For eCommerce businesses, global expansion is a top priority. By broadening their customer base and reaching new demographics, they can experience increased profits – making it a win-win situation!

However, unlocking international growth for your business requires strategic inventory management, streamlined logistics, and a global payment system. To build successful cash flows worldwide, it's essential to ensure your payments are secure and accessible from any corner of the globe - but how? Keep reading to find out!

In this blog, we'll discuss what a global payment method is and how it can help merchants send or receive funds from customers regardless of their location. We'll also talk about eCommerce localization, using which you can make your websites and apps adaptive to different countries according to the user's location.

All in all, this blog will sort payments for your business, making it easy for you to expand and go global.

What Is a Global Payment Method?

As the name says, a global payment method allows merchants to accept payments from their customers regardless of their location. Both the issuing brand (in the case of debit/credit cards) and the merchant's payment processor are located in different countries.

Let's say your business is located in Russia. If a customer who uses a credit or debit card issued by a brand in France makes a purchase, it's a global payment. And the payment method used in this transaction, debit/credit card, is an international payment method.

Standard global payment methods include digital wallets, credit and debit cards, contactless payments, buy-now-pay-later, etc. (more on that later).

Global payments work in favor of both the customers and merchants. Customers can purchase what they want from anywhere, easing accessibility. And merchants can expand their businesses wherever they wish without much logistical resistance.

What is eCommerce Localization?

eCommerce localization is the process wherein an online business modifies its content and personalizes it to cater to a different location or market.

Take Amazon, for example. The Amazon website in the USA is in English and uses global and local payment methods available in the United States. Check out this image for reference:

On the other hand, the Amazon website in Mexico has a different URL, uses the Spanish language, and offers global and local payment methods available in Mexico. Check out this image for reference:

To understand why businesses go for eCommerce localization, refer to the following benefits.

Benefits of eCommerce Localization

eCommerce localization is about personalizing the entire user experience, which includes currency, payment methods, appearance, and more. And businesses that offer eCommerce localization experience the following benefits:

-

Competitive Advantage

Not every business makes an effort to localize and offer a personalized experience to its customers. However, you can get a competitive advantage if you put in the effort. In fact, 47% of consumers believe that having a local presence is a significant factor in deciding the shop they want to buy from, according to Shopify.

-

Improved Customer Satisfaction

Personalizing the website, language, and payment methods can help you offer your customers a better experience, improving customer satisfaction. According to Shopify, personalized websites experience 20% higher customer satisfaction rates.

-

Tap into Global Markets

eCommerce localization helps you cater to a broader range of customers, allowing you to tap into global markets. And this helps ensure growth and better revenue.

-

Better Conversions

A localized interface or website is relatively easy to navigate compared to a universal one. This adds to the customer experience and motivates them to purchase more, increasing conversions.

How Do Businesses Benefit by Offering Global Payment Methods?

Here's how:

1. Enhanced Market Reach

One of the most significant advantages of offering global payment methods is that it helps businesses expand their market reach. For instance, if you have an online business and provide a single local payment method, there are only so many customers you can cater to.

On the other hand, if you have support for global payment methods, your market reach will drastically expand. Regardless of your location, you can sell your products or services to customers in any corner of the world. This will allow you to capture a wider market and boost your business's bottom line.

2. Boosts Checkout Conversion Rates

One of the biggest reasons behind cart abandonment, according to BigCommerce, is the lack of desirable payment options or methods. And cart abandonment leads to poor checkout conversion rates, which hits the bottom line pretty hard.

By integrating multiple global payment methods, you can offer customers numerous options to choose from. They can select whatever they feel comfortable with and proceed with the payment. This will significantly reduce the instances of cart abandonments and boost your checkout conversion rates.

3. Reduces Costs

Most online businesses have standard options such as credit or debit cards. While these payment methods get the job done, they're expensive, especially for merchants. After all, there's a specific amount merchants have to pay for processing payments through cards. And this adds to merchants' overall costs, reducing the profit margin.

Fortunately, alternative payment methods such as digital wallets, buy-now-pay-later, bank transfers, etc., charge way fewer fees, making it financially feasible for businesses. So, offering alternative global payment options can save money while ensuring a better customer experience.

