Complete Guide On How To Accept Payments Online

Knowing how to accept payments online has become critical as e-commerce has grown in importance. In this guide, we’ll cover what you need to know to accept e-commerce payments. First, to lay a foundation for understanding what goes into online payments, we’ll take a look at the overall payment ecosystem and the components which go into it.

Table of content

- How to Accept Payments Online?

- The Payment Ecosystem: Understanding the Foundation of Online Payment Transactions

- What is a Payment Gateway?

- Payment APIs

- Payment Processor Integrations

- Online Payment Management Systems: How to Manage Payments Online

- Automated Accounting

- Global Payment Integration

- Get Set up to Accept Payments Online and Increase Your Revenue

How to Accept Payments Online?

We’ll go into detail on some of the key software components which interact with the payment ecosystem, including payment gateways, payment APIs, payment processors, online payment management systems, and automated accounting systems.

Finally, we’ll show you how to use a global payment integration platform to assemble all the components of your online payment solution into a single system ready to let you accept payments from anywhere in the world.

The Payment Ecosystem: Understanding the Foundation of Online Payment Transactions

Online payments occur within a payment ecosystem that includes all the parties and processes involved in digital transactions. Understanding this payment ecosystem will make it easier to understand the online payment process and the various software components necessary to make it function.

We’ll start by defining the payment ecosystem, looking at some examples, and explaining how it works.

What is a Payment Ecosystem?

The online payment ecosystem consists of all the parties involved in digital transactions and the processes which link them together in order to make transactions happen. Parties involved encompassing a whole range of participants connecting customers to merchants. These include:

- Cardholders

- Merchants

- Issuing banks: financial institutions which provide credit cards, debit cards, and other payment methods to consumer and business cardholders

- Acquiring banks: financial institutions which provide merchant accounts to merchants in order to accept credit card payments

- Credit card networks (also called credit card associations): organizations owned by financial institutions which license and govern credit card transactions between issuing and acquiring banks

- Independent sales organizations (ISOs): third-party providers who partner with financial institutions in order to sell credit card processing services to merchants

- Payment gateways: merchant services delivered by financial institutions or e-commerce app providers which enable merchants to accept digital credit card payments

- Payment processors: services that relay data between payment gateways, acquiring banks, credit card networks, and issuing banks to verify sufficient funds, screen for fraudulent transactions, and authorize or decline transactions

These are some of the key participants in the payment ecosystem. Other participants also may enter into the picture in a supporting role. For example, software providers may provide merchants with apps that help facilitate payment gateways by connecting them with other apps such as bill payment software or accounting software.

Security providers may work with merchants, credit card networks, and other parties to help protect transaction data and prevent fraud.

What Are Some Examples of Payment Ecosystems?

To flesh out our definition of a payment ecosystem, let’s identify some examples illustrating some of the different participants named above. Major issuing banks and financial institutions include:

- Citi

- Chase

- Bank of America

- Synchrony Financial

- Wells Fargo

- Barclays

- U.S. Bank

- USAA

- Credit One Bank

- PNC Bank

Top acquiring banks include:

- Chase Merchant Services

- Fiserv

- FIS

- Global Payments

- Wells Fargo

- Bank of America

- Elavon

- Paysafe Group

- North American Bancard

- Priority Technology Holdings

Major credit card networks are led by:

- Visa

- Mastercard

- American Express

- Discover

Popular payment gateways include:

- PayPal

- Stripe

- Amazon Pay

- Authorize.Net

- WePay

- Square

- FirstData

- 2Checkout

- Merchant e-Solutions

- SecurePay

- Ayden

- Bitpay

- Braintree

- PayU

- Verifone

These are just some of the thousands of companies that help populate the global payment ecosystem. There are many more, especially when you expand the scope to include providers outside the United States and the English-speaking world. Today’s payment ecosystem is global, multi-lingual, and multi-currency.

How Does a Payment Ecosystem Work?

To illustrate a payment ecosystem in action, consider a consumer making an online purchase with a Mastercard credit card. The Mastercard was issued by Citi, which is the issuing bank. The merchant has an account with Chase, who is the acquiring bank.

The merchant’s website offers the option of using PayPal as a payment gateway, and the buyer has their PayPal digital wallet account linked to their Mastercard, so they elect to pay through PayPal.

When the buyer authorizes the transaction through PayPal, PayPal sends the transaction information to the payment processor used by the acquiring bank, in this case, Chase. Chase’s payment processor forwards the information to the buyer’s credit card network, in this case, Mastercard.

