Fingerprinting is one of the most effective ways to prevent fraudsters or cybercriminals from breaking or hacking into websites. If you're an online merchant or business owner, make sure you have included fingerprinting in your tech stack. And if you haven't, we got you covered.

This blog discusses what fingerprinting is, how it works, its benefits, and how merchants can include fingerprinting in their tack stack.

What is Fingerprinting?

Here Fingerprinting or device fingerprinting is the process of assigning an identifier to the device that the user uses to browse a website or an app. Device fingerprinting services assign an identifier or fingerprint to devices based on the following attribute:

-

HTTP request headers

-

IP address

-

Installed plugins

-

User-agent string

-

Timestamp

-

List of installed fonts

-

Silverlight data

-

Client time zone

-

List of mime-types

Once the fingerprint is assigned, businesses can prevent fraud and track the online activity of the user to some extent in order to understand their behavior and target them in a personalized way. Think of fingerprinting as a more reliable and robust alternative to cookies.

Fingerprinting is not limited to capturing the device information. Using the right fingerprinting service provider, such as inai, businesses can capture the payment method used by the user for making the payment and then assign a fingerprint to the same to prevent fraud.

It basically helps merchants track the payment flow accurately, identify any fraudulent activity and ensure the complete safety of their business and consumers. Let's learn more about how payment method fingerprinting works.

How Does Payment Method Fingerprinting Work?

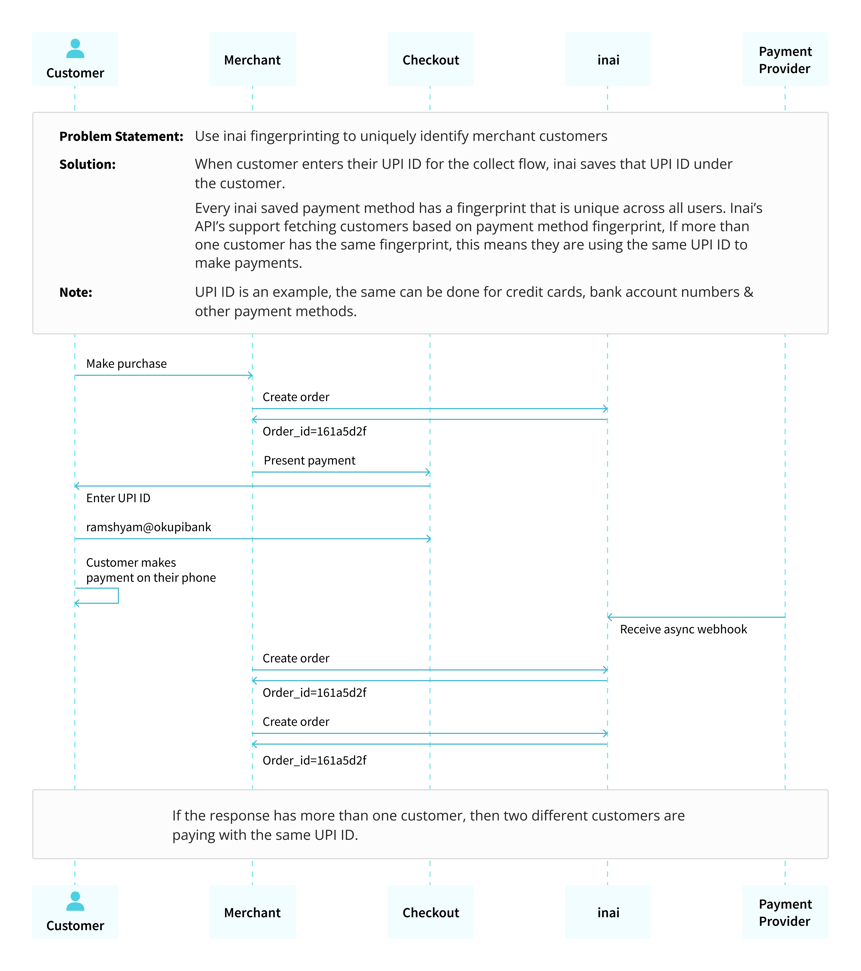

Here's an illustration to help you understand how payment fingerprinting works:

Let's say a customer adds a product to their cart and places the order. When this happens, an order id will be generated, and the customer will be presented with the payment options such as UPI, credit/debit card, wallet, and bank transfer (consider UPI for this example).

