Establishing a successful business requires more than just great ideas; companies need efficient payment solutions to ensure transactions run seamlessly. But what exactly does that entail? Find out how these effective pay-in and pay-out systems can give your venture the support it needs for guaranteed success!

What are Payins?

Pay-ins are modern payment solutions offered by payment aggregators and payment gateways. Using these solutions, merchants can accept payments from their customers via different payment methods, such as:

- Local cards

- Monthly installments

- E-wallets

- Bank transfers

- Direct debit

- Cash payments

Who can use Payins?

All businesses start small and target a specific region where they offer services and accept payments. However, when businesses expand to newer locations that need more local and global payment methods, they opt for pay-in solutions.

So, any business that wishes to expand to a new geography can opt for pay-ins. However, most commonly, eCommerce and travel merchants opt for such solutions.

What are the Benefits that Payins Offers to Businesses?

Here are the benefits of opting for a pay-in solution:

1. Lower Cart Abandonments:

Businesses need to ensure they're offering various payment methods for customers or risk losing potential profits. Customers' preferences may vary, so having an expansive list of options is critical in helping them complete their purchase and strengthen the bottom line.

However, using pay-in solutions, you can offer a host of different local and global payment methods to your customers. This will help you reduce cart abandonments and improve sales.

2. Business Expansion:

Earlier, businesses could not expand to different countries because of the inability to accept payments.

But, with pay-in solutions, you can break this location barrier. Using a reliable pay-in platform, you can accept payments from whatever country you wish to expand your business into.

2. Competitive Advantage:

If you're offering more payment methods and supporting more currencies than your competitor, it can significantly boost your growth. Not only will you retain your existing customers, but you might also get new customers who aren't happy with their vendor. And this will give you a substantial competitive advantage.

What are Payouts?

Payouts are the exact opposite of pay-in. In payouts, businesses actually pay the money to suppliers, freelancers, employees, customers (in case of refunds), sellers, or other parties that need to be paid. The gig workers or sellers that receive the payments via payouts are known as payees.

Who can use Payouts?

Marketplaces and businesses with a vast workforce of regular employees, gig workers, or freelancers can and must use payouts. Such payment solutions not only reduce your headache but also make it easy for payees to receive payments.

What are the Benefits that Payouts Offer to Businesses?

Here are the benefits payouts bring for businesses:

1. Diverse Payment Methods:

Businesses these days hire freelancers from different countries who prefer unique payment methods for accepting money.

For instance, some prefer bank transfers, wallets, or even gift cards. With payouts, you can process payments in almost any payment method the payee desires. And in the case of refunds, companies need to support the methods customers prefer to ensure a good customer experience, which can be made possible with payouts.

2. Faster Processing of Payments:

Supporting just the traditional payment methods for payouts can get the job done, but it could take a lot of time to settle the payments.

And that can be inconvenient for the payees. However, you can deal with this issue using reliable payout platforms. You can process payments much faster when you support all global and local payment methods. This will help improve your business reputation and customer loyalty.

3. Payee Onboarding Becomes Easy:

Using a modern payout solution, you can easily add all the required information about the payees and verify their identity. This will help you save time and prevent any fraud.

4. Optimization of Payments Operations:

Insurance companies can optimize their payment operations with the help of payout solutions. For instance, using payout solutions, insurance companies can reimburse claims via different payment methods such as UPI, and e-wallets, which makes the process faster and more convenient for the customer.

What is the process of Payins and Payouts Flow?

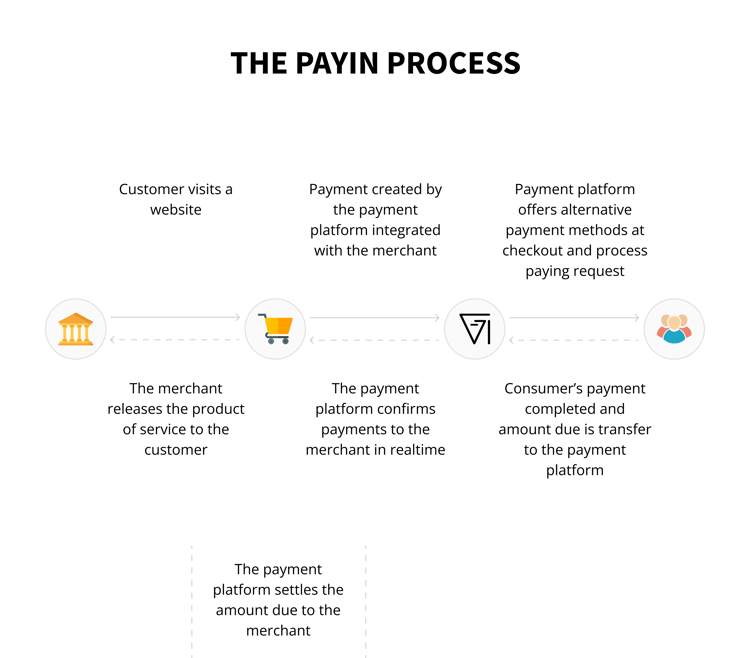

1. PAYIN FLOW

The transaction process goes from customers to merchants through a payment platform like this:

-

The customer visits the merchant's website or mobile app to purchase something.

-

A new payment is created by the merchant and integrated with the pay-in platform.