Mastercard then forwards the information to the payment processor used by the issuing bank, in this case, Citi. When Citi’s processor authorizes or declines the transaction, the result gets relayed back to PayPal. PayPal finally relays the response back to the merchant and buyer.

Reading about this process takes longer than it actually takes to conduct the transaction. The entire process typically completes in two or three seconds, assuming there are no disruptions such as slow connections.

The exact steps in the process can vary based on factors such as how the merchant’s website is set up and which credit card network is being used. For example, some merchants may have customers enter credit card data directly on their own website, while others may hand this step off to a third-party provider with stronger security safeguards.

When an American Express or Discover card is used, the credit card network doubles as the issuing bank, speeding up communication with the payment gateway during the approval relay cycle.

Payment Gateways

Now that we’ve covered the basics of the payment ecosystem, let’s take a closer look at one of its most important components: payment gateways. First, we’ll develop a fuller definition of what payment gateways are.

Then we’ll explore the different types of payment gateways. In this context, we’ll look at some of the best payment gateway companies and what they offer merchants.

What is a Payment Gateway?

As mentioned earlier, payment gateways are merchant services delivered by financial institutions or e-commerce app providers which enable merchants to accept digital credit card payments. They serve several functions:

- Transmitting credit card transaction data from merchants to acquiring bank payment processors for further processing by credit card networks and issuing banks’ payment processors to determine whether the transaction will be approved or declined

- Relaying approval or decline results back to merchants so that transactions can proceed to the next step

- Encrypting transmitted data for security

Payment gateways may be provided to merchants directly by the same financial institutions which provide their merchant accounts. More often, they are provided by third-party e-commerce providers known as payment service providers (PSPs) who partner with financial institutions and credit card networks to facilitate merchant transactions.

Some payment gateway providers offer white label services which allow financial institutions, PSPs, or other parties to use or resell the provider’s technology under their own brand name.

Payment gateway services may be used for both digital and brick-and-mortar transactions. In a digital context, payment gateways may be connected with websites or mobile apps. They also may be used over the phone using interactive voice response (IVR) technology. For brick-and-mortar transactions, payment gateways may be connected with point-of-sale equipment such as credit card readers or contactless pay terminals, enabling in-store customers to make purchases through means such as credit cards or mobile wallets.

Payment gateways that work with merchant websites may receive data either from the merchant’s server or directly from the customer’s web browser without going through the merchant’s server. The latter method places a less technological burden on the merchant to maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS), a security standard required by major credit card providers.

What Are the Different Types of Payment Gateways?

Payment gateways used with websites fall into three major categories:

- On-site payment gateways

- On-site checkout, offsite payment

- Offsite redirect

With an on-site payment gateway, the transaction is conducted on the merchant’s server. This gives the merchant complete control over the way the transaction is conducted, allowing for full customization. However, this also gives the merchant full responsibility for any technical glitches or security bugs. This option requires more web development and incurs greater expense, so it’s most often used by larger companies.

When checkout is handled on-site but payment is handled offsite, the front end of the checkout process which is visible to the customer occurs on the merchant’s site, but the collection and processing of sensitive data are handled on the site of the payment gateway provider.

This shifts the technological and security burden for processing and protecting data away from the merchant to the payment gateway provider. In the process, it reduces the control the merchant has over the checkout experience, but without relinquishing it entirely.

When an offsite redirect is used, the customer who is about to check out gets sent to an external website to perform the actual checkout process. Usually, a message alerts the customer that they are being redirected offsite. The checkout and payment transaction then occurs on the server of the payment gateway provider.

After the transaction has been completed, the payment gateway may return the customer to the merchant’s website automatically or may give the customer the option of returning to the merchant’s site. Alternately, the transaction process may be designed to simply terminate once the gateway has completed the payment. For example, if there is only one product for sale and nothing else for the customer to buy, the merchant may elect not to have the customer return to the site.

What Are Some of the Best Payment Gateway Companies?

Leaders in the payment gateway market as measured by market share include:

- PayPal

- Stripe

- Shopify Pay Installments

- Amazon Payments

- Braintree

- Square

Let’s look at what distinguishes each of these brands and how they illustrate the different types of options for payment gateway solutions.

