Advances in technology can be a double edge sword. As technology has progressed in global commerce, fraudsters are using it to their advantage to create new and evolving tactics to con people and organizations out of their hard-earned cash.

In this ebook, you'll learn the common types of fraud in APAC, how to protect your customers against them, and the payment technology you should implement into your business.

Trends Shaping the Fraud Landscape 2023

Despite companies and regulators implementing tighter controls to protect customers, such as widely adopting 3DS 2.0 and SCA, cybercriminals are becoming increasingly sophisticated. Fraud is evolving exponentially in Asia Pacific (APAC)

- A study by Juniper Research found that global e-commerce fraud loss is estimated to reach over USD41 billion by 2023.

- North America will experience the most significant fraudulent transactions by value and will account for over 42% of global eCommerce frauds in 2023.

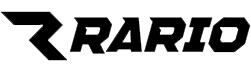

- During the Covid-19 pandemic, large retailers faced 70% more fraudulent attempts than before.

- An Experian study found that a quarter of consumers across the Asia Pacific (APAC) have been victims of online fraud.

- 80% of APAC consumers expect businesses to protect them against online fraud.

The Rising Cost of Fraud in APAC

While online fraud is a problem on a global scale, the APAC market is experiencing it on unprecedented levels, with one in four consumers falling victim to fraud. In addition, consumers and businesses face substantial financial losses through banking and payment scams when shopping online.

Experience recent Global Identity & Fraud Report found that Chinese and Indian consumers are particularly vulnerable to online fraud, with 29% of consumers in each market falling victim to scams.

An even more startling figure arose from Indonesia, where more than half (51%) of respondents have experienced payment fraud incidents on social media platforms. Whereas only 26% of surveyed Singaporean consumers feel that businesses meet their fraud protection expectations, 59% do not feel insecure when shopping with merchants.

The report also found that nearly half of all business respondents report fraud as a significant concern in 2022.

Fraud Types To Watch Out For

Buy Now Pay Later Fraud

Buy Now Pay Later (BNPL) is the hottest topic in payments. By 2025, BNPL will account for USD 680 billion worth of global e-commerce transactions. BNPL allows customers to pay for goods and services online later or to spread the cost via monthly installments.

BNPL providers are fully liable if a customer does not pay and for fraud disputes, which gives them the incentive to keep card not present fraud rates low. Unfortunately, businesses have little visibility over BNPL fraud and often do not screen BNPL transactions to keep costs down.

However, BNPL fraud is only set to rise. TikTok's of fraudsters offering triangulation fraud discounts or hacking tutorials are everywhere. Young people see fraud as a fun and easy way to earn money, not a criminal offense.

Types of BNPL Fraud Surfacing

Synthetic Identity Theft

The fraudster establishes an identity based on sets of data they can get quickly on the surface web. They then place orders without any intention of paying the BNPL provider back.

Account Takeover

The fraudster gains access to an already existing BNPL account and places orders.

Triangulation Fraud

BNPL triangulation involves fraudsters offering discounted prices for products online. Customers pay an agreed amount, and the fraudster places an order using BNPL. After that, the fraudster will open a dispute with the provider. Because providers and merchants have separate systems, fraudsters can quickly receive the total funds without being discovered.

BNPL triangulation involves fraudsters offering discounted prices for products online. Customers pay an agreed amount, and the fraudster places an order using BNPL. After that, the fraudster will open a dispute with the provider. Because providers and merchants have separate systems, fraudsters can quickly receive the total funds without being discovered.

Refund Abuse and Friendly Fraud

Involve customers requesting money back from the provider, often keeping your products for free. Merchants have liability for non-fraud disputes.

Friendly Fraud

As digital payments increase across the APAC, so are incidences of 'friendly fraud'. Friendly fraud happens when a customer makes a legitimate purchase only to dispute it later.

Such incidents are mainly due to miscommunication - a report by Ethoca and Aite Group report found that 77% of surveyed consumers said they have difficulty recognizing their transactions in their bank statements.

The financial impact on businesses is clear. Friendly fraud has been estimated to have cost merchants up to USD 50 billion in 2020 By 2022, while global chargebacks in 2022 are expected to reach volumes 47% higher than 2019 pre-pandemic levels.

However, there is light at the end of the tunnel. The same study estimates that 25% of friendly fraud can be avoided by merchants giving customers more details about their transactions, such as statements that provide easy access to merchant names and locations, delivery dates, and itemized receipts.

Card Testing

When cybercriminals get their hands on a stolen credit card number, they usually do the following: First, they check to see if it's still active by making a small transaction. If the transaction goes through, the cybercriminal will know they can make another large purchase using the same card.

There Are Three Reasons Why Card Testing Is a Problem::

- This purchase is less likely to be observed by the merchant or card owner and is less likely to be caught by the bank.

- Frictionless payments create fewer hurdles for cybercriminals.

- The more extended card testing goes unnoticed, the higher the consequences.

