Every business, big or small, performs regular reconciliation of their financial records for accurate accounting. However, businesses must ensure their reconciliation processes are efficient to achieve the best results, minimize accounting errors, and plug any revenue leaks. And this blog is there to help.

Below, we'll discuss the top 5 signs that indicate reconciliation inefficiencies in a business. If you notice any of these signs in your business, it's probably because of inefficient reconciliation. Also, we'll list a solution you can rely on to transform how you reconcile payments completely. So, read in full.

What is Reconciliation?

Payment reconciliation is a bookkeeping process wherein you compare your internal financial records with the statements your PSP or bank provides to ensure accurate accounting.

Payment reconciliation serves multiple purposes, such as:

- Fraud Detection

- Identifying Operational inefficient

- Informed Decision Making

- Better Cashflow Management

- Error Detection

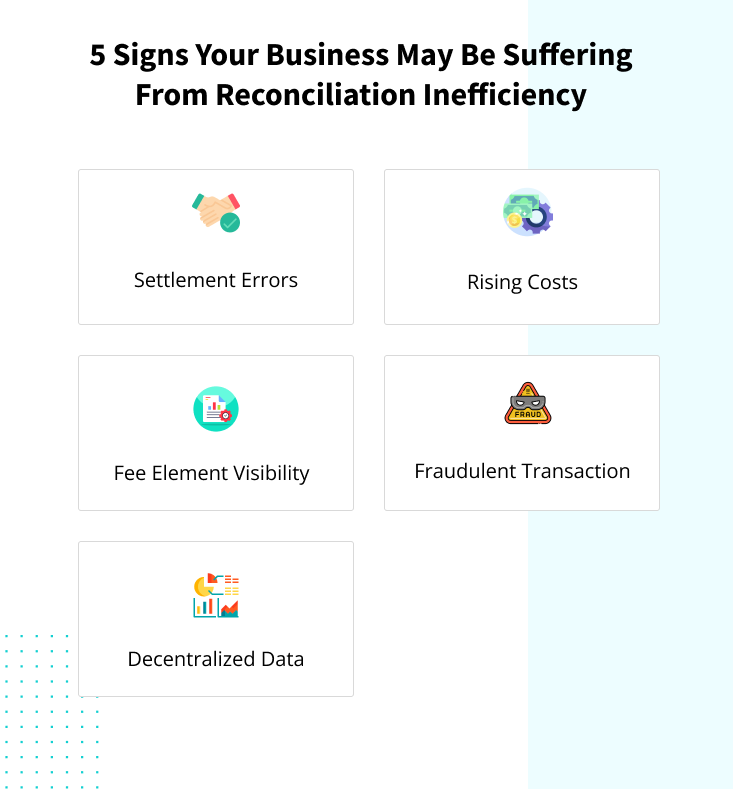

5 Signs Your Business May Be Suffering From Reconciliation Inefficiency

Here are the five signs you need to be on the lookout for:

1. Surge in Errors and Settlement Discrepancies

Reconciliation involves comparing the internal payment records with the bank statements and ensuring they match. The motive here is to minimize the errors and ensure accurate accounting.

However, if the records don't match or you experience settlement errors and other discrepancies, it can indicate an inefficient reconciliation process. And this inefficiency could be caused by multiple reasons.

For instance, you could rely on manual elements for reconciliation, such as employees who might make errors entering the data. Or maybe data from all sources is not being consolidated. So, if you notice a rise in errors, you need to take it seriously and analyze the reconciliation process.

2. Elevated Operational Costs and Resource Drain

One of the biggest challenges with reconciliation is the involvement of manual elements. While some manual intervention is required, you must never rely entirely on manual labor. Why?

Well, manual work takes time, and the probability of making mistakes is high as well. Also, reporting gets delayed, and it becomes hard to identify potential issues when you know there could be inaccuracies because of the manual elements involved. And all this can drain your resources and add to your operational costs.

So, if you notice rising operational costs and too many resources being used in reconciliation, you need to rethink the entire process.

3. Uptick in Fraudulent Transactions

Reconciliation is an essential accounting process that helps you detect fraudulent transactions. Here's how:

-

Identifying Unauthorized Transactions

During reconciliation, all transactions are checked against the company's internal records. If you cannot recognize any transaction, it could be fraudulent.

-

Duplicate Checks and Missing Deposits

You can also determine if there are any missing deposits. It would certainly mean there's something fishy. And if there are duplicate checks, you can say someone has issued fraudulent checks.

So, if you notice a rise in fraudulent transactions, it's likely your reconciliation process is inefficient.

4. Limited Visibility into the Fee Components

Complete visibility into fee components is essential for accurate reconciliation. However, because of manual data handling, lack of a centralized system, or too many PSPs involved, businesses might not get complete transparency into the fee components.

Because of poor transparency, you may have to bear revenue leaks, inaccurate reporting, and difficulty identifying discrepancies.

So, if you think there is limited visibility into the fee components, you may not be able to make the most of the reconciliation.

5. Absence of Centralized Data from Multiple PSPs

It's common for businesses to integrate multiple payment service providers. After all, doing this helps merchants globalize their business and cater to the ever-evolving needs of the customers.

However, due to a lack of a centralized system, there is often no accurate way to consolidate data from multiple sources. And when you don't have a centralized system for data, how can you expect precise reconciliation, let alone making data-driven decisions?

So, an absence of centralized data from multiple payment service providers indicates inefficient reconciliation.

How can inai Help?

inai is a one-stop solution for end-to-end payment reconciliation. Here's how inai can help:

-

Automate Reconciliation

With inai, you can completely automate reconciliation. Whether you have a single payment source or 50, inai allows you to reconcile transactions from all those sources with the click of a button.

-

Optimize Fin-Ops

As you can automate reconciliation with inai, you can reduce manual inefficiencies and get the job done in a fraction of the time. This way, you can free up to 60% of your time in finance operations and use it productively.

-

Fee Intelligence

inai is not limited to matching records. With inai, you get in-depth fee intelligence from a complete breakdown of all your fee components to actionable payment insights.

You can leverage this data to track and analyze all your payments and determine if you're paying any extra fees. Also, you can benchmark fees against the market and uncover multiple opportunities to reduce costs and maximize profits.

In a nutshell, inai can help you reduce reliance on manual elements and make your reconciliation process efficient. So, what are you waiting for? Integrate inai in your payment stack and make reconciliation a piece of cake.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)

.jpg?width=50&name=IMG_5672%20(1).jpg)