1. PayPal

Founded in 1998 under its previous name Confinity, PayPal is the oldest payment gateway service, and remains a leader in the industry, with approximately half of the market share. The company rose to prominence in partnership with the online auction site eBay, serving to help eBay customers make purchases. Since 2014, PayPal has operated as a separate entity, although it continues to serve as a payment option for eBay customers.

PayPal offers businesses a variety of ways to receive payments from customers, including:

- Paying from a PayPal balance

- Using a PayPal credit card

- Linking to another credit card, including American Express, Discover, Mastercard, Visa, and UnionPay

- Linking to a debit card

- Linking to a bank account directly or indirectly through a third-party service, a payment method known as a bank redirect

- Payment vouchers, where customers prepay for a digital code which can then be used online as cash

- Linking to digital wallets such as Apple Pay, Google Pay and Samsung Pay

Merchant fees for PayPal transactions vary with payment type. Most payment methods charge a percentage with a fixed fee added.

2. Stripe

One of PayPal’s biggest competitors, Stripe occupies a somewhat different niche by providing software that enables merchants to integrate online payments into ecommerce sites and mobile apps. Stripe offers a variety of ways merchants can receive both online and in-person payments, including:

- Out-of-the-box online checkout options which can be set up without advanced coding knowledge

- Web developer tools for merchants who want to develop more advanced or customized checkout options

- Point-of-sale terminals for accepting in-person payments

- Automated invoicing and payment links for contractors

In addition to allowing merchants to accept payments, Stripe offers other supporting services. These include sales tax collection features, banking, and credit card services, and security tools.

Stripe charges a standard rate of a percentage plus a fee per successful transaction. Volume customers can negotiate custom pricing.

3. Shopify Pay Installments

Shopify provides a variety of e-commerce services for retailers to accept payments online and in-store. One of their most popular payment services is Shopify Pay Installments. This allows merchants to give customers the option of paying in multiple installments in a digital version of retail layaway programs.

Customers can split their payments into four installments with no interest or fees. This type of tool can increase conversion rates by giving customers more flexibility with their payment options.

Shopify offers additional payment services along with their Pay Installments feature. Shopify does not charge a transaction fee if you use their own Shopify Payments product. If you use an external payment gateway, there is an additional percentage per transaction fee which varies with the type of plan you have.

4. Amazon Pay

Amazon Pay is an online payments processing service provided by ecommerce giant Amazon. Merchants can place an Amazon Pay button on their websites to allow consumers to make purchases using payment methods stored in their Amazon accounts. One distinctive feature of Amazon Pay is that it enables transactions made through Alexa, Amazon’s voice assistant. Amazon Pay’s features can be useful for streamlining sales from customers who are already Amazon customers, which includes a large percentage of consumers.

To help merchants integrate Amazon Pay with their sites, Amazon partners with other major ecommerce providers. Amazon ecommerce partners include Shopify, BigCommerce, Magento, and Zuora. Merchants who use Amazon Pay incur a fee per transaction, which includes a processing fee and an authorization fee.

5. Braintree

Braintree, previously owned by eBay, is now owned by PayPal. They provide a technology platform that helps merchants accept online and mobile payments. Their platform combines the features of merchant accounts and payment gateways into a single interface.

Braintree’s platform allows U.S. merchants to accept most major credit and debit cards, including:

- Mastercard

- Visa

- American Express

- Discover

- Diner’s Club

- JCB

- UnionPay

Their platform also supports payment from major digital wallet providers, including:

- PayPal

- Apple Pay

- Google Pay

- Venmo

Braintree charges a percentage and a fee per transaction for most types of payments. PayPal and PayPal Credit transactions are subject to PayPal terms, while ACH debit transactions incur a percentage fee per transaction.

6. Square

Square provides digital payments services along with other financial services. Their company’s name comes from the square-shaped credit card readers they provide companies. This is one of a variety of hardware devices Square provides to let businesses accept credit card payments at the point of sale or over the phone by entering data. They also provide options to receive payments online, from mobile devices, or by manually entering data.

Square provides one card reader free and charges a fee for additional readers. Software apps are free to use. Transactions incur a percentage plus a fee per transaction for every tapped, dipped, or swiped payment.

Payment APIs

Payment gateways don’t stand alone, but they function as part of the payment ecosystem. They need to interact with credit card networks, issuing and acquiring banks, payment processors, and other participants in the ecosystem. This means interacting with multiple software applications. Handling this function is what APIs are for.

What is a Payment Gateway API?