Types of Global Payment Methods

Here are some common and trending types of global payment methods:

1. Credit and Debit Cards

Credit & debit cards are one of the most common global payment methods. Credit/debit card brands tie up with banks and issue customers a card they can use to make national and international tractions. Also, such cards can be used for both in-store and online transactions.

2. Digital Wallets

Yet another popular global payment method is digital wallets. Such wallets can be connected to the customers' bank accounts or credit cards from where they can load their balance and make payments. Popular digital wallets include Alipay, Apple Pay, Google Pay, Pay Pal, etc.

3. Bank Transfers

Using bank transfers, customers can directly transfer funds from their bank accounts to their (merchant's) bank account internationally and nationally.

4. Buy-Now-Pay-Later Installments

Using BNPL, customers can purchase costly things and return the money in installments. This payment method improves accessibility for customers and improves sales of expensive commodities for merchants.

5. Offline Payment Methods

These methods require the user to be physically present. Take any brick-and-mortar store, for example. Customers can use their cards or digital wallets to make payments.

6. Cryptocurrency

While this method is less popular than any method mentioned above, its use is steadily increasing. A simple mobile app lets customers pay online or even offline merchants in cryptocurrencies such as Bitcoin, Ether, Ripple, and more.

Good Read: Top Payment Methods In India That Your Business Needs to Know

Top Payment Method Providers Globally

Here are some of the popular brands that offer global payment methods:

1. Debit and Credit Card Brands

Popular credit/debit card brands include:

- Visa: Visa is a popular card brand that uses its global payment system to issue global debit and credit cards to its customers.

- Master Card: MasterCard is another famous card brand that is a well-known rival of visa and offers international debit and credit cards. It connects billions of customers, merchants, issuers, and businesses across the globe.

- Maestro: Maestro is a debit card brand by MasterCard that enables businesses to make in-store payments.

2. Digital Wallets

Popular digital wallet brands include:

- Apple Pay: Apple pay is a popular digital wallet explicitly meant for iOS users. It works on almost every Apple device that runs on iOS, such as iPads, iPhones, Apple Watches, Mac computers, etc.

Customers can use Apple Pay to pay at brick-and-mortar stores and online websites globally, making payments more seamless. - Google Pay: Google Pay is an online digital wallet and payment system available in several countries worldwide. Customers can use their smartwatch or mobile in-store and make online purchases using specific devices at certain locations.

- PayPal: PayPal is yet another popular digital payment platform available in 200 regions/countries and supports more than 25 currencies. It's one of the best digital payment methods that customers use, and merchants should support it.

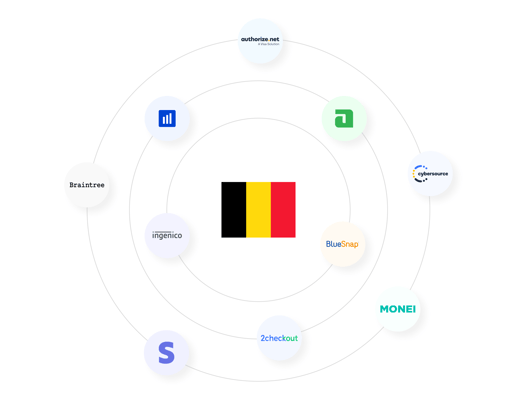

How Inai Supports Global Payment Method Transactions

inai is a global payments integration platform that can help you integrate 30+ payment gateways that support 300+ international and local payment methods in over 200 countries/regions. This way, you don't have to integrate all payment methods one by one. You just need to reach out to inai and integrate our end-to-end payment solutions; boom, you're ready to send or receive payments globally.

You can check out the list of payment methods used across countries that you can integrate into your website or application.

Accept Global Payment Method Transactions to Increase Your Revenue

Imagine every potential internet user can be your customer and pay for your services regardless of their or your business's location. What does it look like? It seems like dollars, right? Well, that's something you can experience for real.

By accepting global payment method transactions, you can expand your customer base, achieve a competitive advantage and substantially boost your revenue. In addition, if your business supports local and global payment methods, it'll add convenience to customers' buying experience, which is essential for your growth.

So, what are you waiting for? Learn how we can help you enable global payment method transactions and boost your revenue.%20(1).png?width=4068&height=1080&name=CTA%20(24)%20(1).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)