The Software as a Service market is experiencing rapid growth. But rapid growth comes hand in hand with fierce competition. Therefore, building a robust product offering along with flexibility, agility, and adaptability is necessary to thrive on the global stage.

In this guide, you'll also learn the SaaS payment trends dominating the market, how they work, and how to build and implement a winning payments strategy.

Industry trends to watch::

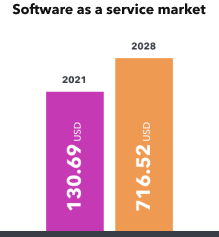

- The Software as a service market is set to grow from USD130.69 billion in 2021 to USD 716.52 billion in 2028 at a CAGR of 27.5% during the forecast period.

- Japan is leading in SaaS adoption in APAC. The country accounts for at least 40% of the region's SaaS expenditure.

- In the Asia Pacific, the SaaS market is expected to witness a CAGR of 12.1% growth during 2022-28.

- SaaS market growth is attributed to increasing demand for digital transformation across all industries.

Building your SaaS Payments strategy

Like most Software as Service companies, you'll need to start by implementing recurring payment methods or subscription payments. They work by charging customers regularly, either on a monthly or yearly basis, to use a product or service.

The main difference between recurring and subscription payments is that recurring payments always follow the same pattern, meaning customers can't choose to upgrade or downgrade their payment plan. On the other hand, businesses that offer subscriptions give multiple pricing plans that customers can switch between according to their preferences on the fly.

The pandemic has influenced companies' interactions with their consumers, paving the way for more subscription businesses to develop. Financial services firm UBS predicts that the subscription industry will nearly double in size to USD$1.5 trillion by 2025. With each company, on average, integrating over 400 different applications, it's evident that recurring payments are here to stay.

The perks of offering subscription payments:

- Easier to predict your future revenue

- Offer your customers a frictionless experience

- Improve your data insights and make better decisions

- Reduced customer churn rates and increased LTV

The objective for any SaaS business is to improve each customer's lifetime value (LTV), reduce client churn, and increase profitability. As a result, many SaaS businesses invest a lot of time and resources into reducing customer churn rates.

There are two kinds of churn to watch out for:

Voluntary churn:

When a customer cancels their subscription to your product or services of their own accord. Many SaaS businesses focus on reducing voluntary churn by improving customer satisfaction scores to prevent potential customers from churning. Unfortunately, 60 to 80 percent of churn rates are caused by customers voluntarily leaving.

Involuntary churn:

When customers unintentionally lose access to your services. The remaining 20 to 40 percent of churn happens involuntarily, which is just as essential to track and manage as voluntary churn. These consumers might greatly appreciate their service and be die-hard fans of the brand.

So, what's making them leave?

It's primarily due to issues with the customer's chosen method of payment; the following may cause declined payments:

- An expired credit card

- Lost or stolen credit cards that have been canceled

- Incorrect bank details (e.g., if a customer switches accounts)

- Payment processing errors or insufficient funds to cover transaction

These problems will disrupt a client's service and stifle recurring income. If not handled promptly and effectively, it might result in losing that customer forever.

A lapsed customer may find it too difficult to restart their membership, determine they don't want the service anymore, or take advantage of the time off to reconsider their alternatives before switching to a competitor.

Therefore, you must actively reduce involuntary subscription churn by choosing the best payment methods to offer, delighting customers, and keeping them coming back for more.

How to reduce involuntary churn:

Also Read : Voluntary churn vs Involuntary churn

1. Smart Payment Routing

After entering their payment details, the last thing your customer wants to see is a failed transaction. Smart Payment Routing sends card transactions to the payment gateways that will most likely create a successful transaction and try again using a failover or backup system.

It's also just as important to route transactions to local payment processors to optimize authorization rates. Routing to local processors can improve conversions by up to 40%.

The process

- The user initiates the payment via the checkout page and selects a payment method from the methods you choose to accept.

- The payment information is sent to the payment gateway.