API stands for “application programming interface.” This is a type of software program which connects with other software programs or computers in order to exchange data or trigger workflows between apps.

For example, when a customer enters their email in a form on a website in order to sign up for an email subscriber list, an API might pass the information they enter in the form on to a customer relationship management app.

In a payment gateway context, an API connects a payment gateway with other apps linked to other components of the payment ecosystem. This can involve functions such as:

- Receiving payment data from websites and apps

- Redirecting checkouts from websites and apps

- Passing data on to payment processors to have transactions approved or declined

- Passing data from payment processors back to websites and apps

- Passing data from completed transactions onto accounting apps or inventory apps to update data

- Passing data from completed transactions on to logistics suppliers to process orders

- Initiating payments to employees or vendors

To perform these functions, an API uses a software code that is usually fairly short compared to standard software programs. APIs may be broken down into even smaller components that can be called upon by developers and programs as needed.

APIs also can be combined into groups of APIs called mashups. Combining APIs in this way allows complex workflows to be executed automatically with single commands or small groups of commands.

Top Payment APIs

Most leading payment gateways provide one or more APIs to help programmers, so the top payment APIs for developers tend to coincide with the top payment gateways. APIs can be distinguished by variables such as which and which payment gateways they connect with, which types of development protocols they use, and which credit card networks and payment methods they support. Let’s look at what some of the individual top payment APIs to manage payments have to offer developers.

1. PayPal APIs

PayPal offers three API options to help developers with new and legacy integration:

- A Representational state transfer (REST) API for developers who need to work with the REST standard when accessing sandboxes

- A Name-value Pair (NVP) and standard communication protocol (SOAP) API for developers who need to work with this alternative protocol

- A Braintree GraphQL API for developers who use this increasingly popular option

In addition to these APIs, PayPal offers several software developer kits:

- JavaScript SDK for displaying PayPal-supported payment methods on websites

- In-app SDK for mobile apps

- Donate SDK for managing PayPal Donate buttons

- Braintree SDK for working with PayPal’s Braintree service

This range of options and tools helps make PayPal’s API one of the most practical payment gateway APIs for developers.

2. Stripe APIs

Stripe’s APIs have been simplified into a few major tools:

- A PaymentMethods API which can be set up to accept the range of payments Stripe supports

- A PaymentIntent API that handles individual transaction information, such as how much to charge

- A SetupIntent API for storing and managing customer payment details for future use

These APIs can be combined together to manage payments.

3. Shopify APIs

Shopify’s API environment includes a variety of API tools:

- An Admin API available through GraphQL and REST which provides data on customers, orders, inventory, fulfillment, and other items

- A Payment Apps API for managing merchant account data such as payments and refunds, available at a single GraphQL endpoint

- A Storefront API for building custom shopping experiences

- A Partner API for scaling your operations

- A Messaging API for managing Shopify’s inbox app

Shopify offers additional API solutions for Shopify Plus retailers and for developers who want to build branded themes for online stores.

4. Amazon Pay API

The Amazon Pay API is designed to allow merchants to:

- Create and manage billing agreements to secure buyer’s permission for recurring payments

- Create and manage order information, such as shipping information

- Manage transaction authorizations and refunds

Amazon Pay transactions take place within embedded widgets so that the buyer never leaves the site.

5. Braintree API

The Braintree API uses the GraphQL protocol. It provides a single integration for managing checkout user interface, payment method types, and customer data. Braintree’s API environment can also be used to manage security, streamline operations and share data with other platforms.

6. Square API

The Square API follows the REST protocol. It can be used for a variety of functions, including:

- Taking online payments and issuing refunds

- Managing terminal checkouts and refunds

- Processing and fulfilling orders

- Creating and managing recurring subscription payments

- Creating and managing invoices

- Cataloging items

- Managing inventory

- Managing customer data

- Creating customer loyalty accounts

- Issuing gift cards

- Creating and managing bookings for Square sellers

- Managing business location and merchant details

- Handing employee team information

- Viewing and managing bank deposit and account data

- Managing snippets for Square online selling

- Controlling access to Square seller accounts

Square includes SDKs to support its API tools.

Payment Processor Integrations

One important role of APIs is integrating payment gateways with payment processors. APIs let payment processors relay data between payment gateways, acquiring banks, credit card networks, and issuing banks. Let’s look at how APIs integrate payment processors into the payment ecosystem.

What is a Payment Integrator?