The customer will then add their UPI id, and the payment provider will send a response to the merchant. The payment method fingerprinting service provider will get the customer's saved method and will generate a unique fingerprint linked to that UPI id.

Merchants can then use that unique fingerprint to query customers. If the response returns more than one customer, it means multiple customers are making payments using the same UPI id, which can be tagged as fraudulent activity. This way, merchants can detect and mitigate illicit fraud incidents.

What Are the Use Cases for Fingerprinting?

Majorly fingerprinting has two uses:

1. Tracking and Targeting Visitors

Device fingerprinting is a powerful way businesses can track and target website visitors. By tracking unique and repeat visitors, businesses can create accurate profiles based on behavior and other information, such as IP address and time zone settings. This allows businesses to target or retarget individuals with personalized ad campaigns, ultimately resulting in more conversions.

2. Preventing Fraud

Most companies use fingerprinting to prevent fraud. Take gaming companies, for example.

These days, identity theft and other frauds are common on online gaming websites. Users create multiple profiles and try to disrupt ethical users' gameplay by stealing money, game currency, and even payment information.

However, with fingerprinting, gaming companies can catch users who've created multiple profiles but are using the same payment method. All they need to do is search for the fingerprint id in their user database. And if more than one user is using the same payment method, they'll have the same fingerprint id and, thus, will be caught. Based on this evidence, gaming companies can ban them permanently, ensuring smooth gameplay for other players.

Benefits of Fingerprinting

Here's how fingerprinting can help:

1. Prevent Gaming Payment Fraud

As stated earlier, several players in online gaming create multiple profiles to turn the odds in their favor and gain an advantage over other players. However, this is unethical and ruins the experience of genuine players, who end up leaving the gaming platform.

Using fingerprinting, businesses can determine if more than one gamer uses the same payment method. And if they are, companies can ban them from the platform, preventing fraud.

2. Curb Card Testing Frauds

Fraudsters often purchase large numbers of credit card numbers from the black market. They try each card one by one to check which one works smoothly. And when they're finally able to purchase something with any card or cards, hackers plan to use it for a bigger transaction.

However, with device fingerprinting, merchants can easily determine which device and the associated account were attempting so many transactions that ended up being declined. And then appropriate actions can be taken.

3. Eliminate Account Takeover (ATO)

Account Takeover, or ATO, is a common attack wherein criminals steal passwords and usernames to access genuine user accounts. Using ATO, cybercriminals take over gamers' accounts and steal game wallets, characters, inventories, and other valuable stuff.

However, fingerprinting helps solve this problem. With device fingerprinting, merchants can assign a fingerprint to a particular device used by the user to log in. And if that account gets taken over and accessed from another device, you can easily catch the criminal and thus eliminate ATOs.

4. Reduce Manual Checks

When checking all the purchases or consumers for fraud, you cannot rely on manual elements because it's not scalable. Also, humans are prone to making mistakes.

However, with a fingerprinting service provider, you can automate the process of checking all accounts or purchases to detect fraud efficiently. This will help reduce manual checks, improve security, reduce error margins, and ensure complete safety.

How Can inai Help?

inai is a payment aggregator or unification platform that can help you include payment fingerprinting in your tech stack. Using inai, merchants can collect the consumers' payment methods and assign a unique fingerprint or identifier to all users. Merchants can then use inai's API to fetch customers with their payment method fingerprint id for inspection. And if more than one customer has the same fingerprint, merchants can take appropriate action.

Want to see inai in action and learn how we can help you? Book a free demo here.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=150&name=karthik%20(1).png)

.png?height=400&name=Header%20-%20Risks%20Associated%20with%20High-risk%20Merchants_%20(1).png)

.png?width=50&name=karthik%20(1).png)