- The payment details are encrypted by the payment gateway and are then sent to the acquiring bank and payment processor.

- The acquiring and issuing bank communicates to check if the payment should be authorized.

- If the payment fails, the user will usually see an error message and be asked to try again. However, with a payment orchestration layer, the payment is simply routed to the next best payment processor. The act is repeated until the payment is approved.

2. Offering alternative payment methods

With over 500 alternative payment methods on the market, it is fair to say that alternative payments are outpacing traditional methods in their popularity. According to Statista, 42% of global transactions occurred via alternative payment methods in 2021!

The pros of alternative payments are that they are not geographically limited, making international transactions easy. For example, millions of customers worldwide often use PayPal to purchase things online.

A con might be that transaction costs, and fees can end up being high, so compare prices before deciding on a payment method. The payment methods that you choose should be driven by the markets you are in and the ones you want to scale in the future:

2. 2. The most popular payment processing options for subscription-based businesses

Prepaid cards

A prepaid card works just like your everyday gift card; it's not linked to a bank account and isn't like a debit card. Generally, when a customer uses a prepaid card, they are spending money they have already loaded onto the card.

Digital wallets

A digital wallet is an online payment method or mobile application that serves as an electronic version of a physical wallet. Users can add electronic versions of their cards to their wallets to use in-store or online.

Bank transfers

People and organizations frequently utilize bank transfers to transfer money straight from their bank account to another, and they are quite common for receiving significant payments from other companies. Bank transfers are popular for European consumer-to-business transactions due to their low fraud rates and ease of use.

Direct debits

This is the most common APM for recurring payments for subscription-based services. Customers give authorization to businesses to withdraw a pre-agreed sum of money from their bank accounts for a specific time.

Should you be keeping an eye on cryptocurrency payments?

SaaS businesses often want to bill their customers in cryptocurrency on a recurring basis, but cryptocurrency systems make this difficult. Cryptocurrency is a 'push' system, meaning that customers have to initiate their payments when they're due, rather than the business being able to manage them.

Using cryptocurrency for recurring payments involves many challenges, but wallet platforms are working hard to solve them, so this is a

future trend to watch. In the meantime, staying with safe, reliable payment methods to collect subscription-based payments may be cheaper and preferable.

3. Create Frictionless experiences

The term "frictionless experience" refers to how easy it is for customers to interact with your company at all revenue-related touchpoints. It's important to note that small details can contribute significantly to the overall customer experience and reduce involuntary churn.

In the future or actively encourage others not to do business with you. You can improve your checkout experience by:

3.1 Optimizing for all devices

Creating a payment page that is easy to use on any device is crucial for achieving a frictionless payment experience. By using responsive design, you can ensure that your pages are optimized for desktop and mobile devices, making it easy for customers to fill in forms without having to scroll.

The look of your payment page is just as important as the products on it. You want to ensure that your checkout experience is consistent with the rest of your site, and an externally hosted payment page can help you do that.

3.2 Localizing for your current markets

Payment pages in the buyer's local language build their confidence in your company. Additionally, if they cannot see prices in familiar currency, it creates unease and could lead them to abandon their purchase.

It is of utmost importance that your global customers can pay with the methods they feel confident and comfortable using. Each country has unique preferences, and sometimes your purchasers do not have a choice in the matter. For example, if you only accept international credit cards as payment, then only 20% of people from Brazil would be able to purchase from you.

At first, it may seem challenging to infuse the payment experience with a local flare for each of your target markets.

3.3 Ensuring security

A common problem that hinders a smooth checkout experience is businesses' need to confirm payments and reduce fraud. For example, 3D Secure is frequently seen as a conversion killer: even though it allows solid authentication and ensures payment to the merchant, it does cause friction by adding an additional step to the payment process.

4. Implementing Dunning techniques

For SaaS companies that want to reduce involuntary churn, dunning is a basic customer service that provides automated notifications when a card fails to process.