Nobody will be happy to notice their cash going missing. They will report the false purchase to their bank, which leads to disputes that cost money and time. If enough disputes are successful, banks and payment processors will offset processing fees and penalties to the merchant. This may result in the merchant being blocked from working with specific payment processors.

The Rise of Synthetic Identities

Creating new identities by combining real and false information is one of the fastest-growing online crimes in North America. Synthetic identity fraud has become a multibillion-dollar industry fueled by the rise in online banking and other digital financial services.

According to FiVerity, synthetic fraud losses rose from USD6 billion annually in 2015 to over USD20 billion in 2020. Synthetic fraud is causing a big headache for merchants and financial institutions as it's one of the most complex types of identity fraud to detect because there isn't an actual victim to report fraudulent activity.

The Challenge of Balancing Fraud and Friction

While businesses are taking action to protect against fraud, there remains a fine line between consumer expectations and the user experience merchants can offer.

Each additional piece of personal information provided by consumers can help minimize fraud and add friction to the user journey, reducing conversion rates. Unfortunately, balancing fraud and friction is even more challenging across multiple channels (e.g., mobile, web, point-of-sale).

Even with security measures, however, merchants still face challenges. Traditional fraud solutions operate on a set of rigid rules, which run the risk of false positives – that is, flagging genuine customers as fraudulent ones and disrupting their experience.

A study by Stripe found 95% of the top 100 e-commerce merchants have flaws in the checkout process and that 17% of consumers said they wouldn't shop with an e-commerce site that has an overly frictional checkout process.

What Is a Payment Aggregator?

A payment aggregator is a layer in your payment stack that a third-party supplies and processes a customer's transaction - allowing merchants to be completely hands-off with their payments.

The aggregator works by routing transactions through the best payment processor for that transaction. Either by method with the highest acceptance rates, lowest processing costs, or by predetermined rules outlined by the merchant. Unlike traditional gateways, routing transactions mean achieving the highest conversion rates for the lowest prices.

The Payment Orchestration Process:

- The user initiates the payment via the checkout page and selects a payment method from the methods you choose to accept.

- The payment information is sent to the payment gateway.

- The payment details are encrypted by the payment gateway and are then sent to the acquiring bank and payment processor.

- Then the acquiring and issuing bank communicates to check if the payment should be authorized.

- If the payment fails, the user will usually see an error message and be asked to try again. However, with a payment orchestration layer, the payment is routed to the next best payment processor. The act is repeated until the payment is approved.

How inai Payment Aggregator Can Help With Fraud Management

With such a wide selection of fraud prevention and management tools, finding the right payment partner can be arduous for merchants. Integrating with numerous vendors can have reduced returns and lead to management issues that would not occur if only one right option was considered instead.

It's about finding the right tool for the right job.

inai offers a unified API that connects to multiple payment rails, fraud, tax, and BI tools. Our no-code dashboard allows clients to localize the checkout experience, manage subscriptions, consolidate their payment stack, and much more — all in one platform.

But let's dig deeper into inai's fraud prevention tools.

It Tokenizes Payments

Unfortunately, not all gateways tokenize their transactions. With a payment orchestrator, you don't need to worry about tokenization, as the orchestrator will handle that automatically. Ensuring that your customer's data is kept safe and sound. inai's fraud detection also has a built-in tool that helps reduce add-on costs that those third-party integrations incur, helping expedite KYC/KYB processes for international payments by up to 25%.

It Makes Compliance More Straightforward

Another advantage of payment orchestrators is that tokenization simplifies PCI-DSS compliance by removing credit card information from your environment. In addition, this data storage and transfer method eliminates any possibility of a third-party cyber-attack.

Along with multiple payment methods, abiding by cross-border commerce legislation becomes more manageable.

It Reduces Friction

inai provides a seamless checkout experience for returning customers. As inai's payment data is already stored via a token, you can create a frictionless checkout. This reduces the number of steps the customer has to take to pay to just one click, which will only delight your customers and improve conversion rates.

Furthermore, inai offers the regionalization of your checkout, allowing you to accept payment methods that your customers want. So, for example, let's say in the US you wish to offer wallets such as Apple Pay, Paypal, and cards via Stripe but show Klarna and Sofort in Germany via Adyen. This level of payment customization is possible through inai.

Along with this, you'll also have the option to customize your checkouts through payment links, SDK integration, or API-based integration, depending on the feel of your checkout to match your brand voice.

It Gives You a Complete Overview

Not having a single source of truth can be disastrous as it can collude your data if you are importing from multiple sources. When connecting to various payment gateways, you'll find that each has its dashboards and reporting tools that may conflict with your tech stack.

With inai, as all your payment processors are routed through one system, you'll gain access to CXO dashboards that includes data of each PSP, acquirers, and gateways, and also manage refunds and failed transactions that act as a single source of truth at every step of the payment process.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.jpg?width=150&name=IMG_5672%20(1).jpg)