To understand payment integrators, we need to look at what payment processors are and what they do. A payment processor is a technology provider who is authorized by an acquiring or issuing bank to automate the handling of transactions.

Because payment processors work with both issuing and acquiring banks, there are actually two types of payment processors: acquiring and issuing payment processors.

Acquiring payment processors work with acquiring banks and credit card networks to handle the acquiring half of financial transactions. Issuing payment processors work with issuing banks and credit card networks. Together they perform tasks such as:

- Issuing cards

- Receiving transaction data from payment gateways

- Passing information on to credit card networks

- Receiving transaction information from credit card networks

- Verifying sufficient funds

- Approving or declining authorization of card transactions

- Transmitting decisions to approve or decline transactions back to payment gateways

- Transmitting messages between financial institutions to facilitate the payment process

- Updating accounts to reflect transactions

- Arranging for money transfers

- Transferring money

- Preserving a record of transactions

Performing all these functions requires communication between various apps used by merchants, credit card networks, acquiring banks, and issuing banks.

How Do You Integrate App Payments?

Integrating your payment processor with your payment system essentially involves configuring your API to connect your payment gateway with your acquiring bank. Your acquiring bank will then handle communication with your credit card network, which will handle relaying information to the issuing bank and back.

Online Payment Management Systems: How to Manage Payments Online

Online payment technology works for sending payments as well as receiving them. Online payment management systems help automate the process of sending digital payments similar to the way payment gateways to automate the process of receiving them. Let’s look at what online payment management systems are and who some of the leading providers are.

What is an Online Payment Management System (Payable Automation System)?

An online payment management system or payable automation system is a software app that automates the process of paying employees, vendors, or suppliers. It automates tasks related to accounts receivable management, such as:

- Receiving invoice scans and data

- Matching invoices with purchase orders and receiving reports

- Managing batch payments to employees, vendors, and suppliers

- Managing individual payments

- Checking for fraud against “do not pay lists” and tax identification systems

- Authorizing payments

- Scheduling payments

- Scheduling recurring payments

- Providing real-time reconciliation updates of payments with accounting software

- Generating reports for cash-flow requirements and disbursements

- Providing analytics insights into accounts receivable and cash-flow data

To achieve these tasks, online payment management systems use digital data uploaded or synced by companies, employees, vendors, and suppliers. For example, the online payment management system might have a user interface that allows vendors to enter information such as contact information, W-9 form data, tax information, preferred payment methods, and preferred currency.

Online payment management systems have payment options similar to those offered by payment gateways, as well as other options commonly used for paying business expenses. These may include credit cards, debit cards, ACH transfers, wire transfers, PayPal, checks, and other payment methods.

Online payment management systems typically use APIs to link to other relevant apps. These may include accounting apps, receipt-scanning apps, invoicing apps, and enterprise resource planning software.

What Are the Best Online Payment Management Systems?

Limited online payment management features are included in many payment gateways and accounting apps. There are also apps with full online payment management functionality, either as standalone tools or as part of enterprise resource management suites. Leading providers in the accounts payable automation space include:

- Bill.com

- Sage Intacct

- Stampli

- Airbase

- DocuWare

- AvidXchange

- Tipalti

- Corpay Payment Automation

- Beanworks AP Automation

- SAP Concur

Solutions range from freeware to premium enterprise options.

Automated Accounting

Online payment management systems often include automated accounting features. Payment gateways also can be integrated with automated accounting tools. This can save you labor and time updating your accounting books after sending or receiving payments. Let’s take a brief look at what automated accounting is so you can see how it fits with software for sending and receiving online payments.

What is Automated Accounting?

Automated accounting uses data syncing and automatically triggered actions to streamline routine accounting tasks. For example, when a credit card transaction for a customer order gets approved, an automated accounting app can update your accounting app to reflect the change in your accounts receivable. Or when a vendor invoice comes in, your app can update your accounts payable.

Automated accounting also digitizes your financial data so that you can make full use of software apps by syncing data between apps. This enables you to do things such as manage your accounting books from your smartphone, share data between your accounting apps and other apps such as inventory apps, or export data to a tax preparation app.

Digitizing your accounting data also lets you use data analytics tools to gain business intelligence insights into your data. For example, you can compare trends in your revenue and expenses with your projected cash flow to see if you will need additional financing to sustain your operations.

Automated accounting represents a technological step forward from manual accounting using formats such as Excel spreadsheets. Automating routine accounting procedures instead of manually entering and tabulating data in Excel saves time and work and reduces the risk of error in data entry or calculations.

