taking your business online and globally. With Rapyd, you can accept payments from customers in over 100 countries and send payouts to workers in over 190+ countries. Here are some other key highlights of this platform:

Pricing and Other Fees:

- Setup Fee: Free

- Charges on Refunds: Information Available on request

- The commission per transaction: 1.2% + €.25 for European cards and 2.9% + €.30 for non-European cards and other payment methods.

Accepted Payment Methods:

- Credit/Debit Cards: Major cards such as JCB, Mastercard, Diners Club, Discover, and Visa are supported.

- Other methods: Supports numerous alternative payment methods such as Apple Pay, Google Pay, PayPal, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- Shopify

- Magento

- WooCommerce

- Wix

8. Revolut

Revolut is a complete payments solution that comes with a payment gateway allowing you to accept and manage payments for your business. Using Revolut, you can integrate different eCommerce platforms and start accepting payments directly from your website. Also, you can customize the checkout experience to ensure better conversions. Here are some key highlights:

Pricing and Other Fees:

- Setup Fee: None

- Charges on Refunds: Information Available on request

- The commission per transaction: 1.2% + €.25 for European cards and 2.9% + €.30 for non-European cards and other payment methods.

Accepted Payment Methods:

- Credit/Debit Cards: Major cards such as JCB, Mastercard, Diners Club, Discover, and Visa are supported.

- Other methods: Supports numerous alternative payment methods such as Apple Pay, Google Pay, PayPal, giroPay, iDEAL, Klarna, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with major eCommerce and CRM platforms such as:

- Shopify

- Magento

- WooCommerce

- Wix

9. Authorize.net

Authorize.net is a perfect payment gateway for small eCommerce business owners who want to expand their business and offer multiple payment methods to their customers. It offers a minimalistic checkout experience and is easy to integrate. Here are some highlights of Authorize.net

Pricing and Other Fees:

- Setup Fee: None

- Annual Fee: None

- Monthly fee: $25

- Charges on Refunds: Information Available on request

- The commission per transaction: 2.9% + 30¢

Accepted Payment Methods:

- Credit/Debit Cards: It supports all major card brands such as Visa, MasterCard, Discover, American Express, etc.

- Other methods: Alternative payment methods include PayPal, Apple Pay, and more.

Supported Currencies: It supports all major currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- WooCommerce

- BigCommerce

- Magento

10. Skrill

Skrill is a popular payment solution that helps betting, gaming, online shopping, and trading businesses to accept international mage payments. It's easy to use and offers numerous eCommerce integrations allowing for easy integration. Here are some key highlights of Skrill:

Pricing and Other Fees:

- Setup Fee: None

- Charges on Refunds: Information Available on request

- The commission per transaction: is 1.25 % for global cards.

Accepted Payment Methods:

- Credit/Debit Cards: All major debit and credit cards such as Visa, MasterCard, Discover, American Express, and more are accepted.

- Other methods: Several alternative payment methods, such as Trustly, Paysafecard, and more.

Supported Currencies: It supports 40+ currencies.

Approvals and Onboarding Time: Information Available on request.

eCommerce Platform Integration: Offers integration with a range of eCommerce platforms, including:

- BigCommerce

- WooCommerce

- Magento

- Wix

Local Payment Gateways and the Rising Complexities for the Businesses?

While you can integrate a local payment gateway in your business and start accepting payments in Denmark, it's not a viable plan in the long run. Why?

Well, a local payment gateway supports a limited number of payment methods and currencies which can stop you from expanding your customer base to other geographies. And even if you manage to add more payment gateways, the costs would be unbearable.

In addition, relying on a single payment gateway can make you dependent. If the payment gateway faces a downtime or surprisingly increases its fee, you have no option but to comply.

So, what's the solution? Well, that's when inai comes in.

How Can Inai Help You Integrate Multiple Payment Gateways in Denmark?

inai is an end-to-end payment aggregator solution that connects you with 30+ payment gateways and helps you offer your customers 300+ payment methods (local and global). You can easily add as many payment methods as you want when you expand your business to different geographies.

Moreover, with inai, you don't have to depend on a single payment gateway. Suppose a payment gateway charges a high transaction fee or cannot process payments anytime. In that case, you can route the transactions to whatever payment gateway you find suitable and keep the payments running.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)