While artificial intelligence has been used in the payment industry for years, it was mostly embedded within the solutions and never actually gained attention. However, with the advent of generative AI platforms like ChatGPT, AI has become more tangible and accessible. But how does generative AI help merchants with payments? Well, read along to find out.

In this blog, we’ll discuss what generative AI is and the importance of generative AI in payments. We’ll also list a generative AI solution to help merchants make the most of their payment data.

What is Generative AI?

Generative AI is a form of artificial intelligence that focuses on creating original data instead of solely organizing and processing pre-existing data. By leveraging large language models, generative AI can help you generate text content, images, videos, and even music.

Popular examples of generative AI include ChatGPT, Midjourney, DALL-E, DeepMind, Bard, and more.

The Rise and Importance of Generative AI in Payments

The evolution of artificial intelligence has been transformative, especially for the payment industry.

For instance, AI plays a crucial role in fraud management. AI technologies such as machine learning algorithms can analyze tons of data and detect anomalies indicating fraud activities, enabling merchants to process payments more securely.

Also, by leveraging generative AI, businesses in the financial domain can extract crucial information from lengthy documents or financial data. This way, understanding complex data becomes a piece of cake.

Moreover, you can ask questions related to your data for more granular insights, enabling data-driven decision-making.

Let’s say you have integrated multiple payment gateways for processing payments, but you don’t know which one is the most affordable or seamless from customers’ POV. Using generative AI, you can get the answer to the above questions and many more within seconds.

In a nutshell, generative AI has evolved substantially over the years, making payments more secure, seamless, and efficient. This trend is expected to continue in the years to come.

Let’s dive into some granular details about how generative AI can help you with payments.

What is Inaibot, and how Does it Help you Make Sense of your Payment Data?

When it comes to drawing valuable insights from payment data, the majority of businesses follow a laid-back approach. They handle the payment processing field in a rigid or fixed manner, which is fruitless, considering the dynamic nature of this field.

Most businesses with a rigid outlook:

- Initially spend a great deal of time looking at the data. However, this does not provide a comprehensive understanding necessary to make decisions.

- After that, they create a hypothesis wherein they expect to change the outcomes by altering certain variables.

- Introduce changes to the system, which requires a lot of time and assistance from developers.

Now, performing the above tasks requires a lot of time. And since guesswork is involved, there’s no guarantee you’ll get some tangible results. That’s when Inaibot comes into the picture.

inaibot is a generative AI chatbot that talks to you like a real person, analyzes all your payment data, and answers every payment-related question you might have. Let’s say you want to understand payment failures better. In this case,

- Once you enter the chat-like interface, the chatbot can ask you questions like “What is the period for which you want to analyze the payment issues?”

- You can select the period and the focus area, such as the “Payment Method.” It means you want to analyze payment failures for a particular payment method

- Let’s say you select “Credit Card.”

- Now, based on the options selected, inaibot will provide you with the reason behind payment failure for credit cards for the selected range.

While Inaibot can help you understand your payment failures better, it’s not limited to that. You can get answers to all your payment queries. Here are some common questions merchants ask inaibot:

- What are the most common provider error codes and reasons?

- Are there any patterns in the data based on the type of product or service being purchased?

- What is the cost of payment failures to your business?

- Do you lose revenue from abandoned purchases?

- Do you have to pay fees to the payment processor for failed transactions?

- What are the top 5 provider error reasons?

- What can be done to reduce the number of payment failures?

- What is the MDR (merchant discount rate) for each provider error code?

- What is the volume and number of transactions for each provider error code and reason? - provide the table

- Are you seeing more payment failures during certain times of the year or on certain days of the week?

- What is the volume and number of transactions for each provider error code and reason?

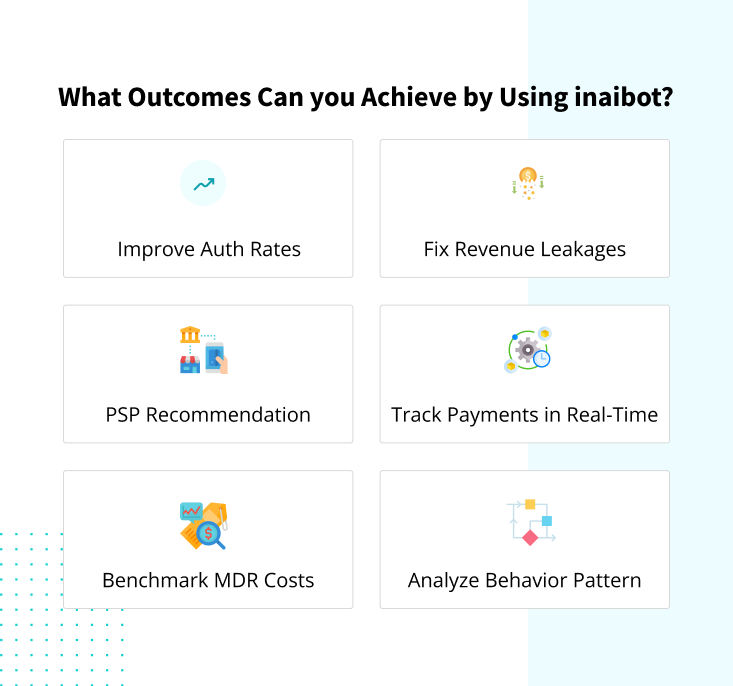

What Outcomes Can you Achieve by Using inaibot?

Think of inaibot as ChatGPT crafted specifically to analyze your payment data and provide actionable insights. By asking the right queries from inaibot, you can achieve the following outcomes:

- Improve Auth Rates: You can simply ask inaibot to identify the error codes causing poor auth rates. Once you have the results, you can immediately fix the issues and boost your auth rates.

- Fix Revenue Leakages: By leveraging inaibot, you can identify issues such as chargebacks, refunds, or failed transactions that might be eating up your revenue. This way, you can fix the issues and plug any revenue leakages.

- PSP Recommendation: Choosing the right payment service provider without the right type of data can be tough. However, with inaibot, you can determine which PSP is affordable and has a high success rate, enabling you to choose the suitable PSP. Or, you can ask inaibot to recommend a PSP based on multiple factors. It’s that easy.

- Track Payments in Real-Time: By using the proper prompts, inaibot can provide you with the data on the latest transactions in the database with details, including the time of the transaction, amount, currency, etc.

- Benchmark MDR Costs: You can compare the MDR or merchant discount rates you’re paying with the industry averages. This way, you can determine if you’re overpaying.

- Analyze Consumer Behavior Pattern: With inaibot, you can identify the patterns your customers follow when making payments. This can help you understand your customer behavior, enabling you to tailor your strategies and improve the customer experience.

Wrapping Up

Payment data is indispensable to any merchant, regardless of the domain. However, to make the most of the massive dumps of payment data, you need to analyze them, which is not possible manually, especially if you want accuracy and tangible results. However, inaibot has your back.

Deploying inaibot is like hiring a team of payment analysts who analyze your payment data 24/7 and are ready for any complex payment-related query. Whether you want to know the common reasons behind payment failures or want a recommendation for the best PSP, inaibot has your back.

So, what are you waiting for? Leverage generative AI to draw actionable insights from your payment data and get a massive competitive advantage.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

%20(1).png?width=4068&height=1080&name=CTA%20(45)%20(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20Top%209%20Payment%20Gateways%20in%20Ireland%20(1).png)