What Accounting Tasks Can Be Automated?

Any accounting task which involves routine repetition of the same steps can be automated. This includes:

- Entering data

- Exporting data

- Updating accounts payable and receivable

- Updating inventory counts

- Performing accounting calculations

- Analyzing accounting data

- Generating financial reports

- Creating invoices

Some of these tasks can be automated using native accounting software features. Others involve syncing your accounting app with your payment gateway and other apps.

Global Payment Integration

A final and essential component of accepting payments online that needs to be covered is global payment integration. In today’s international economy, your customers may come from anywhere in the world. Furthermore, within regions, different segments of your target market may have different payment preferences.

For instance, some customers may prefer to use PayPal, while others may wish to use a Visa card, and others still prefer Mastercard. Being able to provide the payment options your customers want can be the difference between closing a sale and losing a customer.

This is where global payment integration comes in. Let’s take a look at what global payment integration is and what to look for in a global payment integration platform.

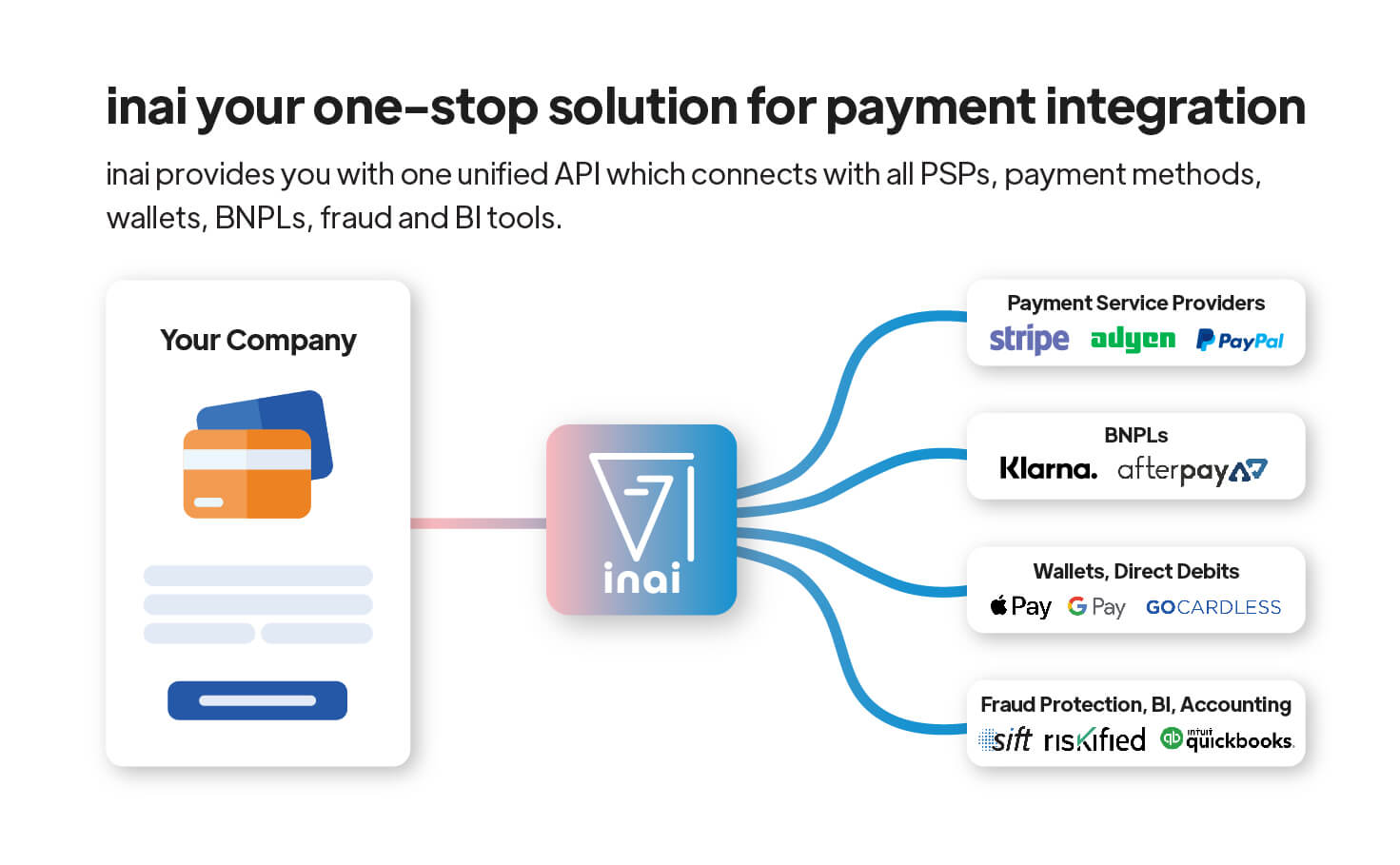

What is Global Payment Integration?