-

The pay-in platform shows the available payment methods and processes the payment request.

-

The customer makes the payment, and the amount is sent to the platform's account.

-

The platform confirms the payment with the merchant in real time.

-

The platform settles the amount with the merchant.

-

The merchant releases the product or service to the customer.

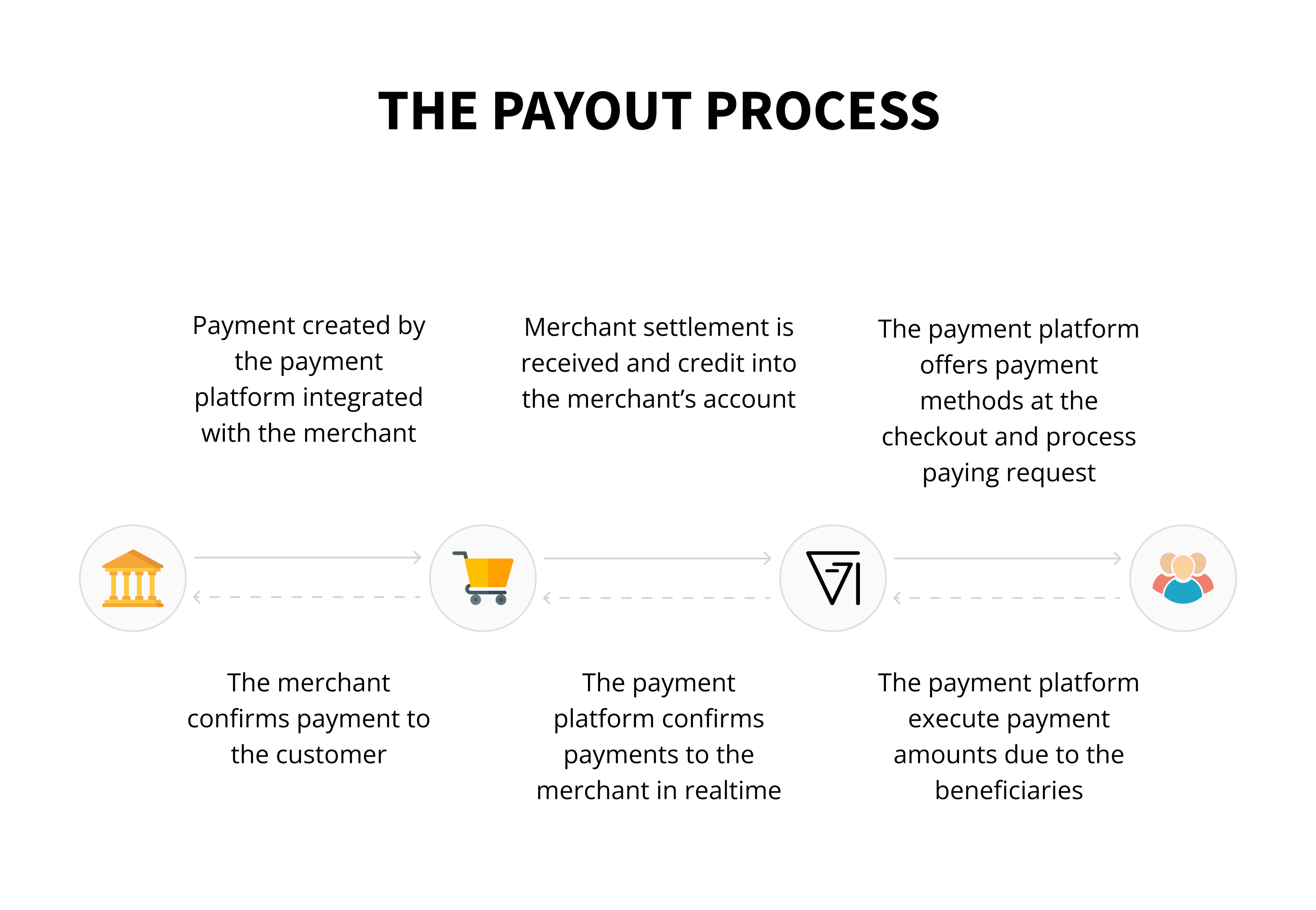

2. PAYOUT FLOW

The transaction process flows from the merchant to the ultimate beneficiary through payment platform like this:

-

Merchant integrated with the payout platform initiates/create the payment.

-

The settlement amount from the merchant is received and credited to the platform's account.

-

The platform offers different payment methods at checkout to the merchant.

-

The platform executes the amount to the respective beneficiaries.

-

The platform confirms the payment to the merchant in real time.

-

The merchant then confirms the payment to the customer/gig worker.

Good Read - Voluntary vs Involuntary Churn : Understand the difference

How can inai Help?

inai is a payment aggregation platform that can help you manage pay-ins and pay-outs on a single dashboard. We have a vast network of 30+ payment gateways and 300+ payment methods, using which you can seamlessly accept and send payments across the globe.

In addition, inai allows you to localize the checkout experience and manage products, refunds, and all transactions on a single dashboard. This way, you can substantially boost your productivity. Moreover, inai supports all business models, from Shopify to Uber.-1.png?width=4068&height=1080&name=CTA%20(3)-1.png)

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=150&name=karthik%20(1).png)

.png?width=50&name=karthik%20(1).png)