It asks for an updated card, offers alternative payment methods, or provides additional options for temporarily downgrading or temporarily putting an account on hold by pausing the subscription.

The right dunning messages can be sent to customers through email or may even show up in the product itself. This way, custom involuntarily churn messages have a chance of actually increasing customer satisfaction and strengthening relationships if done in a personal manner.

5. Subscribe to account updaters

Having an account updater can help your business by keeping customers subscribed to your service. An account updater provides the updated card information needed so customers don't drop your product because their credit card info has changed or expired. Updaters can salvage over 90% of unusable cards and update out-of-date accounts automatically.

Visa, Mastercard, American Express, and Discover all offer subscription services for account updaters. But even these large schemes do not cover every country you may be in; however, more are being added regularly.

How to reduce involuntary churn:

With international business, you may want to avoid caution and offer as many local payment methods as possible. However, this can come at a high cost and be very time-consuming.

To decrease involuntary churn and delight new customers, you must have a high-quality local payment method integration. Each local payment method has its way of handling funds flow, which comes with various operational, legal, and regulatory complexities.

Choosing the right PSPs is crucial

However, relying on multiple third-party providers may be left scrambling if one of them experiences issues or downtime. Additionally, integrating with too many PSPs can make it hard to keep track of your overall payments.

But integrating a payment aggregator can help you to

- Offer a wide range of payment options

- Comply with all relevant regulations

- Deliver a seamless customer experience

- Easily and quickly integrate payment methods into your website

How inai helps SaaS

Payment aggregation is a technology that can help level up the end-user experience, reduce churn, and improve conversion rates.

inai is a payments aggregator that helps SaaS:

- Set up shop with over 300 local payment methods in just 60 minutes

- Improve conversion rates with smart payment routing

- Impress customers with full checkout localization and customization

- Scale your subscription business without an engineering team.

And that's just the start - by integrating with inai, you'll:

Choosing the right PSPs is crucial

The platform helps lower the risk of missed subscriber payments and clerical errors by streamlining your recurring billing process with prearranged schedules. No more manual intervention. inai handles proration, taxation, invoice consolidation, and more.

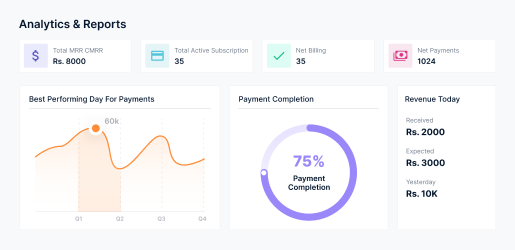

Manage revenue operations

Not having a single source of truth can be disastrous as it can collude your data if you are importing from multiple sources. In addition, many payment gateways have their own dashboards and reporting tools that may not always work well with your tech stack.

However, with inai, SaaS businesses can enjoy CXO dashboards that act as a single source of truth instead of relying on multiple payment gateways for the data.

Scale easier and faster

As your business grows, so will the pressure on your payments infrastructure. inai relieves the burden so you can easily manage a large volume of payment methods right from one centralized place. As you expand globally, you can easily add more payment methods to your repertoire

Reduce the costs of payment processing

Inai has an outcome-first approach. While other payment orchestrators sit on third-party tools for subscription management, billing, and fraud detection, inai has a built-in tool that helps reduce add-on costs incurred by those third-party integrations. Inai also helps expedite KYC/KYB processes for international payments by up to 25%.

Last but not least, with inai's smart payment routing, payment data will be sent to a designated payment gateway based on specific criteria, increasing your conversions and reducing cart abandonment. Avoiding any downtimes that may be happening across payment methods—in return, ensuring maximum conversion rates across the board for all markets.

Grow your global subscriber base

With inai, you can manage subscribers from one place with greater visibility into lifecycle metrics. With our management software, you can control trial periods, test sales techniques (i.e., upselling, cross-selling, and add-ons), and implement different pricing models that suit your business.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)