A global payment integration platform is a software app that allows you to expand your ecommerce site to accept more payment options from more countries and regions than you could normally do with a standard payment gateway setup. An integration platform can do this by acting as an API that connects your website to multiple payment gateways, each capable of supporting multiple payment options.

This lets more of your customers use the payment option of their choice, increasing your sales conversion rate and multiplying your sales revenue.

What Should You Look for in a Global Payment Integration Platform?

Global payment integration platform functionality can range from basic options to feature-rich, advanced customization. Here we’ll use the inai platform, which is a best-in-class solution, to illustrate the full range of options a top global payment integration platform can provide.

1. Payment Methods

The most essential function of a global integration platform is supporting the payment methods your customer base prefers. For example, in the United States, the inai platform’s universal checkout setup supports payments using:

- Apple Pay

- Google Pay

- Alipay

- Microsoft Wallet

- ACH

- Samsung Pay

- Venmo

- Visa

- Mastercard

- Discover

- JCB

- American Express

Other payment options are available for other countries. Altogether, the platform supports over 300 payment methods from around the globe.

2. Checkout Experience for Developers and Users

Supporting your customers’ payment preferences depends on a developer interface and user interface which allow you to deliver the payment options your platform is capable of handling.

To facilitate this, the inai development environment uses prebuilt UI elements which can be combined by developers to build a range of options to fit the needs of your website visitors, including using:

- Hosted payment pages

- Drop-in widgets

- Payment links

- Invoicing

- APIs

- Developers can work with native iOS or Android apps and use cross-platform SDKs.

- Workflows

Beyond supporting the checkout experience on the customer side, global integration platforms can make internal workflows that support checkouts from the back end more efficient. The inai platform’s workflow management features include:

- Optimized routing of workflows for maximum efficiency in managing payment issues and delivering a satisfying checkout experience

- Custom fraud flows to give you more control over your security procedures

- Failover logic to provide backup redundancy in the event of a disruption

These types of workflow feature significantly enhance the functionality of your global payment integration, helping you deliver more consistent quality checkout experiences.

4. Subscription Management

Recurring payments are an important part of online payment acceptance, so a suitable global payment integration platform should support the subscription management features you need. The inai platform includes a number of vital subscription management tools, enabling you to take control of items such as:

- Pricing strategy controls to increase your sales through flexible pricing models, upsells, downsells, trial subscriptions, coupon codes, tax rates, and other options

- Billing automation tools for handling declined payments (dunning) and partial payments (proration) to give you more flexibility in managing these exceptional situations

- Revenue operations management for handling integration with solution stacks with affect sales, such as CRM, sales and marketing analytics tools

- A unified dashboard that lets you manage subscriptions and other essentials from one place

These features illustrate some of the functionality of best-in-class global payment integration solutions. A high-end solution such as inai includes many features which go above and beyond basic payment integration to deliver an optimized global payment solution.

Get Set up to Accept Payments Online and Increase Your Revenue

Accepting payments online depends on using the right technology to connect you to the digital payment ecosystem. The payment ecosystem includes all the participants who enter into online transactions, including buyers, merchants, issuing and acquiring banks, credit card networks, payment gateways, and payment processors. Payment gateways let you pass transaction data from your website and apps onto payment processors and credit card networks to approve or decline transactions.

APIs facilitate this by letting you connect payment gateways and other apps together within the payment ecosystem. Online payment management systems expand the payment ecosystem by allowing you to send as well as receive payments, enabling you to automate tasks such as paying vendors. Linking this to automated accounting solutions lets you save time updating your books to reflect online payment transactions.

A global payment integration platform lets you bring all the components of your online payment system together into a single solution that lets you accept payments from customers anywhere in the world using their preferred payment methods.

The inai global payment integration platform is designed to make it easy for you to quickly start accepting any payment method your customers need.

Let’s get started

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)