The rate, or authorization rate, is a critical metric for businesses in the world of e-commerce. It measures the success of payment transactions, helping merchants gauge the efficiency of their payment processing systems. However, vanilla auth-rate calculators, which typically present auth-rates as the fraction of successful transactions over the total number of transactions, can sometimes obscure more than they reveal.

In this blog, we'll delve into the concept of auth-rates and why merchants should be more discerning when it comes to measuring and optimizing them.

What is the Order Level Authorization Rate (OLAR)?

At its core, the order level authorization rate represents the rate of successful or fulfilled orders out of the total orders placed/initiated.

Here's an example to help you understand this concept better:

- Let's say John visits an eCommerce website and adds a few items to their cart.

- John tries to pay, but the transaction fails. (the 1st attempt failed due to an internet issue)

- John retries the payment, but the transaction fails again. (1st retry failed due to card expired)

- Now, John has changed the payment method from a card to an alternative payment method. (2nd retry successful)

- As John did not add or remove items from his cart, a single order was generated.

- However, a single order had three transactions (1st attempt and two retries).

In the above scenario, Using the traditional transaction authorization rate calculation, the rate is 33%, as only one out of three attempts was successful.

However, the order level auth rate for this scenario is 100%. Why? Because the order was ultimately fulfilled, regardless of the number of failed transactions. Additionally, this metric provides insights into the success and failure rates of each transaction attempt and the reasons behind any failures.

What Other Metrics Should Merchants Look For?

-

Auth rates across retries: Merchants should track the auth rates across retries as well as the gap between transaction and order level auth rates. High order level auth rates with low transaction level auth rates indicate potential UX/ technical issues with your payments stack.

-

Retry Attempt Rates: This tracks how many customers retried after a failed payment. A low rate indicates that the error reporting is not appropriate and does not encourage the customer to retry.

