Increase your top-line revenue by up to 10% with insights recommendations

Get a 360° visibility of your payment data and identify

opportunities to increase revenue.

No Integration required!

Trusted by the best companies in the world

.png?length=95&name=cover_fill_Huel_Logo_large_5_7ed55590-35a9-4c2c-9aa2-02af266ae92b%20(1).png)

OUR PERKS

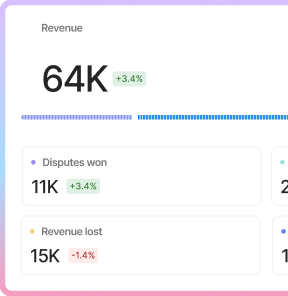

Get real-time visibility on all your payment metrics

Uncover insights from your own data

Segment your key metrics by the processor, country, business unit, or BIN.

Leverage BIN enrichment to uncover insights by issuer/card brands.

Identify the best-performing processors and route transactions by card brand, country, methods, etc.

Reduce involuntary churn on your subscriptions

Optimize your retry strategy with advanced insights and segment data by issuers, card brands, error codes and retry timings to recover more revenue. Know more →

Unlock more revenue with ML

Get actionable recommendations from inai to identify opportunities to recover more revenue

Our proprietary ML models track over 100+ data dimensions and their impact on your revenue.

Engage with our LLM-powered conversational bot to 'chat' with your payment data and uncover non-obvious revenue leaks.

Go Live in minutes. No Integration required

Fast turnaround for new payment processor support.

Support for all the major payment processors

Connect to your payment processor without the need to write code or wait for your engineers.

Stay on top of any payment anomalies. No integration required.

- Send an alert to payments team if auth rate deteriorates

- Send an alert to customer success team for velocity withdrawal

Why inai?

Enhance auth rate using inai’s proprietary ML model to minimize failed transactions. inai’s model operates on a range of tools that isn't limited to:

Optimize checkout conversion

- Improve your conversion rates by optimising 3DS

- Reduce abandoned carts with intelligent error messaging

Recover more revenue with smart retries

- Reduce accidental churn with inai’s smart retries.

- Our customers have seen an uptick in conversions by 5-15%.

Route Payments Based on Insights

Leverage data to identify the best-performing processor and route by card brand, country, card, etc.Approval rate optimization

- Uncover opportunities to reduce payment declines

- Understand the drivers of payment failures and how to fix them

PrICING

A pricing plan that scales

with you

Enterprise

Custom

-

Custom number of sources

-

Unlimited number of seats

-

Unlimited transactions per month

-

Custom alerts

-

Custom data storage

Growth

Talk to sales

-

2 sources supported

-

5 seats

-

Upto 100,000 transactions per month

-

Upto 10,000 Alerts

-

Data storage for 6 months

-

Optional Add-ons

-

Additional source from $35/month

-

Per 100 trans/month from $0.4

-

Per Alerts/month from $0.05

-

Extra month of storage from $25/month

-

Chatbot based querying $100/month

Starter

$99 /month

-

1 source supported

-

1 seat

-

Upto 10,000 transactions per month

-

Upto 1000 Alerts

-

Data storage for 1 month

-

Optional Add-ons

-

Additional source from $35/month

-

Per 100 trans/month from $0.4

-

Per Alerts/month from $0.05

-

Extra month of storage from $25/month

-

Chatbot based querying $100/month

Security and Compliance You Can Trust

No PII needed

Only what's necessary for PSP compliance, ensuring top-tier privacy.

Enterprise-Grade Security

Stay protected with end-to-end encryption and globally recognized compliance standards.

SOC2 Type2

ISO 27001

PCI-DSS

.png)

GDPR

Ready to Recover Lost Revenue?

Don’t Let Failed Payments Cost You Any More Revenue. Get in touch with our team to start maximizing your revenue with Revive.

Find out how much extra revenue you could gain by recovering failed payments. Contact us for a free assessment and see the potential impact.

Frequently Asked Questions

How secure is our payment data with Observe?

Observe adheres to SOC-II Level II, PCI Level 1, ISO 27001, and GDPR standards, with no PII data required.

How does Observe integrate with our systems?

Observe offers no-code integration, compatible with processors like Stripe and PayPal, requiring minimal setup.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)