-

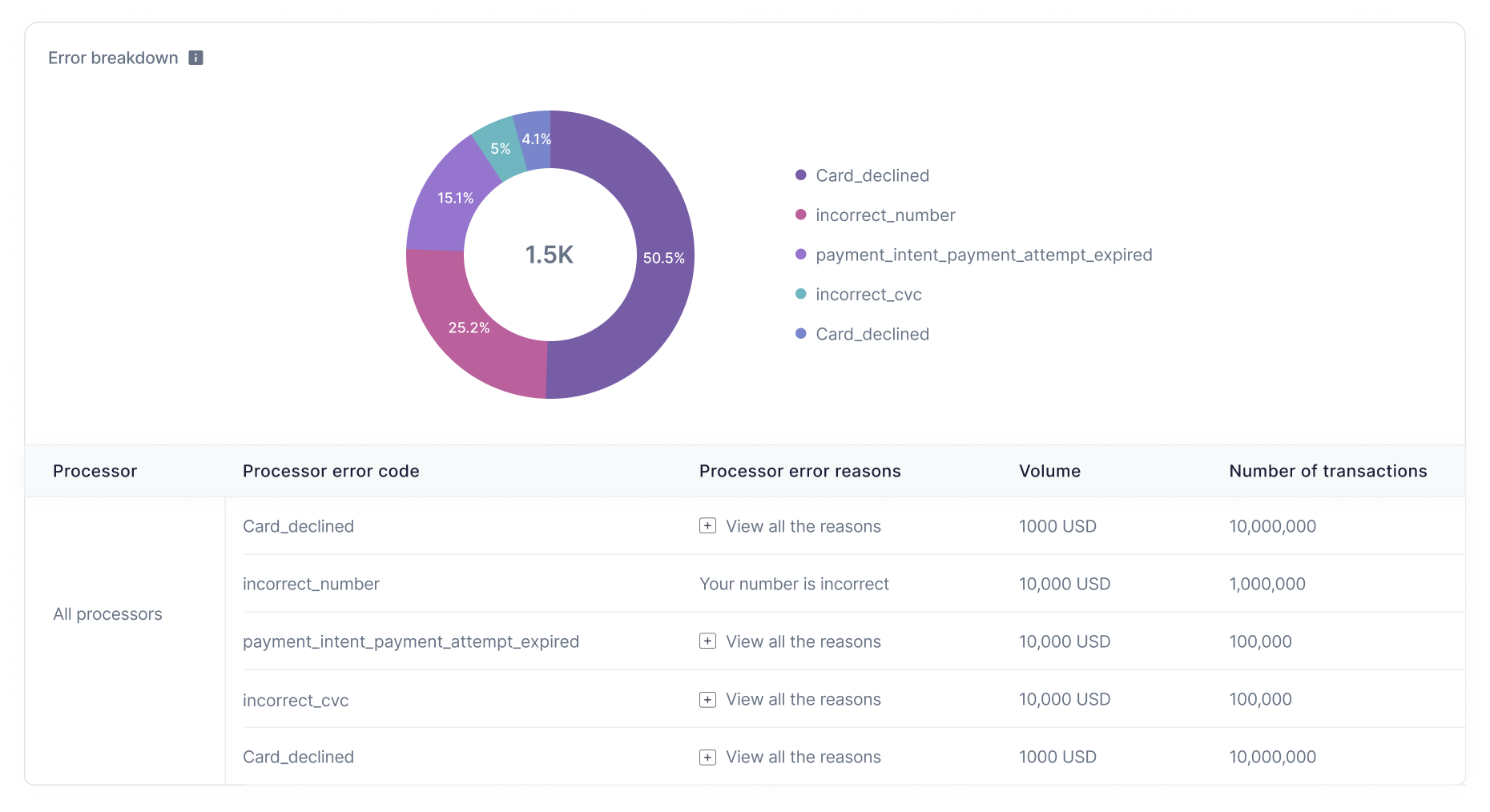

Visibility into the Error Reasons: Often, merchants know that the transaction failed. However, they aren’t aware of the exact reason because of a lack of data. Merchants should also track the errors for payment failures to gain a better understanding of their payments.

-

Drill Down of the Failure Reason by Attempts: In addition to tracking errors across retries /orders, merchants should track the migration path of these errors across retries to understand what errors got addressed eventually leading to success and which ones did not.

-

Understanding what leads to successful retries: To formulate an effective retry strategy, merchants must delve into the key components contributing to successful retries. This involves investigating factors such as:

-

- The impact of changing payment methods on successful retries.

- Determining the optimal timing for retry attempts.

- Exploring potential variations across schemes, processors, issuers, and much more.

Inai Optimise provides a bunch of tools to help you optimize your retry logic such as:

-

- Segmenting Your Retry Cycle

- Update payment methods

- MCC Tracking

- Bank Statement Branding

- Retry optimization by time, types (Hard vs Soft), geography and so on.

Get Insights with Inai Optimize

It's worth noting that many payment processors worldwide don't operate granularly on orders and transactions, leading to inconsistency in calculating these metrics. Inai's proprietary algorithms use multiple data points to look at the transaction collectively and analyze it.

Inai Optimize goes beyond the basics of auth rates to provide a rich array of insights and analytics. Here's a deeper look at some of the key features that can empower merchants to fine-tune their payment processing strategies:

1. Order Retry Authorization Rate Across Attempts

In the complex landscape of e-commerce, it's not uncommon for customers to make multiple attempts to complete payment. Inai Optimize offers a detailed analysis of order retry authorization rates, allowing merchants to track how often customers need to retry their payments before a successful transaction. This can be visualized through informative bar charts, making it easy to grasp the trends and patterns in retry attempts.

2. Retry Attempt Rate:

In the complexity of optimizing transaction processes, it's essential to gauge how many customers return to attempt a retry.

Imagine you're making an online purchase, and your transaction fails. Would you usually attempt it again immediately? Chances are, you'd hesitate. But what if you saw that your saved payment card had expired? In that case, you'd be more inclined to give it another shot.

This scenario underscores the importance of retry attempt rates which could provide valuable insights into customer behavior, helping merchants fine-tune their strategies and maximize successful transactions.

3. Uncover Critical Insights of Retry Success

Inai Optimize takes a deep dive into understanding what causes a retry to succeed after a previous attempt failed. This level of analysis can uncover critical insights, helping businesses fine-tune their payment processes. By identifying the key factors that contribute to retry success, merchants can implement targeted improvements and reduce friction in the payment experience.

4. Identifying Problematic Payment Methods and Gateways

Sometimes, the source of payment failures lies in specific payment methods or gateways. Inai Optimize provides detailed information on whether a particular payment method or a specific payment gateway is causing a higher rate of failures. Identifying these trouble spots is the first step toward addressing the root issues, improving customer satisfaction, and increasing the overall success rate of transactions.

5. Progression of Errors Across Retries

Understanding the progression of errors as customers attempt multiple payments is crucial for a comprehensive analysis. Inai Optimize allows businesses to track and analyze how error codes or error types change from one retry to the next. This data can highlight patterns that indicate whether issues are being resolved or persisting over time.

The insights gained can inform strategies to address these errors more effectively.

Conclusion

In summary, Inai Optimize is not just a tool for calculating auth rates; it's a comprehensive platform that offers valuable insights into every aspect of the payment process. By delving into order retry authorization rates, failure recovery rates, retry success factors, problematic payment methods, and error evolution, merchants can make informed decisions to enhance their payment processing efficiency.

With Inai Optimize, auth rates are not just numbers; they are a gateway to understanding and optimizing your e-commerce operations.%20(1).png?width=4068&height=1080&name=CTA%20(45)%20(1).png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png)

.png?height=400&name=3DS%20(1).png)